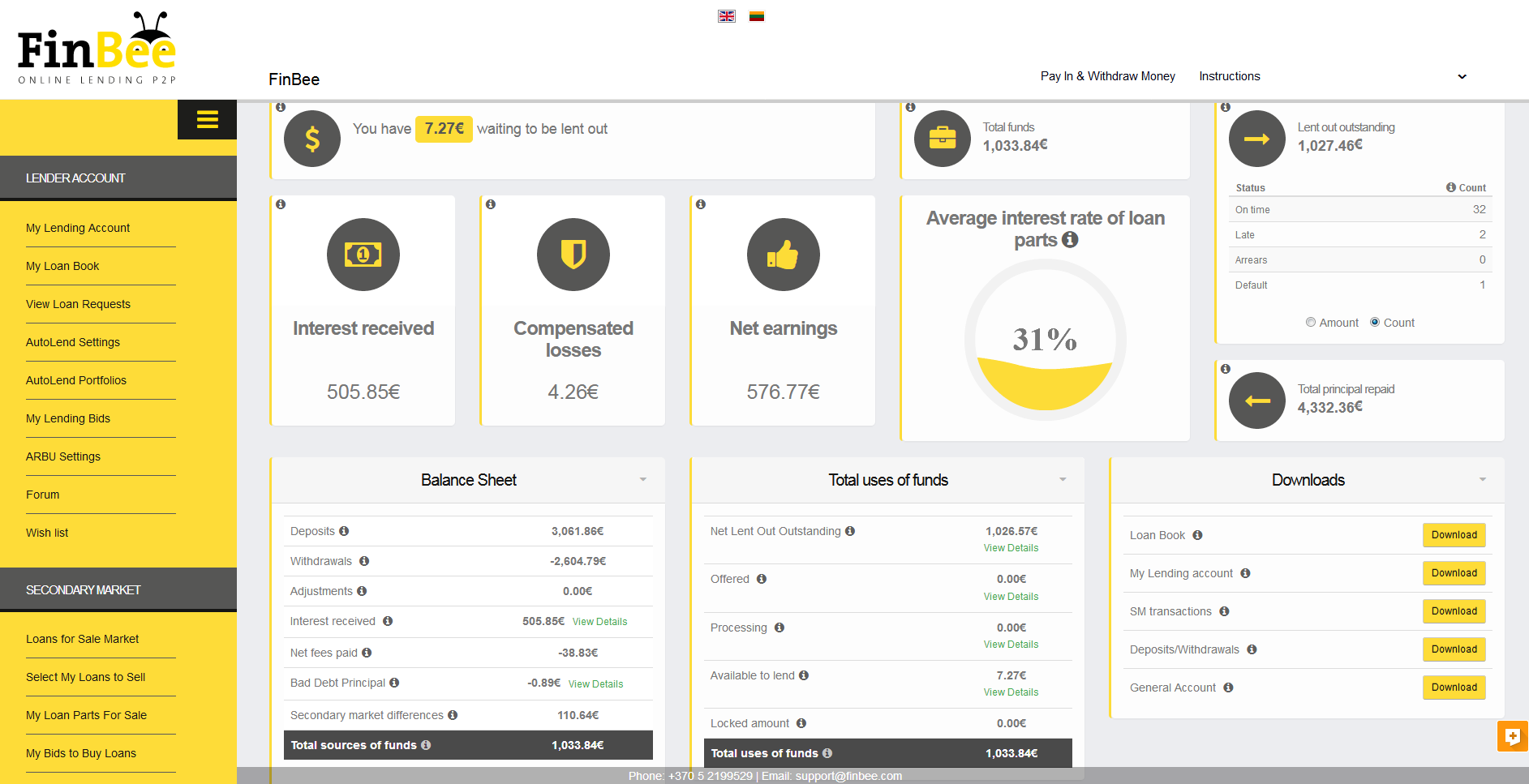

A year has passed since I last wrote about the portfolio I built on Finbee. For a detailed description of this Lithuanian p2p lending marketplace see my earlier review. As described there, I invested mostly in the highest risk grade loans (‘D’ loans). Currently I have invested 1,027 Euro in 35 loans. 32 are current (965 Euro), 2 are late (23 Euro) and one is in default (38 Euro), but rates for this loan are paid to me by Finbee’s compensation fund. The average interest rate of my loan parts is 31%. Interim I had grown my portfolio to up to 3,000 Euro invested, but interest rates have decreased due to high investor demand that was not met by comparable growth on the borrower side, so I have withdrawn 2,604 Euro meanwhile.

My results so far

My self calculated yield (XIRR) is 31.5%. This is the highest I achieved on any p2p lending marketplace over a longer duration of time. This includes the 110 Euro capital gain caused by sales of loans on the secondary market with premiums (see my article on trading on Finbee’s secondary market). Calculating the result again, this time with assuming a full write-off of the defaulted loan gives a yield of 29.4%.

Screenshot of my Finbee dashboard – click to enlarge

There are 19,930 Euro (as of March 13th) in the Finbee Compensation Fund. Current estimate is that the fund is paying about 9,000 Euro per month on defaulted loans and has decreased about 2,000 Euro from February to March. To grow the amount in the Compensation Fund Finbee will need to increase the volume of new loan originations. I looked into the list of open loan requests this morning and there are currently only 3 consumer loans and 2 business loans open for funding.

Finbee recently added business loans to SMEs, but I have not invested in any of these.

How about 2nd and 3rd places? What are they?

Assuming you mean that in connection to yield:

My second best is my Bondora portfolio yield. Read in my older reviews:

https://www.p2p-banking.com/tag/bondora/