Smava.pl is the youngest P2P lending service in Poland – the portal went live in January 2009. In the first days of August I met Przemyslaw Moscicki, the company’s CEO, and Arkadiusz Hajduk, COO, for an interview about the past and future of social lending in Poland.

Michal Kisiel: First of all, could you explain something of the origins of smava.pl? How was smava.de involved and also, why Poland, and Wroclaw, where smava has their HQ, in particular?

Przemyslaw Moscicki: The answer is simple, although the whole process took some time. During the 6 months preceding the establishing of the company, we met the founders of almost every large P2P lending company worldwide. We wanted to find out how they perceive the business, and what their vision of starting a business in Poland looked like, because each of them (with one exception) was interested in entering the Polish social lending market. We had to make a choice. The most important criteria for us were – besides the ability to finance the enterprise, which is of great importance of course – the know-how, the support in product development and the “all-round†business experience. We wanted to work with a team who will not only invest the resources, but who will also be actively engaged in developing the business in Poland.

We have chosen smava because, in our opinion, it was not only growing quickly, but also gave us an opportunity to build a safe P2P lending market in Poland. Safety is of extreme importance in Poland. This is how we chose the team to build a new P2P market in Poland. We work together – in other words it’s not that smava.de works in Berlin and smava.pl works in Wroclaw. We are actively building the first, secure Polish p2p lending business together.

You place extreme importance on safety. Why is safety is the most important thing when building a P2P lending market in Poland?

Przemyslaw Moscicki: (smiles) The Poles are innovative – they can “disarmâ€, get around, even the most sophisticated safety procedures. We were determined to choose a model of operation that will prove itself in the Polish environment. The safety measures that are proven to work in, let’s say, Switzerland, would not necessarily work in Poland. I am not saying that the Polish version of smava is safer than the German one, but it is adapted to Polish conditions and has proved to be the safest p2p lending platform in Poland.

I suspect that you had a chance to get to know the inside of smava.de. What are the most important differences between smava.de and its Polish cousin?

Przemyslaw Moscicki: Spread between interest rate on bank deposits and interest rate on credit is tremendous here in Poland. It is the widest of anywhere in Europe reaching a huge 18%. That is the main reason why P2P lending here has such enormous potential. Borrowers and lenders are able to divide this margin which is normally where Polish banks make their money . Moreover, the saturation with consumer credit is much lower in Poland, compared to the rest of the EU. This makes the Polish market almost perfect for a P2P lending enterprise.

Smava.pl is very similar to smava.de as far as its priorities are concerned. These priorities are best summarized as follows: offering the cheapest loans on the market and giving investors an opportunity to make unusually high returns in a safe, and predictable, environment. However, what makes smava.pl different is this: We don’t have investor pools (‘Anleger-Pool’ in German). What’s more, defaulted loans are serviced by , and not sold to, the leading debt-collection agency in Poland – Kaczmarski Inkasso.

Interestingly, in the rare cases when a loan is passed to a collection agency, the investor is not charged for the service – he or she gets 100% of the recovered money. The investor may also monitor the whole recovery process online.

You have entered the Polish market as the last player. What was your idea of your competitive advantage over the others? Have you chosen a specific market niche? In other words, who makes up your target market?

Przemyslaw Moscicki: The principal assumption that we work on is the need to build a safe market, a market whose effectiveness is measured not by the number of loans taken out, but by the returns the investors make. This is probably the best description of our target market: not only the clientele of the banks, but also the kind of borrowers who banks tend to shy away from for one reason or another, such as the low liquidity of financial institutions. Our target consists of trustworthy customers who are able to pay off their liabilities.

We are not competing with organizations outside the banking industry, such as payday loan providers like Provident, and neither do we target the customers with a bad credit history in the BIK (Biuro Informacji Kredytowej – the credit bureau in Poland).

One of the things that make you different from the rest of the P2P lending platforms in Poland is the credit-scoring model provided by the BIK. How does that model differ from the scoring system used by Polish banks such as BIKSco CreditRisk)? And how was the model developed?

