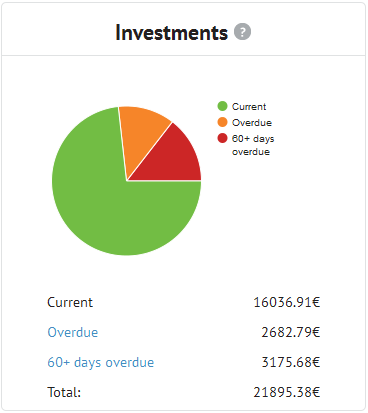

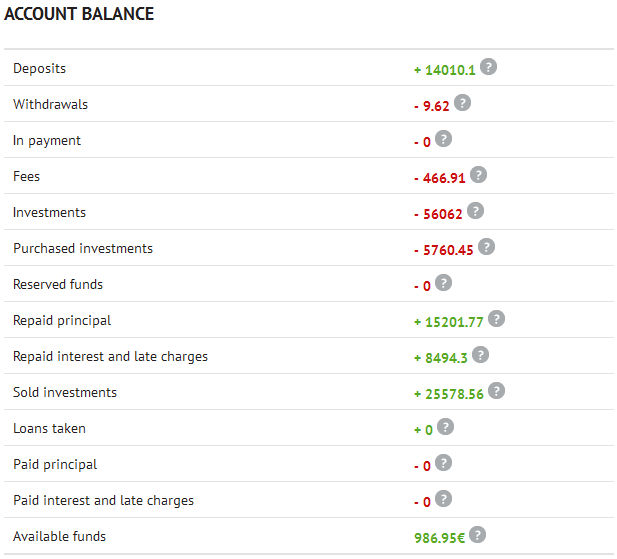

In October 2012 I started p2p lending at Bondora. Since then I periodically wrote on my experiences – you can read my last review published in April here. Since the start I did deposit 14,000 Euro (approx. 15,900 US$). My portfolio is very diversified. Most loan parts I hold are for loan terms between 36 and 60 months. Together the loans add up to 21,895 Euro outstanding principal. Loans in the value of 2,683 Euro are overdue, meaning they (partly) missed one or two repayments. 3,175 Euro principal is stuck in loans that are more than 60 days late. I already received 15,202 Euro in repaid principal back – this figure includes loans Bondora cancelled before payout. I reinvested all repayments.

Chart 1: Screenshot of loan status

At the moment I have 0 Euro in bids in open market listings and 987 Euro cash available.

