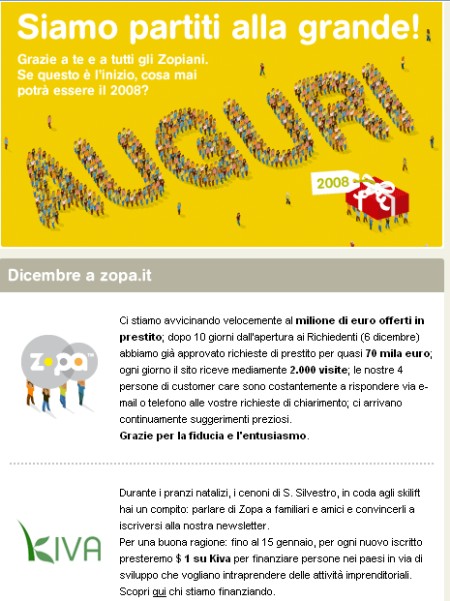

In an email newsletter Zopa Italy encouraged its member to spread the word about Zopa to friends and relatives. Zopa says it is for 'a good reason': Zopa Italy pledges to lend $1 on Kiva for each new member that registers at Zopa Italy before January 15th.

Everybody can monitor how much Zopa invested on this lender page at Kiva.

I am sure that Kiva will highly appreciate this promotion, a target audience that is already interested in p2p lending gets introduced to Kiva's concept. But I am not sure if that is a good marketing campaign for Zopa. Should the lenders decide Kiva is an interesting concept they might lend their money at Kiva instead of at Zopa. Maybe Zopa speculates lenders will invest in both. Or Zopa wants the added social angle to increase chances of press coverage.

What do you think? Discuss this at the Zopa forum.

(Source: Email newsletter from Zopa Italy, Dec. 27th)