Przemyslaw Moscicki: The model is used to assess the credit risk associated with lending to specific users. It was developed by the BIK – the most experienced provider of such systems for the Polish banking sector. This system was created with the cooperation of a Polish and German team of experts and it uses the experience gained by smava.de during our cooperation with Schufa in Germany.

The system allows to estimate the risk of default – the investors are able to account for that risk when they try to determine the possible returns. This is one of the reasons why using smava is safer and more predictable than using other financial services.

The scoring model is frequently updated and validated by the BIK.

Smava.pl is sometimes accused of being too strict when verifying potential borrowers. Some have argued that a person who is not able to borrow from a bank will also not be able to use smava. What is your response to such criticisms?

Przemyslaw Moscicki: Our algorithm for determining the creditworthiness of a potential borrower is similar to the systems used by all the banks. If a borrower is not going to be able to pay off the loan, he will not be granted access to our P2P market – and it has nothing to do with any good or bad will on our part. We naturally have the interests of investors at heart, but we must also think about the interests of borrowers. For some of them, obtaining a loan would mean getting into a spiral of debt. That is not what we want either for them or for our investors.

Does this not place you too close to the banks as far as the practices of determining creditworthiness are concerned? What is it about you that sets you apart from them?

Przemyslaw Moscicki: There are several important differences. Creditworthiness is not the only factor that guides the banks in their decision making, especially at a time like this. It is financial liquidity that counts – banks tend to deny credit when they don’t have enough liquidity. The second important issue is the spread. As I said, it is really high in Poland, at a level of 18%. When lending to the average customer, the bank checks if the interest received will cover the risk and the margin. The margin must be big enough to meet the expenses necessary to run the bank itself. In the case of some perfectly trustworthy borrowers, a bank may reject a credit application because lending money to such people would be unprofitable.

In our case investors are still ready to lend the money as they do not have the corporate costs that are peculiar to banks.

We are accused sometimes of being “badâ€, of being “like all the banksâ€. There is always the dilemma of whether we should let the borrower in, knowing that they might not be able to pay off the loan. Getting into the well-known spiral of debt is very easy and we do not want to be the one that allows that to happen. This is especially true when we observe what happens on other P2P lending platforms in Poland where there are users who run up huge debts, borrowing to pay off their existing liabilities.

Is the interest rate cap forced by Polish law (20% in August 2009) an obstacle for smava and the whole P2P lending market in Poland?

Przemyslaw Moscicki: The law does not work the way it was supposed to – there are ways it can be circumvented (which are exploited both by the banks and companies offering similar financial services). In my opinion, the idea behind the interest rate cap is reasonable. If we could have listings with 100% APR on smava, and there are listings with 1300% APR on other Polish P2P lending platforms, who would be interested in borrowing on such terms? The only people who would be are those already trapped in debt and not coping with their existing liabilities. When the interest rate goes up significantly, the market starts to attract a totally different group of customers. In reality it does not matter how much interest somebody is willing to pay – the only thing that counts is what they are able to pay.

Monetto.pl (one of the other Polish P2P lending services) is practically on its last legs, although it has still not officially gone under. How do you think this case is going to finish? Do you think that it caused much harm to the idea of social lending in Poland?

Przemyslaw Moscicki: Monetto.pl was not the first, nor will it be the last, failed attempt to create a secure P2P lending platform – it highlights the importance of safety. We made a calculated bet on the safety factor and we made preparations for our entry into the Polish market for well over a year. We could have been the first on the Polish market but we have chosen to be the last, albeit the one with the safest and the best product.

The Monetto case should ideally be resolved in a way that causes the least damage to its users. One possible solution to their situation seems to be the idea of hiring an outside provider to service the existing loan agreements until they expire.

If one looks globally on the P2P lending market, there are many competing models based on different sets of business assumptions. Of all of these, which do you consider the most interesting and the one that would serve as a blueprint for your enterprise?

