After several month of waiting since the first announcement, the Estateguru* secondary market will now launch. In the past weeks could participate in a closed beta test prior to the coming public launch of the market. Estateguru used this to get some feedback and to fine tune the wording (e.g. in the FAQ).

After several month of waiting since the first announcement, the Estateguru* secondary market will now launch. In the past weeks could participate in a closed beta test prior to the coming public launch of the market. Estateguru used this to get some feedback and to fine tune the wording (e.g. in the FAQ).

Overview of important facts about the Estateguru secondary market:

- seller pays a 2% transaction fee

- loans in all status can be offered, including late and in default

- only the total loan part can be offered, it is not possible to split it and sell parts of it

- seller can set the price at par or at premium. Discounts are not possible

- buyer gets all repayments and interest after the sales transaction date

- bought loans can not be resold for the next 30 days

- each listing runs for 7 days. Unsold parts will be removed automatically

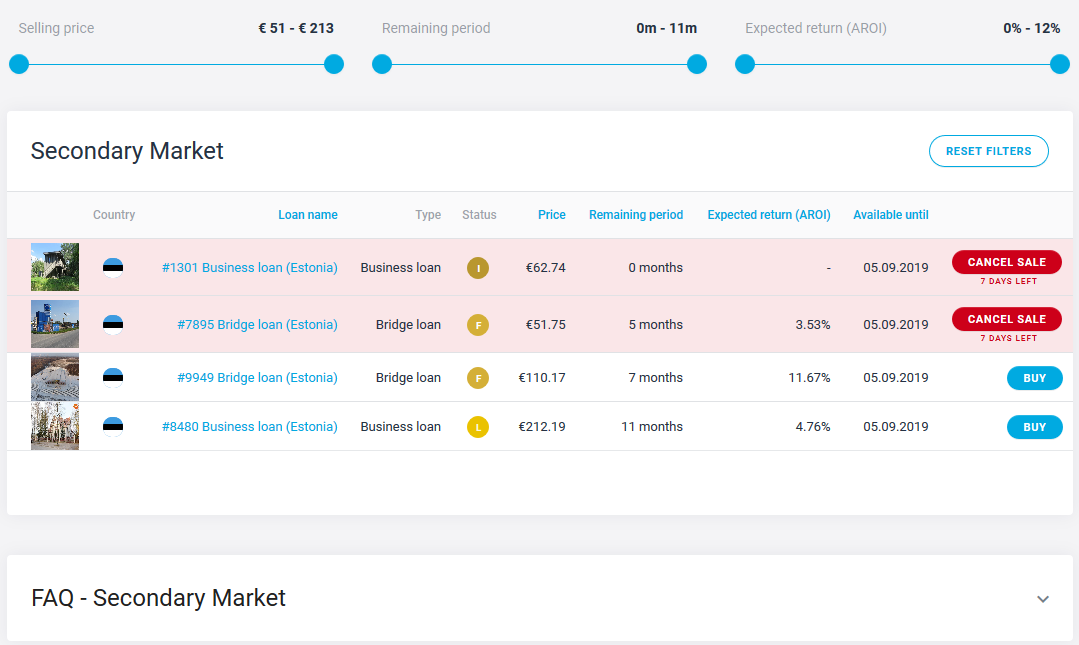

And now, without further ado, this is how the secondary market looks:

Fig. 1: Estateguru secondary market

On top of fig. 1 you can see the available filters. Also most columns can be used for sorting. The red highlighted loans are parts I listed for sale. I’ll now show you the steps necessary to sell a loan.

First I consented to this notice for activating the secondary market.

Fig. 2: Activating the secondary market

Then I went to my portfolio, selected the loan, I wanted to sell and clicked the “Sell” button on the right. Now I got to this screen:

Fig. 3: Setting the sales price

There is a slider on the upper right for the sales price. It is preset to 2% premium, to recover the sales fee. I set a higher premium here. Below the price the AROI for me (the seller) and the AROI for the buyer is shown. As the AROI is prominently featured in the market overview (see fig. 1) it is an important criteria for the buyer. And 3.56% is probably to low to achieve a sale. In fact this part did not sell in the 7 days (the other listed part #1301 did sell, see Fig 5.).

Here is the Estateguru AROI definition: ‘AROI (annualised return on investment) is an estimated annual return based on the total return on investment’.

After I clicked “Sell my claim” there is a screen for entering the password.And after that a display where Estateguru confirms that the loan is listed for sale

Fig 4.: Email I received notifying me of a successful sale of a loan

I like the overview table of the secondary market. As improvements I suggest to display the premium percentage and to allow filtering by status. Maybe that will be added in the next release. I also asked if they could add the ability to trade at discounts. The reply was that they wanted to offer an easy opportunity to sell loans and not overcomplicate the tool.

My first impression

The secondary market delivers what it aims to do: allow an early exit by selling loans. The 2% fee is relatively high, I expect that will keep the traded volume low. Sellers of late and defaulted loans will have to carefully consider the price set, as I think that with any positive news updates on the recovery status of the loan, the loan part will be bought, before the seller has a chance to read and react to the update.