Prof. Dr. Andreas Dietrich of the Lucerne University of Applied Sciences and Arts, Simon Amrein, Reto Wernli and Dr. Falk Kohlmann have published the study ‘Crowdfunding Monitoring Switzerland 2015‘. It analyses the development of crowdfunding in Switzerland giving special attention to the development of p2p lending.

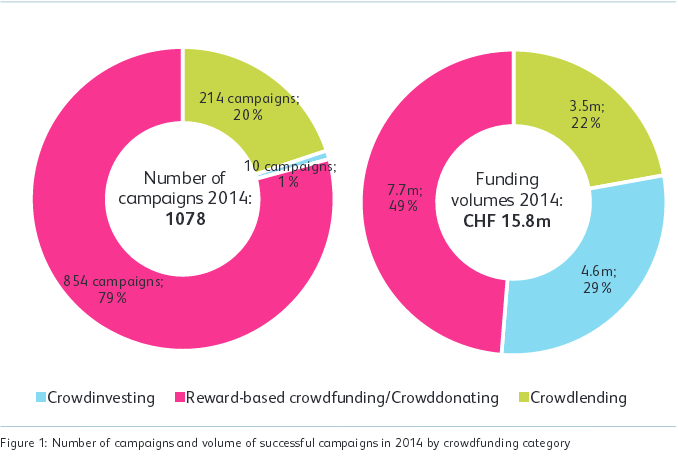

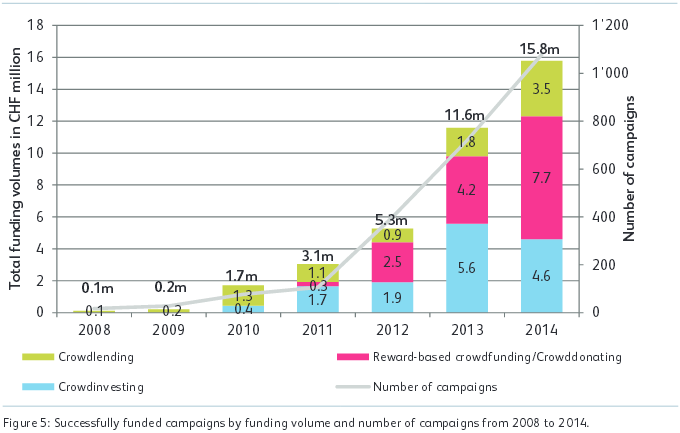

The Swiss market is growing fast; albeit on low absolute numbers compared to other European countries. The market is in a very early development stage. As the following chart shows the volume is mainly generated by crowdsupporting/crowddonating.

Source: Crowdfunding Monitoring Switzerland 2015 study

The total market for new loans to consumers in Switzerland in 2014 was 3.9 billion CHF. Via p2p lending 3.5 million CHF were originated in 2014, so that equals a market share of only 0.1%. But the p2p lending volume has nearly doubled compared to 2013 (1.8 million CHF). The authors state:

The crowdlending market has experienced the strongest year-on-year growth of all crowdfunding segments. … The number of campaigns rose from 116 to 214, and all of them were successfully funded. The current challenge of crowdlending platforms is not finding funders. On the contrary, it is (more) difficult to get borrowers on the platforms. Crowdlending campaign funders invested an average of CHF 1,100, which is substantially different from the figures in reward-based crowdfunding & crowddonating as well as in crowdinvesting. The average campaign amount was CHF 16,200, which was slightly higher than in the past year (CHF 15,000). The average loan amount in crowdlending is very similar to the average consumer loan as of the end of 2014. The crowdlending market is, however, still niche market.

Source: Crowdfunding Monitoring Switzerland 2015 study

Regulation limits that a private consumer loan cannot be financed by more than 20 different individual lenders.

The authors analysed loan data of the Cashare marketplace. Examining who uses p2p lending as a borrower the study finds:

The average borrower age is 38. One fifth had at least one child under the age of 16 at the time the loan was raised. At 37 percent, married people were proportionally under-represented, although they make up 54 percent of the permanent resident population. 19 Homeowners (19 percent) and women (24 percent) are also under-represented. The distribution of nationalities is slightly more representative of the Swiss population. 71 percent of the borrowers were Swiss, while 29 percent of the borrowers were not in possession of a Swiss passport. The average proportion of the foreign-born resident population in Switzerland was 22 percent between 2008 and 2013.

The age distribution of the borrowers leads to the conclusion that crowdlending is currently still primarily used by the tech-savvy Generation Y. 60 percent of all loans raised since 2008 went to people under the age of 40. Only 4 percent of the borrowers for successful projects were over 60 years of age.

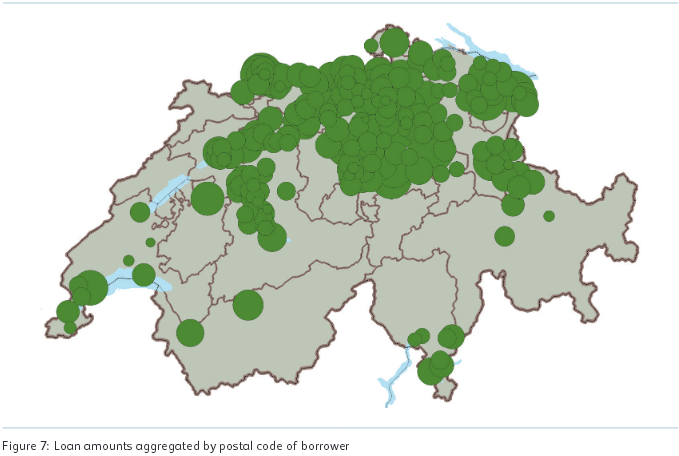

Also the borrowers regional distribution shows that use is much more common in the German speaking areas of Switzerland.