Arkadiusz Hajduk: We are not using any of them as a blueprint.. We are trying to build the best model according to the knowledge we have gained about the market. We have not built a copy of Prosper or LendingClub, for example. On the other hand, we have learned a great deal from their experiences– that is for sure. Where did other P2P lending platforms fail? What clearly does work in Poland and what definitely does not work? The local experience is very important.

There is also one more matter, which is that it is probably too early to say that someone has succeeded in this market. There is no P2P market that might be considered as an example of the way to build such business and truly say that it has been a success, except of course for smava.de 🙂

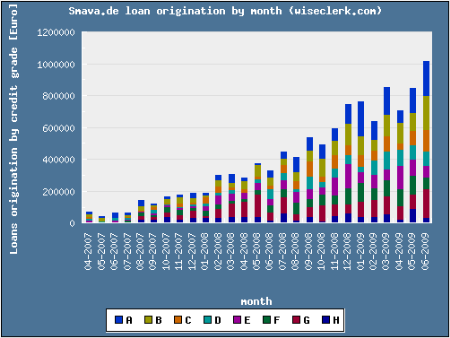

Przemyslaw Moscicki: We really liked what smava had done in Germany. The beginnings of many P2P markets are based on the same scheme – you start by building volume and put the word about that you are doing so. Smava did not do any flamboyant “showing off†at the beginning. In the first year of operation, loans funded by Boober in the Netherlands were worth about 1,5 million euros (while smava’s were only in the region of 1 million). It was a well thought-out, cautious approach – checking the safety features first (the way we do it in Poland now), then focusing on building up volume. Looking at it from the long-term perspective, smava’s approach proved successful – Boober no longer exists in Holland and the volume of loans funded by smava now reaches almost 14 million euros.

If I may returning to the question of international differences, there are P2P lending markets that rely heavily on the social element, such as Prosper that features social recommendations, groups building credibility together and so on. Do you plan to move in that direction and enhance the social features in smava?

Arkadiusz Hajduk: Our experience of the P2P lending markets, including Prosper, are not that positive. It looks like the social features of P2P lending are far less important than what people thought they would be at first. There were high expectations – for example, that groups would boost repayment. In smava.de there is a conviction that groups are not that helpful in this regard, although they are popular and active. We are talking about a specific situation of course, people dealing with money. Maybe this fact changes the whole context of what it means to be a community.

We cannot in advance say it will never work. Maybe we are at the stage where we are not yet ready to think about commerce, money, and exchange from the social perspective. It looks now as if the “social lending†phenomenon is closer to finance, but maybe later the focus will change. When everyone is accustomed to handling virtual money, to dealing electronically with people they have never met, and to building trust online, maybe then it will work.

For now we have social features in smava.pl – users join the groups quite actively. We plan to support these interactions continually between our users in the future.

P2P lending markets in some parts of the world have lately experienced severe regulatory problems (for example, the suspension of Prosper.com’s activity, and the problems of Zopa.it). Is the legal situation of social lending platforms in Poland defined well enough for you not to be afraid of similar obstacles to overcome?

Przemyslaw Moscicki: The Polish legal system is very different from the Italian one and extremely different from the American system. KNF (the Polish financial supervisory board) repeatedly presented their point of view in the media. They treat P2P lending markets as auction websites so we do not foresee any problems here. Moreover, Zopa and Prosper are based on totally different business models. The truth is that the law hardly ever responds quickly enough to changes in environment – especially a virtual one. The same problems haunted eBay and PayPal. I have every reason to believe it will change in the future.

Observing the communication style of smava.pl (using “banking†keywords on the website, microblogging at Blip.pl, and your advertisements) I get the impression that you use “confrontational rhetoric†– positioning smava as an alternative to the “greedy banks†and competing with banks directly. Is that a fair picture of your position and, if so, why did you choose it?

Przemyslaw Moscicki: What we want to accomplish is education, not confrontation. In Poland we have the highest interest rate spread in Europe and, at the same time, banks tend to advertise financial services in a misleading and ethically dubious manner (some have even in fact lead to legal action taken by KNF – the financial services authority). Poles still, as a rule, trust what they see in commercials. That is why we try to educate consumers and show them that loans with smava are undoubtedly the cheapest on the Polish financial market. That is a fact discussed within the leading mass media in Poland, and not a marketing trick of ours.

