On the p2p lending marketplace Mintos there is a very large and active secondary market. In my previous article I described that the YTM calculation shown on the secondary market is based on the assumption that the buyer holds the loan part till regular end of term and the buyer will achieve a higher yield, if he buys at discount and the loan is repaid prematurily.

In the article I will look into a possible strategy on the Mintos secondary market: buying overdue loans at discount.

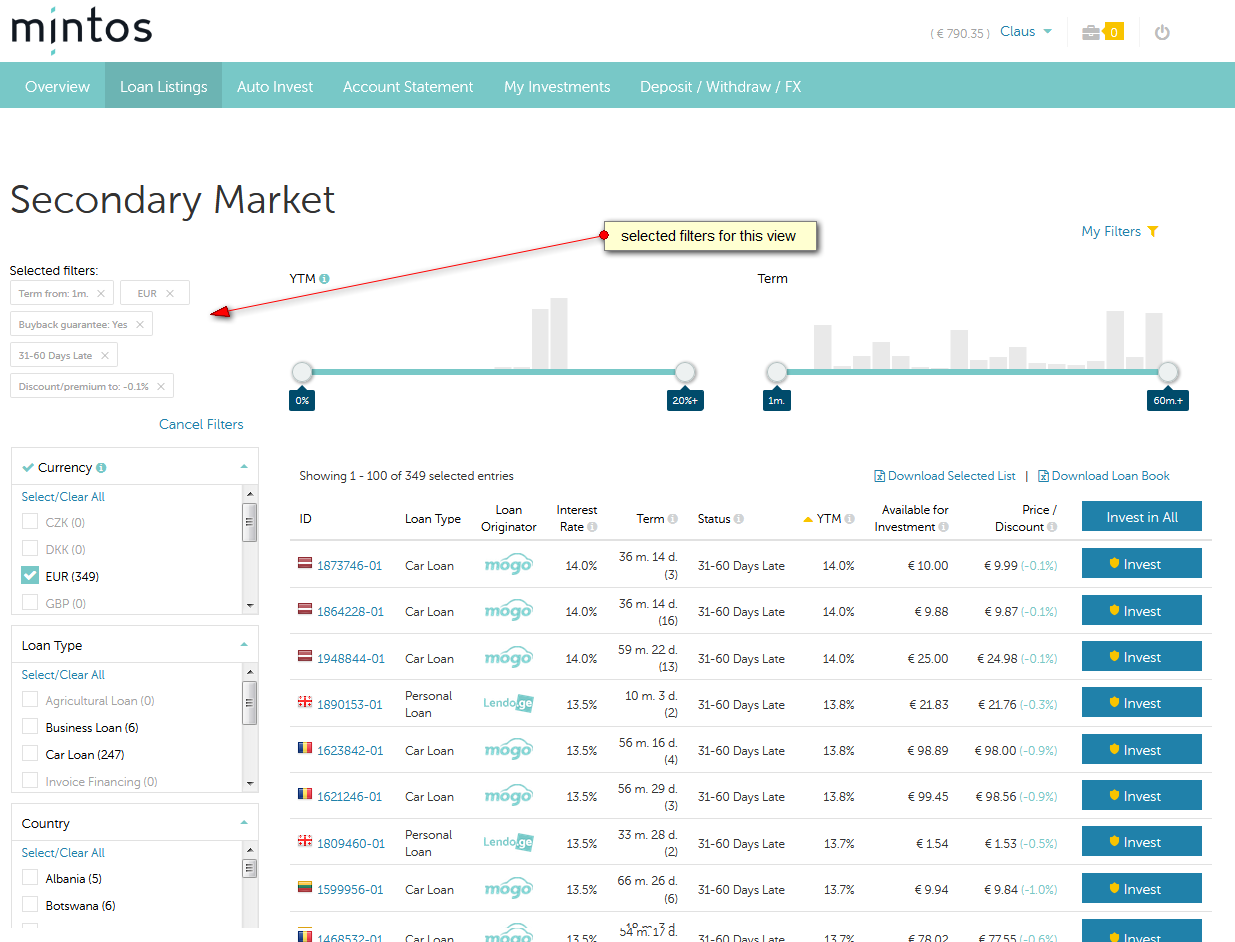

In a first step I sort/filter the buyback loans to only have those at discount that are very late (31-60 days overdue).

Click on image for larger view

I get a result of 349 loans with various discounts and an YTM of up to 14%. Not surprising for me, many of the loans listed at the top are Mogo loans. These are less attractive for buyers with this strategy. Why? Because they actually have a lower probability of defaulting. The paradox of this strategy is that the buying investor actually wants a high probability that the loans he buys default because that will boost his yield.

So in the next step I sort/filter to exclude Mogo loans. I also exclude loans that have a low YTM. This, because there is a chance that they do payup and then the buyer might be stuck with the loans for longer than 30 days.

Finally let’s change the filter to require a minimum discount of 0.3% and there are 21 results:

What would a buyer get?

If these loans do pay up and then run till regular maturity date, then he recieves a yield of 12.4% to 13.8%. Decent, but not very high compared to other Mintos loans.

However there is a chance of at least 50% that these loans will default and are bought back within the next 30 days. If that happens to a loan, that a buyer bought at 0.3% discount, it will boost his yield very roughly by more 3.6% (0.3% for 30 days multiplied by 12 to get annual effect). Likely it is more because the next payment date will be less than 30 days away. But even taking 3.6% the yield will be around 17%.

Looking at it, it is obvious that discounts as high as possible are preferable. The loan with the 0.6% discount would mean a boost of very rougly 7.2% yield on top (0.6*12). So that could lead to about 20% yield.

I have taken the screenshots for this article just at a random point in time. Higher discounts do happen and discounts of around 1% are not a rarity.

This is certainly not a strategy for a beginner at Mintos and it requires time and monitoring, but it is a frequently used strategy when investing on the Mintos secondary market.

Not yet investing on Mintos? Get cashback!

Mintos is offering 1% cashback on all investments made in the first 90 days after registration if you use this link to signup: Mintos registration. Currently there is an additional cashback offer for new and existing investors of 4-5% cashback on Mogo loans with loan durations of 48 month or more. Need to enroll once (click banner in dashboard after you finished registration). Expires Feb. 16th. The 4-5% roughly equals 1% increased yield.

More cashback offers are listed on the P2P-Banking p2p lending cashback list.