Who? What? You might wonder why that is relevant as most readers are unlikely to be LHV Bank customers. LHV Bank is a bank in Estonia.

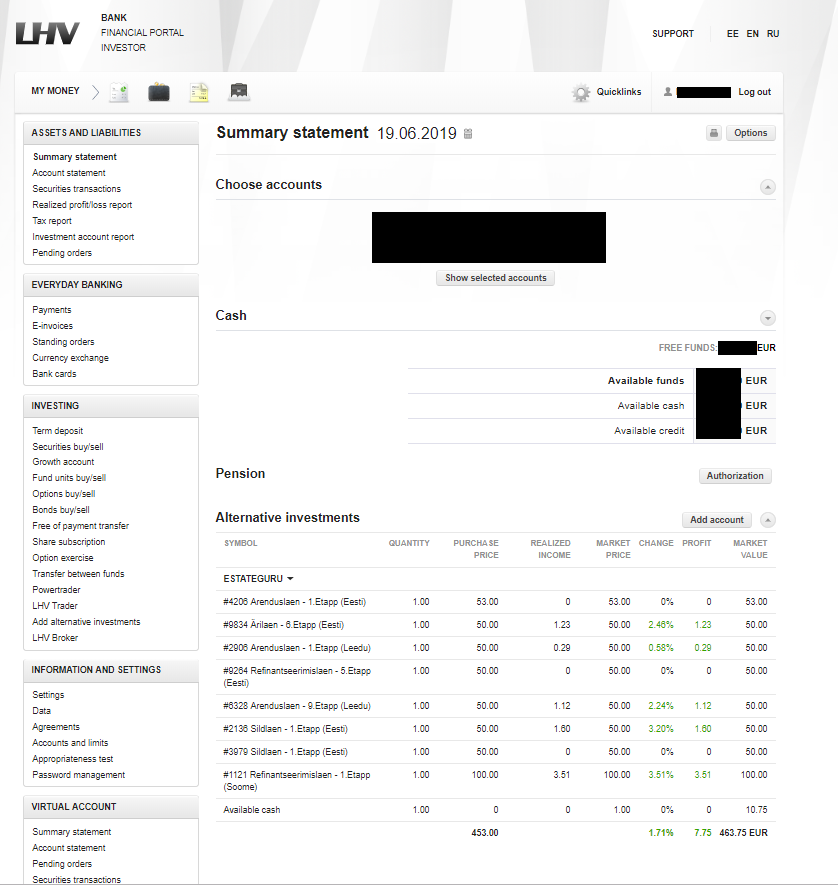

I think it is highly interesting, as it is – to my knowledge – the first time a bank has integrated p2p lending investments in its customer interface. So the LHV bank customers, not only see their accounts and stock depots, but also their Estateguru* investments conveniently listed in their online bank dashboard. Much has been talked about what role could banks have in p2p lending (mere transaction banks? providing credit lines?) and also there is a lot of speculation if PSD2 (open banking) will help fintechs to seize the access to the customer from banks because they could control the user interface in the future. But this is actually a first step a bank takes in the opposite direction. By aggregating “non-bank” information inside the dashboard, they aim to make the banking interface more useful for the customers.

Press release:

LHV customers can now see their short term property loan investments on LHV internet bank. On the summary view of internet bank, besides public stock exchange investments, one can see also alternative investments like short term property loan investments and cryptocurrencies, thus making it possible to get a quick and comprehensive overview of one’s investment portfolio. EstateGuru and Coinbase are the very first services to be switched on to the platform.

“LHV’s new service is the best example of cooperation between banks and fintech. LHV is most definitely a trendsetter in the banking sector. It is fulfilling to see that short term property lending has become a solid part of investments, and traditional banking has accepted it. EstateGuru has more than 25 000 investors throughout Europe, and the number is rapidly growing among both retail, professional, and institutional investors. We can provide our customers with more added value via interfaces like that of LHV’s “, commented EstateGuru’s COO Mihkel Stamm.

Alternative investments have become a substantial part of the Estonian investment scene, particularly among new investors. There are more than 13 000 people in Estonia who have invested in crowdfunding platforms. The fixed rate of return on debt instruments and access to the new and attractive asset classes have found their well-deserved place in investors’ portfolios. The better the quality of information, the more successful the investors.

“LHV aims to keep pace with its customers’ investment activities and that’s why we decided to take a step closer to the universe of alternative investments. The added value of this new service for our customer is a better and more comprehensive overview of the assets, thus making the portfolio management more successful “, added the Head of Investment Services at LHV, Martin Mets.

About EstateGuru

EstateGuru is the leading European platform connecting an international community of investors and businesses offering the highest diversification options for investors and flexible terms and speed of funding for businesses. The mission of EstateGuru is to provide hassle-free and flexible financing to property developers and entrepreneurs as well as diversified property backed cross-border investment opportunities to its international investor base—from the small individual investors to the institutions and everyone in-between. EstateGuru has more than 25 000 investors from 45 countries and the total money lent to date is more than 122MEUR. …

About LHV

LHV is the largest domestic financial group in Estonia. LHV’s mission is to help to create Estonian capital. According to LHV’s vision, the people and enterprises of Estonia dare to think big, start things and invest in the future. LHV’s values are to be simple, supportive and effective.

Very good news indeed , just for your information this is exactly what credit.fr the platform that i have launched in France in 2015 has done from september 2016 with Hello Bank the online bank of BNP PARIBAS GROUP