Ratesetter is the brand name of one of the top 3 UK p2p lending marketplaces. Unfortunately only UK investors can invest on Ratesetter UK, otherwise I would have tried it out.

Ratesetter is also the brandname of Ratesetter Australia. While not rund by the same company this Australian p2p lending marketplace uses the same technology base and is offering similar products, consumer loans of up to 5 years. Since launching in 2014 Ratesetter Australia has originated more than 325 million AUD in loan.

The site does not feature it, but actually Ratesetter is open to non-resident investors. I recently found this out and went ahead and opened I account in the past week. The signup process for non-residents is not as straightforward as on other marketplaces. I post a detailed description of how I did it below.

But why send money that far away?

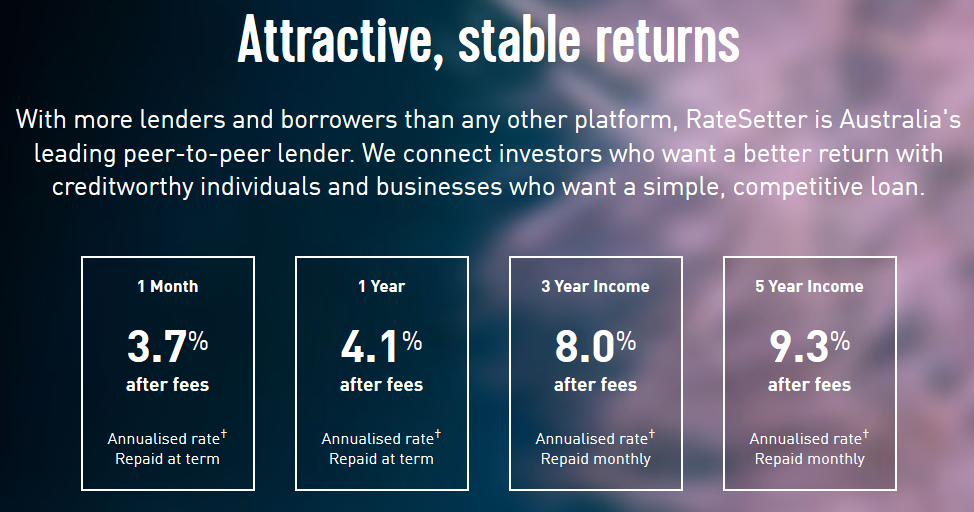

Because rates are attractive. Interest rates are currently up to 9.3% (compare that to around 6% that is achieveable for 5 year investments on Ratesetter UK*).

And that rate is AFTER fees.

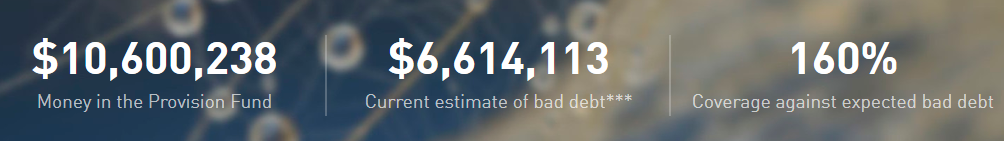

A further important feature is the provision fund. That is capital stored that is used to reimburse lenders of defaulted loans. While that is no insurance or guarantee, it is in my view a much stronger portection than the ‘buyback guarantee’ that some other market places promise.

There is currently 10.6 million AUD in the Ratesetter Australia provision fund. And since 2014 the provision fund has paid for every default without exception.

Review of advantages

- established platform

- very high interest rates (displayed rates are after fees)

- no default losses since 2014 for investors (due to the provision fund)

- comprehensive statistics & loanbook download

Review of disadvantages

- signup a little more effort than usual (see description below)

- no secondary market. Investors investing in the secondary market should not expect to be in a situation were they might need that money earlier

- 10% withholding Tax for German residents (for other countries check here – according to Ratesetter it is either 0% or 10% depending on country)

- very volatile currency exchange rate

- transaction fees for changing EUR -> AUD according to description below is 0.35%; to convert back AUD -> EUR the fee is 0.45%

My conclusion

Only investors that want to invest a larger amount for a long duration should consider this. Otherwise it is not worth the effort in my opinion.

Currency exchange rates EUR/AUD last five years (Source)

How I signed up as a a non-resident investor on Ratesetter Australia – step my step explanation

As the process is more effort than usual, I suggest you read the complete remainder of the article and decide if it is for you, instead of just diving into the registration process.

Step 1: Trigger Ratesetter registration process

Sign up via this link* and the first 5 investors have a chance to get a cashback bonus of $75 AUD – see conditions below*