So on a related point, how do you perceive the bank and P2P lending relation? A conflict? A peaceful coexistence in different market niches? Cooperation? Synergy? Do you think that P2P lending might be a real substitute for banking products? What about banks starting their own social lending markets – is that a viable option?

Przemyslaw Moscicki: P2P lending in our execution should be treated as a totally new asset class with no real substitute. It gives an opportunity for safe investments with ROI in between 14 and 22% per annum. I am convinced that it is not only complimentary to other asset classes but that it will definitely act as a substitute for a great deal of them for the simple reason that smava offers a much higher ROI than that offered by bank deposits, and it is much more predictable than most of the remaining financial instruments.

The relation between banks and P2P lending might be compared to the relation between eBay and warehouse retailers. Ebay is a modern, cheaper and more comfortable way to achieve the same goal as the traditional method of retail. As for the last question – I do not think that it would be profitable for banks to start their own P2P lending markets. It would be profitable for them, for sure, to invest via smava, as in fact some of them are already considering.

According to the information I have, smava.pl does not publish figures on the volume of loans originating from the platform. Do you plan to share that information in the future?

Przemyslaw Moscicki: As a result of looking at how smava.de was developing, we are not focusing on building up the volume during the first year of operation. We are determined to build the safest P2P lending market in Poland, offering safe investments and the cheapest loans on the market. We plan to publish the data corresponding to this in the not too distant future.

The Polish P2P lending market is comparatively “crowdedâ€, so to speak. Do you think that there is room for new entrants – specialized markets aimed at specific market segments (for example, student loans)?

Arkadiusz Hajduk: The niche markets are already here, for example Finansowo.pl. Its owner, Rafal Agnieszczak, at one of the BootStrap meetings, said that it was supposed to be a market for students. In my opinion, it is too early for any specialization to occur. You have to build the market for everyone, just to get people accustomed to the idea. It is only then that you can think about serving specific niches….

So it is “general†social lending first, and then what might come after that?

Arkadiusz Hajduk: To be honest, I am not convinced that such a thing as specialized P2P lending will ever exist. Looking for instance at Fynanz or GreenNote – they try to move in that direction but there is no significant volume to speak of. Fynanz had reasonable assumptions – to serve students of top universities. It looks great in theory but in practice it looks as if this specialization is too early.

Przemyslaw Moscicki: There is also the question of investment and risk. Getting a P2P lending market started means a lot of work and money. In my personal opinion it is much too early to think about anything other than the general business in Poland right now.

If I could ask one or two final questions: what are your plans for the nearest future? What are you focusing on? Is it your preference for smava to be “the safest P2P market in Poland†or “the biggest market in Polandâ€, or perhaps something completely different?

Przemyslaw Moscicki: Looking at it from the long-term perspective, only the safest platforms will survive. In the financial market one cannot choose between safety and growth. The leaders in the P2P lending market will be the ones that can take one step backward to build a secure marketplace and then march 100 steps forward to boost the volume. I am sure that smava will be that kind of player in the P2P lending market.

As for our forthcoming plans, we have just started cooperation with the ZANOX affiliate network. That is all I can disclose for now.

Arkadiusz Hajduk (32) has co-founded and played an important role in building p2p lending operations in Poland (smava.pl), Canada (ioucentral.com) and Denmark (FairRates.dk). Arkadiusz focuses mainly on product development, operations and technology of p2p lending. Arkadiusz holds a Master’s degree in Engineering from the Technical University of Denmark and a Bachelor’s degree in Engineering from the Wroclaw University of Technology.

http://www.linkedin.com/in/ahajduk

Michal Kisiel writes as a guest author for P2P-Banking.com covering p2p lending developments in Poland. He is assistant professor at University of Economics in Wroclaw, Poland. He is also blogging (in Polish) about financial innovations on finnovation.pl.

P2p lending site

P2p lending site