Chart 2: Screenshot of account balance

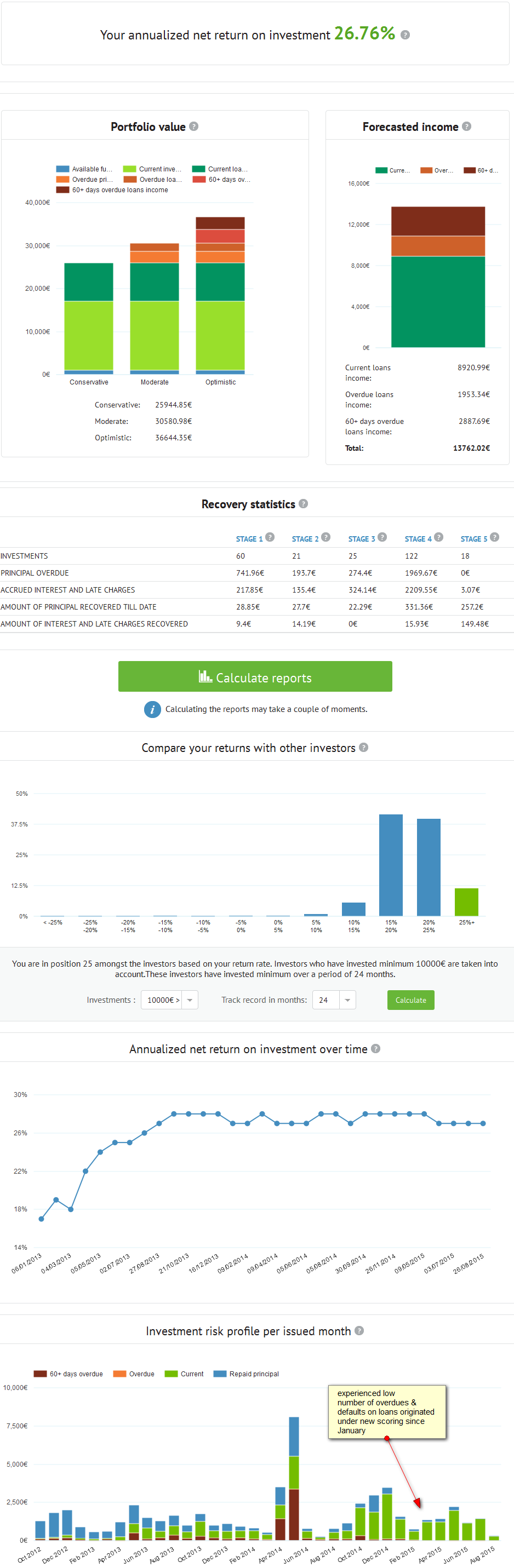

Return on Invest

Currently Isepankur shows my ROI to be 26.76%. In my own calculations, using XIRR in Excel, assuming that 30% of my 60+days overdue and 15% of my overdue loans will not be recovered, my ROI calculations result in 21.8%.

What happened to my portfolio lately

The last few weeks were the first time I was struggeling to find enough Estonian loans matching my criteria (see previous post) to manually invest into. I decided about two weeks ago to activate the portfolio manager, but only for AA and A loans making 50 Euro bids each. But so far this resulted only in 4 new loans for me. So my cash in the account is slowly accumulating instead of being reinvested.

Chart 3: Statistics on ROI and funded volume for my account

Major changes at Bondora announced

There are again major changes on how the Bondora marketplace operates.

Two weeks ago Bondora announced changes in the collection process.

Yesterday Bondora announced that the following changes to the core functions of how the market operates will be introduced:

the way Investors will be able to invest into loan listings will change:

Passive Investing: Bondora.com (or the web layer) will transition to being a product geared solely towards passive investors. In practice it means the following:

- We will replace Portfolio Manager and Portfolio Builder with a new product that will be free of unnecessary complexities, such as allocations, bid amounts, etc., and will fully automate achieving the preferred rate of return at the desired risk level;

- The above product will be a sole option for investing (or selling your investments) through the web layer; thus, we will sunset both Primary and Secondary Markets;

- We will consolidate reporting (such as Investment List, Transactions, Account Statement, Data Export, etc.) into a single section making it the sole “go to place†for regular or adhoc reporting purposes.

In a nutshell: Think of highly sophisticated investment engine that works towards your target return and is controllable through a single-page dashboard.

Active Investing: an API (Application Program Interface) will be introduced to support investors looking to use custom investing strategies. In practice it means the following:

- We will provide all investors a programmatic way (through an API) to access and invest into all loans that have passed our credit checks and scoring;

- Similarly to the current loan listing details, the API will provide all information about the prospect borrower that we are legally allowed to provide; thus, investors will be able to apply custom evaluation models before making an investment decision;

- We are investing into infrastructure to ensure robustness and stability of the API in the events of high volume requests what was difficult to maintain through a web interface.

In a nutshell: Think of a highly granular and extremely fast access to all investment opportunities (a fire hose) without the limitations that a web layer imposes.

Instead of building and maintaining web layer features for a narrow user base, the above will allow us to focus the efforts of our 50+ people team on things that will benefit every investor on the platform; namely, growing of supply of quality investment opportunities and further improving the credit scoring.

This means that if I want to continue my current loan selection criteria after the changes are enacted, I will have to use the new API.

Hi wiseclerk. Interesting state…question, how much every month cash flow forecast? Thank.

Matej, I won’t be far from truth if I guesstimate cashflow following way:

Outstanding principal (22k) times curent Xirr 0.26 brings yearly interest. Monthly its about 500 euros of projected income.

Hi Carlos. XIRR 0,26? You’re kidding? You investing only HR loans? …I have XIRR about 13 percent yearly. Truth is, I investing only Estonia loans A, B, C….sometimes loans D

Matej, my cash flow, that is repayments and interest, is about 800 EUR per month

Nice interesting cashflow. Thank you for answer.