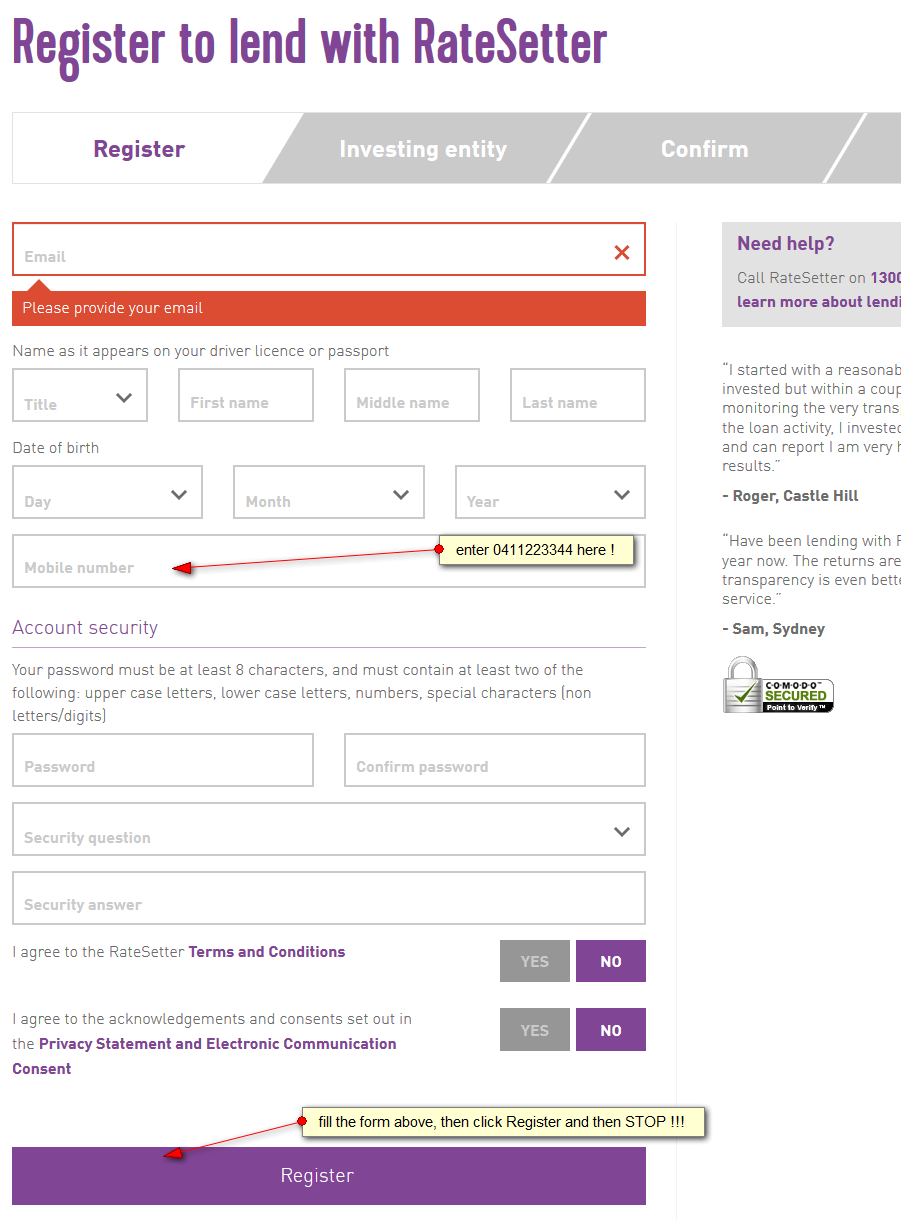

First there is a welcome page, click “Register Now” there and then this page is shown:

Yes, you saw that right. After clicking Register, you STOP and do NOT proceed with the signup on the website as it can only handle Australian residents.

Step 2: Continue registration

After a few minutes I got an automated email asking me to complete my registration. I did NOT click on the link provided in the email, but rather send a reply email, stating that I am a German resident and would like to invest on Ratesetter and that I have an Australian bank account. I asked that they would please guide me through the process.

Step 3: Australian bank account

WTF? Sounds much more prohibiting than it actually is. I had a Transferwise* account already and with a few clicks could open a free Transferwise borderless account in Australian dollar which comes complete with account number and BSB code (routing code). If you don’t have Transferwise* you can open it for free, only plan a little time for verification.

The Australian Transferwise account later serves as reference bank account which is entered into the form in step 5.

Converting EUR in AUD costs 0.35% at Transferwise (how I saved that fees is written below). The current fee for later changing back AUD to EUR is 0.45%.

Step 4: Obtain scanned certified copies of documents for registration

While I waited for the answer from Ratesetter from Step 2, I went ahead and obtained scanned certified copies of documents. I could do that a the town hall (cost incurred 3.50 EUR). It will probably be different in other countries. Needed is

a) current driver licence OR current passport

b) proof of address no older then 60 days: utilities bill (such as an electricity bill or phone statement) OR bank statement or other bank correspondence OR correspondence from a local or central government department

Step 5:. Going on with registration

Meanwhile I got the reply from Ratesetter support. They are super helpful, but time zone difference means every back and forth takes a day. Ratesetter sent me a link of a web form to complete. I did that (entered ‘-‘ for SWIFT) and told them so via email, which I attached the requested certified document copies to.

Step 6: Registration is complete

One day later I got the confirmation that my registration was completed and I was ready to go.

Step 7: Deposit

One can now convert in the Transferwise account Euro to AUD wechseln and then send money from the Transferwise Australian currency account to Ratesetter. Ratesetter shows the necessary routing information under Transfer funds in > Transfer by Bank Transfer > Other

Saving in currency exchange when depositing

I could save the 0.35% Transferwise currency exchange fee for EUR > AUD by using a free Revolut* account and exchanging between Monday and Friday EUR to AUD fee free. Then transfer the AUD either to the Transferwise AUD account or directly as a Ratesetter deposit payment.

I just started. I intend to lend for the 5 year market and experiment with setting my own desired rates slightly above market rate. Watch out for an update here on the blog after I have several month of experience or – probably more frequently on the dedicated thread on the German discussion forum.

*$75 AUD Cashback Bonus for the first 5 investors, that register thought the given link before 16.09.2018 and at least $2000 AUDÂ on the 3 or 5 year market. Precise terms and conditions on the Ratesetter site. To qualify I think swift action will be needed, given that the registration, deposit and lending will take some time.

Very interesting. The question is if this a breach of AML legislation though?

Any thoughts?

Do you have any specific rule in mind?