I really like this time. The new year lies ahead with crispy, yet unknown innovations. What p2p lending developments might happen in 2012. Here are some personal opinions.

Last year I failed big time with most of my predictions for 2012 not coming true.

Deeper integration of mobile (probability <25%)

Can you use a p2p lending service from a Smartphone? Sure. Some even have special apps for that purpose. But that’s not what we are talking about here. We are at the advent of a couple years timespan where several players (compare this infographic) will be fighting over market shares in the developing mobile payment market. If there is a role for p2p lending services, it is yet undiscovered (aside from the use p2p microfinance makes of it in underdeveloped countries).

Introduction of a p2p financed ‘credit card’ (probability very low)

Carried over from last year – did not happen

I envision a p2p lending service where the borrower does not get a loan in one full amount initially but can access liquidity on demand (within a predefined credit line). From the funding side this would work somewhat like lenders investing in Ratesetter’s rolling monthly loans. On the borrower side the customer could either request an additional payout via a web-interface or more sophisticated the service could issue a branded credit card / debit card for that purpose, enabling the customer to access cash instantly on an ATM.

This concept has very interesting advantages as it allows the p2p lending service to build a durable relationship to the borrowers. And for the borrowers it offers the potential of lower rates on short term debt than the high rates credit cards typically carry.

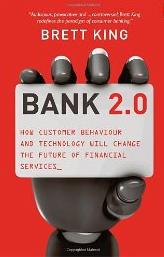

I just finished reading

I just finished reading