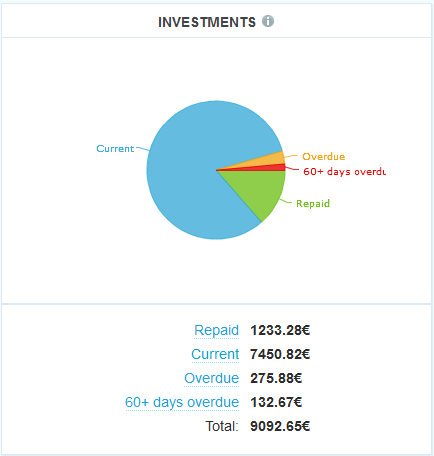

Chart 1: Screenshot of loan status

Most of the money in my account is working to earn interest. Only 98 Euro are currently held in cash. 245 Euro are tied in bids on current loan listings and will originate in the next few days.

Chart 2: Screenshot of account balance

How I used the secondary market

Looking at my account balance (see chart 2) you will notice the relative large amount (2,032 Euro) of sold loans. This is due to 2 developments.

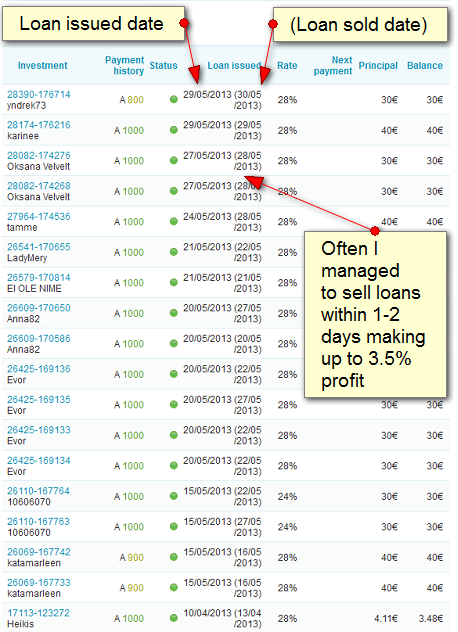

When the Isepankur secondary market launched in the end of March, I listed neary all my overdue loans for sale. Not only did I succeed to sell them within days, I also managed to sell them at 3 to 5% premium prices meaning I sold them at 1.5 to 3.5% profit (that is after 1.5% resale fee).

Secondly the resale market has been very active. I used that as I adapted my strategy and I am now investing in 2-3 parts of interesting new loans rather than just one as I would have before the introduction of the resale market. Immediately after the new loan is issued I list the surplus loan parts for sale at a 4 to 5% premium on the market. There are currently over 1,200 loan parts listed for sale on the resale market. Even disregarding the late loans, there is still a mass of over 1,000 parts for sale. This might lead to the expectation that it is hard to sell parts at premium.

Quite to the contrary I often manage to sell loan parts within 1-2 days. Even allowing for 1-2 days bidding phase and another 2-3 where the money sits idle waiting to bid, this means that I make around 3% profit in about 6 days. Extrapolating that results in a staggering annual yield.

Chart 3: Loans I recently sold

Return of Invest

Currently Isepankur shows me a 25.4% annual ROI. As chart 4 shows the ROI figure rose considerably over the past weeks. In my own calculations, using XIRR in Excel, I currently get a 16.3% ROI.

Chart 4: Statistics on ROI and funded volume

My current strategy

I primarily invest in loans with the top credit score (A1000). I often invest in two or three parts of 40 Euro each and then list all but one for sale. Even if they do not sell, my risk exposure to one loan stays limited and I continue to have a very diversified portfolio.

Isepankur originated a record loan amount in May

Isepankur is offering jobs in preparation to the the planned expansion into serving borrowers in Finland, the Netherlands and Spain.