German laws require a banking license to hand out loans. To comply with regulation the two active German p2p lending services partner with a transaction bank, which originates funded loans and then sells the debt claim to the individuals (‘lenders’) that did bid on the loan request on the p2p lending marketplace.

Smava now switched it’s bank partner. Since Smava’s launch in 2007 the bank partner was the biw Bank für Investments und Wertpapiere AG. For all new loans after Dec. 1st, Smava cooperates with the Fidor Bank AG (see earlier coverage on Fidor). Smava feels that Fidor is a great match and praises the integration advantage Fidor offers with its web APIs. The change does not bring any immediate benefits for lenders other than a) unlend money will now earn 0.5% interest p.a. and b) the e-money license of Fidor allows lenders to start lending without verifying identity first – but that’s rather symbolic as it applies only to amounts of up to 500 Euro (and the minimum bid on Smava is 250 Euro) meaning that new lenders could test Smava with up to 2 bids before going through postal identification process.

P2P Equity

Smarchive, the fourth startup pitching at German marketplace Seedmatch (see earlier coverage on Seedmatch) raised 100,000 Euro in less than 3 days. The pitch originally was for 50K, but was oversubscribed to the maximum possible amount (100K).

Seed Enterprise Investment Scheme (SEIS)

In the UK the market the surrounding conditions for the emerging p2p equity market get better and better. From April 2012 investors in eligible startups will be able to claim 50 percent income tax relief (on a maximum investment of 100,000 GBP per year). The minimum required investment is just 500 GBP per startup. The new law will replace the Enterprise Investment Scheme (EIS) which currently already offers a generous 30% tax break. The British government will also ease some of the restrictions of the current EIS scheme.

The SEIS will bring a huge boost to p2p equity marketplaces in the UK.

Maybe an idea to be copied in other legislations to foster startup foundation?

ThisisMoney on P2P Lending Risiks and Quakle

ThisisMoney has two (1,2) long articles on the failure of Quakle and risks associated for lenders with p2p lending in general. While not wrong, the articles oversimplify some things. And actually there are more risks for lenders then the two mentioned (compare my old article ‘For Debate: A Flaw in Current P2P Lending Models?‘). The author is a strong advocate of the P2P Finance Association: ‘Checking for the association membership is crucial. It’s a self-governing industry body, so does not carry the same weight as regulation by the Financial Services Authority – something the industry wants but lacks as yet – and is currently the best benchmark for those considering lending.‘. Not a bad advice, but with the association and the market so young, I see that as a bit of limiting, possibly excluding any new entrants that might launch.

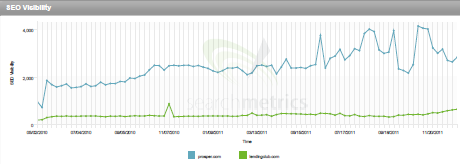

German p2p lending service

German p2p lending service