British Zopa.com has launched the Zopa listings. The Zopa listing feature, of which the plans had been announced in August show individual borrower listings requesting loans. The concept is similar to the listings other p2p lending services like Prosper.com use.

Read this earlier description of Zopa listings.

Zopa

How p2p lending is different from bank loans

Part I: Platform & lender view

Occasionaly, when I talk to analysts or journalists, their perception is that p2p lending is very similar to bank loans. They argue:

- The platform does check, if the borrower is eligible to receive a loan by validating credit history, income and other documents just like a bank would do (note: this argument applies more to Zopa and Smava, less to Prosper)

- The listings descriptions and photos just give the lender the illusion that they know where their money is going and for what purpose. In reality nobody checks the information in the listings and the listings could be all false.

- The p2p lending platform is just taking the role of the bank. The platform earns fees on each loans which is comparable to the spread the banks live on.

My opinion is that p2p lending is very different from banks giving loans.

One main difference is that the platform does not have the loans in their own books. The risk is carried by the lender. The platform must aim to provide as much information as possible to allow the lender to gauge the risk and it must prevent the lenders from fraud. It is then the decision of the lender, if – based on the information – he wants to bid or refrains.

For the lender the ability to decide who gets the money is a major motivation compared to depositing the money in a banking product. The p2p lending services are aware that the listings are a central point to their marketing. Zopa, which currently does not have individual borrower listings, will introduce 'Zopa listings' in the future.

Regarding argument 2: It is true that listings are not checked on any of the platforms and a borrower could use the loan for a totally different purpose then stated in the listing. My opinion is that this is not a problem, as long as lenders are aware of this and as long as the protection from fraud (identity theft; no intention of borrower to repay in the first place) is high. I don't care if 2, 3 or even 20% of the borrowers lie in their listings. I believe that the majority is telling the truth and what I really care about is that my money is repaid. The borrower said he wanted to use the money for the college education of his daughter and actually used the money to buy a new car? I personally would not care as long as he repays the loan.

P2P lending services achieve a level of constant interaction with the lenders few banking products reach. In the Prosper forums many lenders express that they spend a lot of time on Prosper browsing and selecting listings and that they find this process somewhat addictive.

Conversely that means that p2p lending is not for lenders that to large amounts of money without spending time.

Conclusion: P2P lending IS different from the way banks loan money. It offers a different marketing angle, the risk is taken by the individual lender rather then the bank, and gives the lender has more control over what his money is used for.

Why US credit unions partner with Zopa for US launch

The philosophy of credit unions is members helping members. Credit unions can easily embrace the peer-to-peer lending concept. Why should they do it? As creditunionmagazine.com suggest Zopa is an innovation that can help credit unions with their image – they can get hip again.

The roles will be shared in this win-win partnership. Borrowers will be members of the credit unions, whereas Zopa lenders will provide the money. The big advantage for Zopa lenders could be that a possible business model is that the lender lends to the Credit union which gives a CD to the lender. The podcast suggest that there will be no default risk for the lender. Credit unions see it as a good customer acquistion strategy.

The credit risk or loss of your principal investment would not apply in the US model. So what would happen is. Most everyones familiar with going onto Ebay. You can either bid on the item and take a risk on what you pay for it. Or you can do a buy it now type option. With a fixed rate CD you would get a buy it now option which would still be market leading rates or you can do a process which I call a variable rate CD with the credit risk spread out amongst borrowers and if a few people go into default maybe you do not get as high a rate, it goes down a little bit but still much better than the market rate. That adds some excitement to the product offering as as well.

Addison Avenue Federal Credit union has signed a letter of intent with a peer to peer lending service. "We see (person-to-person lending) pretty closely aligned with the credit union mission and as a way of attracting new members," says CEO Benson Porter.

James Alexander, Zopa co-founder, on peer to peer lending

Intruders TV did a long interview with James Alexander of Zopa.com covering the development of Zopa, regulation, market approach, lender and borrower advantages, the competition and other topics. The video starts of with polling passers-by on the street whether they heard of Zopa and would use peer-to-peer lending themselves.

(Source: Intruders.tv)

P.S.: Noticed the bulletpoint on the whiteboard "Sell loan on phone".

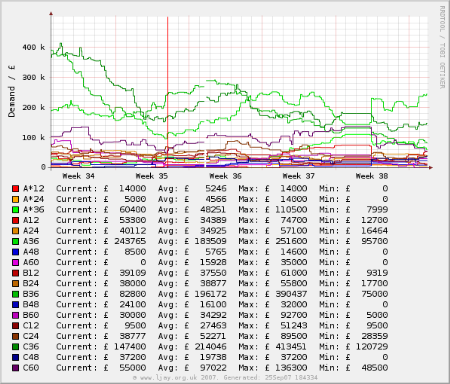

Zopa demand figures

Lenders at Zopa do not (yet) select an individual borrower but rather select a market and a rate at which they want to lend their money. This is matched to borrower demand and if a match is found, money is lend out.

There is a 3rd party site tracking the development of the Zopa demand volume and charting it (daily, weekly, monthly, yearly). Recently the amount requested has gone down in most markets.

(Source)

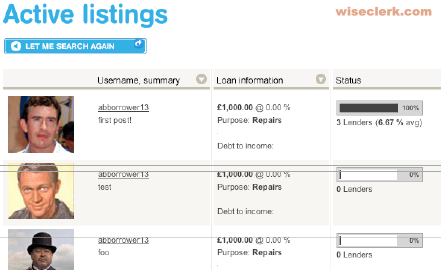

Zopa listings preview

Tuesday I wrote about Zopa's plans for Zopa listings. Now a preview of how the new Zopa listings will look is available. With this feature Zopa will take the step from anonymous borrowers to a more personal look with borrower listings and profiles. To create a listing borrowers will have a credit grade of at least C.

I looked at the preview today and found the resemblance to Prosper.com layout striking in many points. The listing overview will look like this:

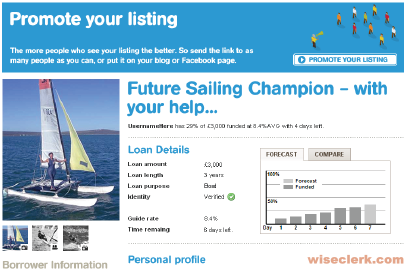

The loan listing itself has photos, a loan details section, a personal profile section and borrower information. Furthermore it will have a Questions and Answers Section allowing the lender to ask questions. Looking at the following example the forecast graph in the upper right looks exactly like the same feature Prosper offers:

The 8 page preview description gives more example screens of Zopa listings, which Zopa says it will introduce within the next months.

Lender feedback (which is limited so far) has been mixed.

With this changes, should the Prosper & Zopa merger that Jeff & Heather wish (it is really only wishful thinking!) ever happen, then at least the layout question seems decided now.