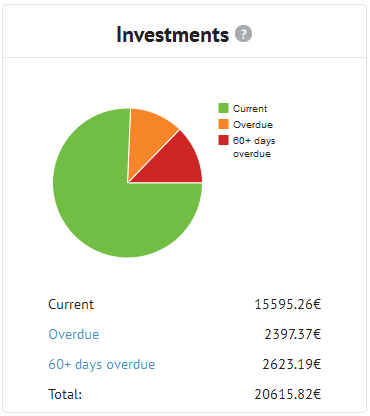

In October 2012 I started p2p lending at Bondora. Since then I periodically wrote on my experiences – you can read my last review here. Since the start I did deposit 14,000 Euro (approx. 15,600 US$). My portfolio is very diversified. Most loan parts I hold are for loan terms between 36 and 60 months. Together the loans add up to 20,616 Euro outstanding principal. Loans in the value of 2,397 Euro are overdue, meaning they (partly) missed one or two repayments. 2,623 Euro principal is stuck in loans that are more than 60 days late. I already received 13,261 Euro in repaid principal back – this figures includes loans Bondora cancelled before payout. I reinvested all repayments.

Chart 1: Screenshot of loan status

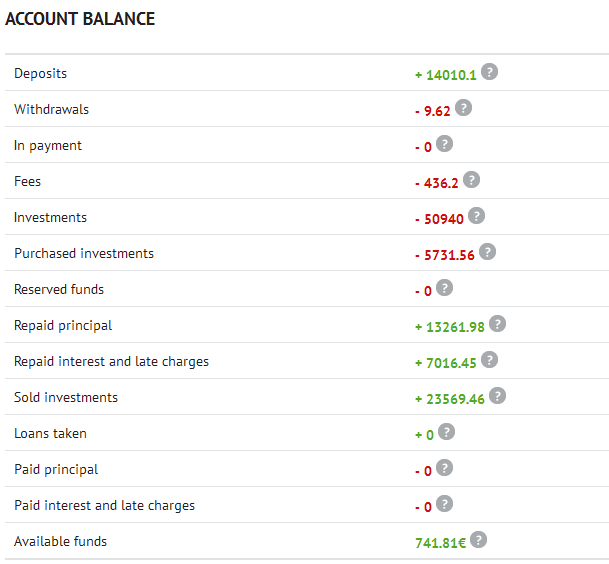

At the moment I have 0 Euro in bids in open market listings and 741 Euro cash available, which is rather high but it will take only 2 to 3 loans that match my investment criteria to allocate the money.

Chart 2: Screenshot of account balance

Return on Invest

Currently Isepankur shows my ROI to be 27.22%. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 19.6%.

Loan selection criteria – what I am currently bidding on

I select my loans manually currently. To compensate for the time needed to pick loans, I often make multiple bids totaling up to 300 Euro in one loan. Each bid is typically only 15 Euro to make it easier, should I decide to sell loan parts later on on the resale market.

My standard criteria for selection right now are:

- Bondora Rating AA to B, sometimes also C

- Credit Group A

- Credit History 1000

- Estonian loans only

- Age typcially from 25 to about 60

- Income ideally well above 1.000 Euro

- Income verified preferred

- Homeownership ideally Owner, Mortgage or Joint ownership

- one or more previous Bondora loans, where the borrower has made repayments for a couple of months are a plus in my view

- DTI that is not excessive

The way I do it, is to run this filter one or two times a day, which typically shows about 5 to 10 open listings and then I manually look at the loan details of each of these.

I don’t buy loans on the secondary market. While other investors point out that there are lots of good loan opportunities on the secondary market – and they are probably right – I find it to time consuming to monitor and bid on the secondary market. I would look into this again, if there was a way to automate selection and bidding on the secondary market for me.

How is your Bondora investment going? Share your actions and reasoning in the forum.