Crowdestate is an Estonian p2p lending market place focussing on property. It is somewhat compareable to Estateguru or Lendy, the difference is that Crowdestate has a wider mix of offers, including unsecured debts or equity. I published an interview with the Crowdestate CEO last year.

The projects usually come with a term of 1 to 2 years, occassionally a bit long or shorter. There were not that many projects in the past . Often only 1 or 2 a month. Recently the pace has been picking up. Investor demand strongly outweights supply. Often the autoinvest bids fill a new offer instantly, if not then it is often filled within a hour of coming on the plattform. There are no fees for investors. Only a few offers pay interest during term, with most accruing interest to be paid at the end of the term. There are no fees for investors.

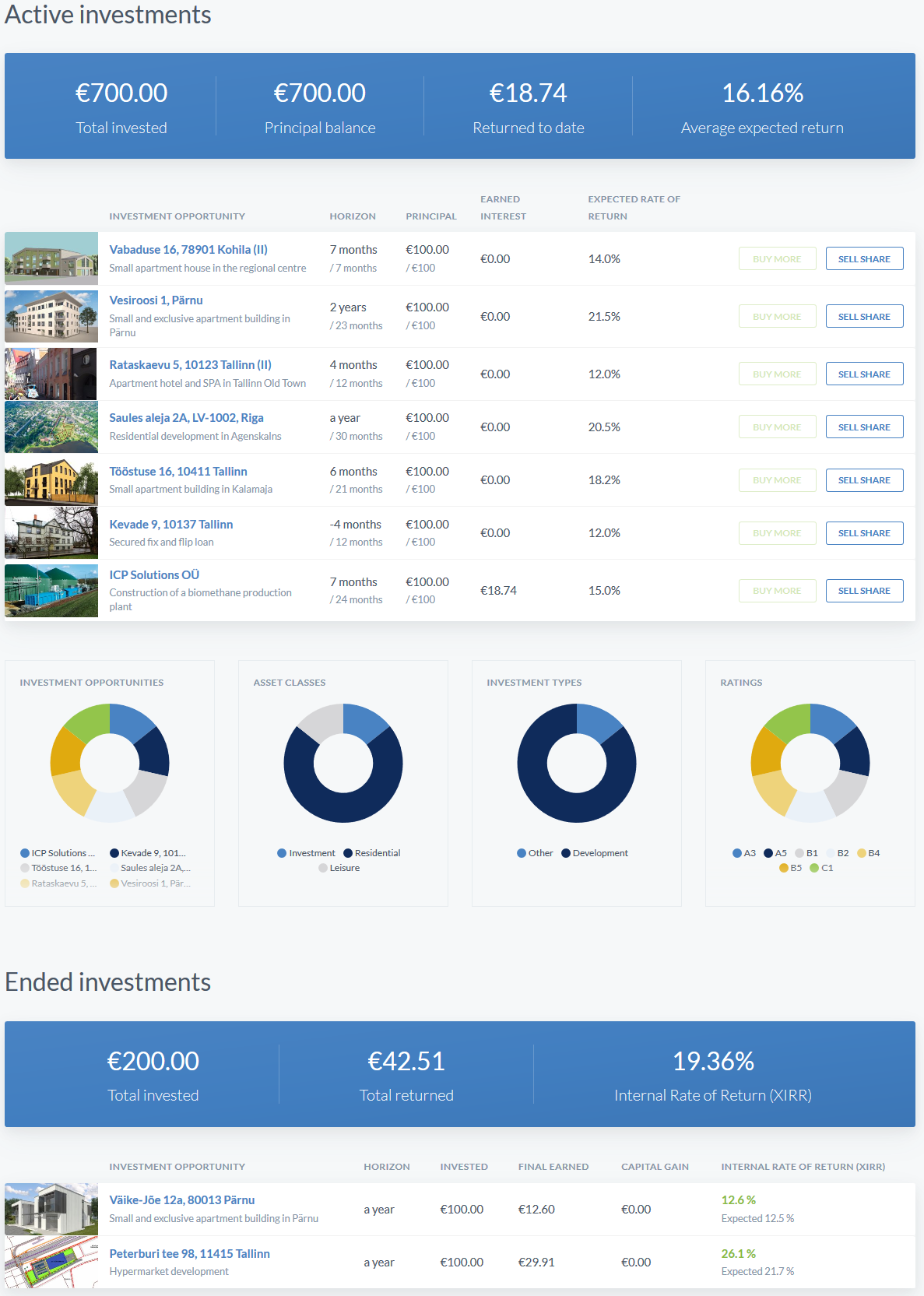

I only invested in a handful of projects to gain some experience. Today Crowdestate launched a new look for the website. This is how my small Crowdestate portfolio is displayed:

My Crowdestate portfolio – click for larger view.

Crowdestate secondary market

Today Crowdestate launched a secondary market. There is a “Sell Shares” button besides each of my active investments. To test it, I just offered one of my loans at a markup. The marketplace allows sellers to set markups or discounts.