Researching the MyC4 concept (see previous post) there are some usability features that call for a comparision to Prosper.com:

- Auction: The model of Prosper seems much more straightforward to me then the auction model of MyC4. The possibility of bidding above the maximum interest rate as long as the weighted average interest is below it, gives it a major twist. Every lender on a loan ends up with a different interest rate while borrower nominal interest rate is the weighted average (mind-boggling, isn't it?). And the full transparency of all bids during bidding process is interesting.

- Usability, communication and transparency: The interface is designed for much interaction. Everywhere the user can post comments (to profiles, to blogs, to loans, to listings). And with a user added avatar on every comment, it is very personal. No anonymity since real names are used (not screen names). Anybody can view the loans other lenders are invested in. Users can add icons to their profile to show which motivation led them to MyC4 (be it profit, education, social lending, …)

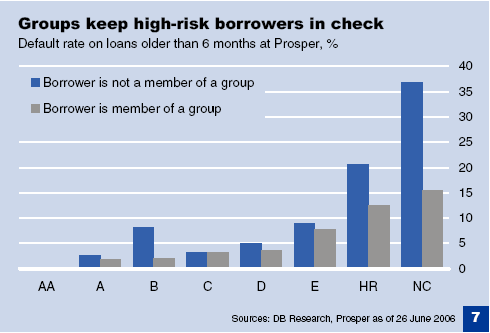

- Defaults. So far none, but naturally it is much to early to judge. Hopefully MyC4 will have defaults as low as Kiva and prove that third world borrowers are more reliable.

There will be continued coverage about my experiences at MyC4.

Danish startup C4 World on it's platform

Danish startup C4 World on it's platform