Brad Slavin has written a 15 page research paper: "Peer-to-Peer Lending – An Industry Insight". It contains a good summary on p2p lending aspects as well as a comparision between Zopa.com and Prosper.com. The figures given are not up to date, I assume the paper was written last year.

Zopa

Social lending voted as the future of finance by the banking industry

Astonishing. Traditional bankers awarded Zopa the Banker Technology Award for Best Internet Project. Now, should we expect to see banks setting up project teams to launch their own social lending services? Or how will banks leap forward to be a part of the "future of finance"?

Source: FirstRung via TheBankWatch

Zopa prepares launch in Italy

Actually Zopa.it is not run by the British Zopa Ltd. but by the franchise “P2P s.r.l” with offices in Milano. The company has licensed the use of the brand and the technology for Italy. Zopa.it will allow Italians to borrow up to 40000 Euro (roughly $55000), which is a high amount, compared to p2p services in other countries.

The company was created by Nova partners, Milan, together with New College Capital Ltd.

It is possible to pre-register on Zopa.it to be notified at launch time.

Sources(1, 2, 3, and own research)

Correction and Update: I must excuse myself to have confused the CEO of Zopa Italy with another Italian banker with identical name. As Carlo of Zopa Italy pointed out in a comment to this post: “Zopa Italy’s Ceo is Maurizio Pietro Sella, not Maurizio Sella. Maurizio Pietro started is working career with Banco di Santo Spirito (Capitalia Group), then joined in 1990 Citibank, where he had several assignements (mainly in London and Switzerland) and in 2002 the Julius Baer Group in Geneva. Before Zopa Maurizio Pietro was CEO of Julius Baer Creval Private Banking Spa, a joint venture between the Julius Baer Group and Gruppo Credito Valtellinese.”

According to unverified sources the venture raised 2.8 million Euro funding from its shareholders. It is speculated that Zopa Italy will take higher fees (maybe 1 percent from lender and 1 percent from borrower) than Zopa in England. This seems possible since consumer banking costs in Italy are generally higher.

Download Zopa default rate figures

British Zopa.com just published a spreadsheet with Zopa default rate figures. The weighted average of overall defaults is a tiny 0.1% ! Even more interesting all defaulted cases happened in 2005 or the first half of 2006.

Another interesting read is this case study on Zopa (published late 2006).

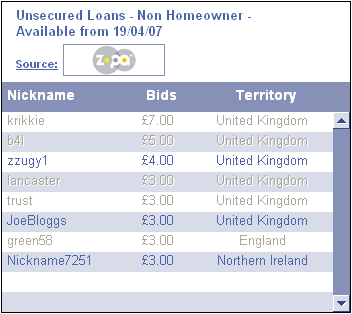

Zopa sells leads of borrowers with low credit grade

Borrowers with unsatisfying credit seeking a loan can not use Zopa.com. Instead of just declining these applications, Zopa now sells these leads through Paaleads.com. Brokers and financial advisors can bid to obtain these leads. (Source Mortgagesolutions-online.com)

Paaleads classifies the leads in three categories:

- Unsecured loans – homeowners over 10.000 pounds

- Unsecured loans – homeowners below 10.000 pounds

- Unsecured loans – non homeowners

As the screenshots below (taken today) show, the leads are selling for prices of up to 35 pounds.

Zopa wins webby

Congratulations to Zopa.com for winning a webby in the category banking and bill paying. (Source: Zopa blog)