Are we headed for the next bubble? The book ‘Technological Revolutions and Financial Capital – The Dynamics of Bubbles and Golden Ages‘ won’t answer that question. But it does a good job analysing technological changes in the past and identifying patterns. The author Carlota Perez develops a model of the repeating interplay between finance and the drivers of technological evolution. Published in 2002 the book’s content seems timeless. I recently read it and can recommend it. Available at Amazon US, Amazon UK and Amazon DE.

Are we headed for the next bubble? The book ‘Technological Revolutions and Financial Capital – The Dynamics of Bubbles and Golden Ages‘ won’t answer that question. But it does a good job analysing technological changes in the past and identifying patterns. The author Carlota Perez develops a model of the repeating interplay between finance and the drivers of technological evolution. Published in 2002 the book’s content seems timeless. I recently read it and can recommend it. Available at Amazon US, Amazon UK and Amazon DE.

Uncategorized

Whatthefintech

Yesterday I spent my day at the ‘Whatthefintech 2’ event at Startplatz Cologne. The attendees were an interesting mix from startups, banks, service companies and interested users.

While none of the pitches and startups were focused on p2p lending, it was highlighted several times as one of the use cases. An interesting discussion evolved around the question whether startups have sustainable business models or just fill in a gap that is there for a limit time span. One argument was that too many fintech startups just add an incremental improvement rather than solve a big problem. An example given was that many startups can deliver a much better user experience than banks, so they win users now. But banks are learning and will catch up on the field of presentation and user experience and when the playing field is leveled then the startup has not much to show as the data and backend processes are still owned by the bank.

I think this is an important point but one that is answered by p2p lending marketplaces – they have a business model that adds real value by offering a more efficient process than banks do. While some p2p lending marketplace use and cooperate with banks, they certainly have developed own technologies which are a core for their product and are not a mere sales-frontends as some of the criticized fintech models.

The banks certainly are eager to open up to the developments. Jana Koch of comdirect bank presented the ‘Startup Garage’ program of comdirect bank, which is a essentially co-working space with mentoring from the bank professionals for teams which have just an idea yet and want to bring that to the first development stage. The bank pays the team to enable them to concentrate on the development of their idea, but does not expect equity or ownership of the idea. From the banks viewpoint the program will be kind of an outsourced research and development offering fresh impulses to the thinking of the bank’s executives.

Some other viewpoints out of the banking sector surprised. Two persons from major banks stated that they expect the branch to play a very important role in the next 20 years as a sales channel for banks and only thereafter to become obsolescent. Maybe this is the paradox that Bankstil also commented last week. What banks publicly say is that the branch is essential and used even by their young and technology liking clients. But what they do is that they close branch after branch after branch.

I liked the presentations, especially those by Peter Barkow who talked about the relationship between German fintech and venture capital and Gernot Overbeck of Fintura, a comparison tools which promises to find the cheapest bank loan for SMEs within 15 minutes and close it within 72 hours.

The pitches of the 3 pitching fintech startups were well crafted (they had 7 minutes each).

As usual the most interesting part for me was the networking.

I am really looking forward to the next conference I’ll attend, which is LendIt in London in 2 weeks. If you register you can still use discount code wiseclerkvip to get 15% off.

Impression from the event. More photos on Twitter.

Graphic: How Fintech Attracts Fast Growing VC Investments

The following graphic from Crunchbase illustrates that Fintech startup investments were the fastest growing sector for VC investments in July.

P2P Lending – Average nominal interest rates in Q2 2014

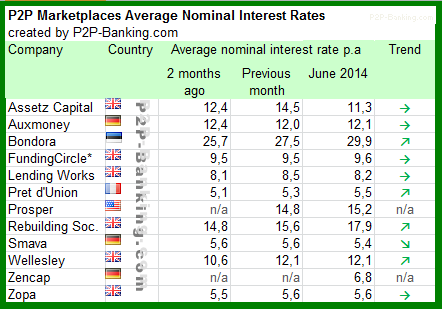

After looking on the p2p lending loan volumes, today I present an overview of average nominal interest rates for selected p2p lending services. As nominal interest rates are before fees they are easier to compare and an attempt otherwise would mean to list 2 rates for each marketplace (an APR for borrowers and a lender rate after fees). Of course nominal interest rates are in no way an indication to achievable lender yields as these are dependant – aside from fees -on defaults and recoveries occuring. Also on Wellesley actual lender interest rates are much lower than the quoted nominal rate.

What the chart does allow is to gauge the market segment the individual p2p lending marketplace concentrates on. But again this is only a first glance, for any further comparision any securities (like collateral, assets, or provision funds) have to be considered.

Table: P2P Lending nominal unweighted (*weighted) interest rates up to June 2014. Source: own research

Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart (or similar charts) in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.

New Investment Fund Focussing on Investing in Global P2P Lending

‘P2P Income Partners‘ is a new investment fund by Symfonie Capital that will invest capital in p2p loans. The founder, Michael Sonenshine, an ex-investment banker, told P2P-Banking.com that he plans the first tranche to be 25 million Euro. He says: “Initially we will invest in loans issued by sites such as Prosper, Lending club, Funding Circle, Zopa, Isepankur and we will add fonds to the mix as we see fit. The P2P market is not only web-based. Â There are opportunities to make direct loan across Europe. Â The key to success is spreading the risk and doing careful due diligence.”. The fund is open to qualified investors. Minimum investment is stated as 100,000 US$.

Review of My P2P Lending Predictions for 2012

In January 2012 I wrote down my predictions for p2p lending developments in 2012. The black text is my original prediction, with the review added in green and yellow.

Deeper integration of mobile (probability <25%)

Can you use a p2p lending service from a Smartphone? Sure. Some even have special apps for that purpose. But that’s not what we are talking about here. We are at the advent of a couple years timespan where several players (compare this infographic) will be fighting over market shares in the developing mobile payment market. If there is a role for p2p lending services, it is yet undiscovered (aside from the use p2p microfinance makes of it in underdeveloped countries). No action so far. Continue reading