P2P lending service Isepankur will open to borrowers in Slovakia starting next Monday. While Isepankur is open for lenders from all over Europe this is the fourth borrower market after Estonia, Finland and Spain. I contacted CEO Pärtel Tomberg and he told me:

P2P lending service Isepankur will open to borrowers in Slovakia starting next Monday. While Isepankur is open for lenders from all over Europe this is the fourth borrower market after Estonia, Finland and Spain. I contacted CEO Pärtel Tomberg and he told me:

Slovakia is a small market with a very strong potential. We have already gathered a great deal of in small markets Estonia, a market roughly 20% the size of Slovakia, and in Finland, same size as Slovakia in terms of population, and will be looking to translate this into a successful launch. The market is quite similar to the markets mentioned earlier with a small number of large banks and lack of alternative offers to the consumers. There is a general lack of affordable and easy-to-use credit products and we will be looking to fill that void with our offer that will be very similar to what we have in Estonia, Finland and Spain. Our target would be to generate approximately 4 million euro of monthly loan volume in Slovakia in the matter of 2-3 years however as always we will start small and conservatively to ensure that only quality loans are offered to the investors.

To apply for a p2p loan the minimum income criteria borrowers from Slovakia have to fulfill are listed in the investment guide. They are roughly the same as for the Estonian borrowers.

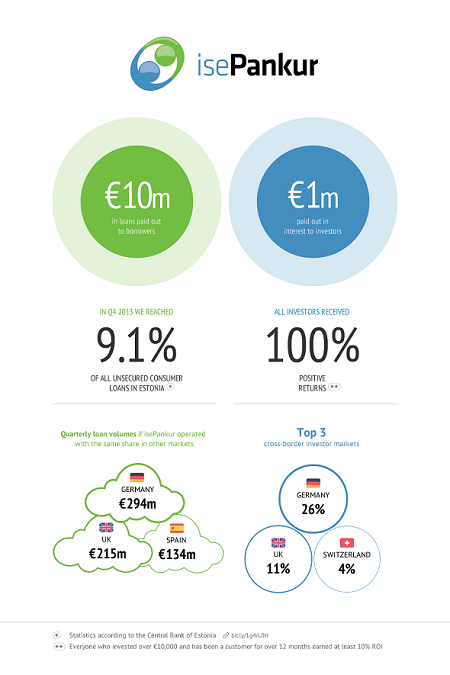

Milestones achieved in 2013

In a recent newletter Isepankur also highlighted the following milestones achieved:

- Isepankur had a market share of 9.1% of all unsecured consumer loans in Q4 2013 in Estonia

- Total loan volume reached 10 million Euro

- Total interest paid out to lenders: 1 million Euro

Especially the first point is impressive. For comparision: Zopa is said to have reached a market share of 2-3% of unsecured consumer loans in UK.

Infographic from last newsletter