As Mike has calculated, the revenue Prosper.com earned in August was $118,000. No figures on the cost structure of Prosper's operations are available.

Prosper

No more Prosper group fees

Prosper.com announced that it will discontinue group fees in the near future for all new loans. Group fees, also called Group leader rewards or Group rewards allowed the group leader to charge a fee that is payed by borrowers with loans in this group.

The announcement:

At Prosper, we have been listening to your feedback regarding groups and group leader rewards.

The original philosophy behind Prosper Groups was to enable borrowers in close-knit communities to leverage the reputation and peer pressure of their group to attract more bids from lenders, resulting in potentially lower interest rates for borrowers, and lower default rates for lenders. We have found, after nearly two years of experience, that the strongest groups are comprised of close networks of friends and associates, where compensation is not the dominant motivation for the group leader’s services.

As a result, we are making changes to Prosper Groups. In the next month, Prosper will discontinue payment rewards on new loans for group leaders. Group leaders will continue to earn payment rewards on all eligible loans originating before the change. Group leaders can also receive referral rewards for referring borrowers or lenders to Prosper under our Referral Program.

We hope this change will encourage group leaders to grow their groups by inviting new members from their pre-existing social networks, turning Prosper Groups into a more powerful community development tool and making Prosper simpler for both borrowers and lenders.

For more details on these changes, please visit our Group Changes Frequently Asked Questions (FAQ).

Thank you for helping us become the Internet’s leading community lending site.

The original idea of the Prosper groups was, that social connections, that already existed offline, would be replicated within the Prosper group structure.

But most groups evolved online only with no previous offline connections between the members. The (the lack of) value of the groups for the Prosper concept has been discussed repeatedly in the Prosper forum. While some group leaders did a good job screening and vetting borrower applications and the group leader could be seen as a compensation for time invested; the majority of lenders seems to see the removal of group fees as a step in the right direction.

Comparing MyC4 to Prosper

Researching the MyC4 concept (see previous post) there are some usability features that call for a comparision to Prosper.com:

- Auction: The model of Prosper seems much more straightforward to me then the auction model of MyC4. The possibility of bidding above the maximum interest rate as long as the weighted average interest is below it, gives it a major twist. Every lender on a loan ends up with a different interest rate while borrower nominal interest rate is the weighted average (mind-boggling, isn't it?). And the full transparency of all bids during bidding process is interesting.

- Usability, communication and transparency: The interface is designed for much interaction. Everywhere the user can post comments (to profiles, to blogs, to loans, to listings). And with a user added avatar on every comment, it is very personal. No anonymity since real names are used (not screen names). Anybody can view the loans other lenders are invested in. Users can add icons to their profile to show which motivation led them to MyC4 (be it profit, education, social lending, …)

- Defaults. So far none, but naturally it is much to early to judge. Hopefully MyC4 will have defaults as low as Kiva and prove that third world borrowers are more reliable.

There will be continued coverage about my experiences at MyC4.

Borrowers – tight-lipped or talking one’s head off?

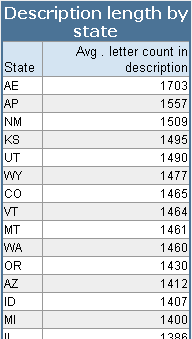

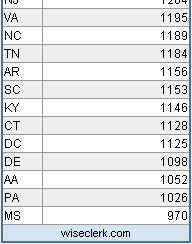

When analysing Prosper.com data it is possible to find out all kind of things. E.g if there are regional differences to how talkative Prosper borrowers are when writing listings.

Prosper's most talkative borrowers live in:

as compared to:

Now, while that was fun, it is not really useful in any way or is it?

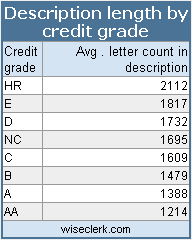

When looking at the length of funded listings, that became loans, by credit grade it gets more interesting.

Apparently the lower the credit grade the more detailed the description has to be to convince the lenders to bid to fund the loan.

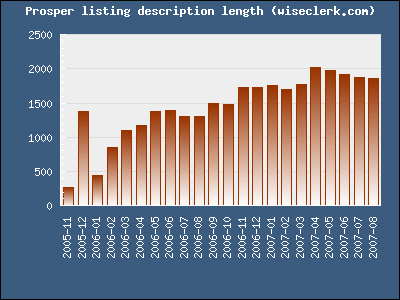

Looking at the development of the description length of funded Prosper listings on the time scale this chart is the result:

There are several possible causes that contribute to listings getting lenghtier:

- Borrowers take other listings as example and add on top of this

- Group leaders (or others) provide templates

- Competition for lender attention is getting tougher

- Borrowers detected that longer descriptions will increase chances (see HRs in table above) – unlikely

Suggestions?

Prosper seeks Vice President Institutional Lender Development

Prosper is hiring a Vice President, Institutional Lender Development. Job description:

As Vice President of Institutional Lender Development you will be responsible for ensuring Prosper has an adequate supply of liquidity. You will need to create an institutional sales process that identifies institutional prospects and sells them on the benefits of lending on Prosper. The position will also be responsible for developing strategies and structures that match the risk and return preferences of prospective lenders. This position will have an attractive incentive compensation plan dependent on meeting goals for institutional lender growth and marketplace liquidity.

This is an interesting development. First, if successful, it will scale up volume. Secondly, at least on the lender side, this step dilutes the peer to peer aspect of the marketplace.

Even more data transparency – Prosper adds missing link

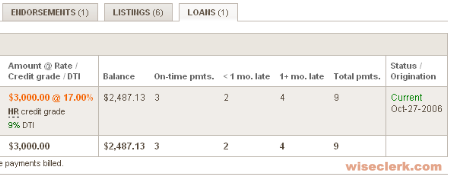

Prosper.com now makes the link between loans and listings available. With this new feature now everyone can see the status of the loan payments of every borrower. On the borrower profile page there is now a "Loans" tab:

Previously only lenders invested in a loan could directly see, which status it had. All others had to use 3rd party tools like Wiseclerk.com. Those had to program their own matching algorithms since no key matching loans to listings was published by Prosper.

Prosper has always been the p2p lending service that made most data available about its market.

I will have to look into which parts of Wiseclerk.com I need to rebuild to make use of the new information linking listings to loans.

Further improvements that Prosper announced include reporting to Transunion and enabling borrowers to repay directly using money in their Prosper account.