Goldman Sachs published the research paper ‘The Future of Finance’ analysing the potential impact of alternative finance companies, especially p2p lending marketplaces, on the US banking sector.

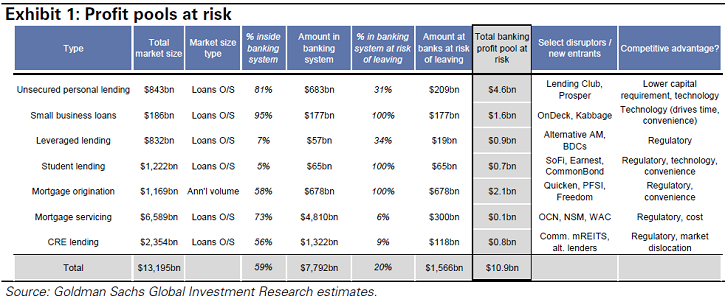

Goldman Sachs states ‘We see the largest risk of disintermediation by non-traditional players in: 1) consumer lending, 2) small business lending, 3) leveraged lending (i.e., loans to non-investment grade businesses), 4) mortgage banking (both origination and servicing), 5) commercial real estate and 6) student lending. In all, [US] banks earned ~$150bn in 2014, and we estimate $11bn+ (7%) of annual profit could be at risk from non-bank disintermediation over the next 5+ years.‘

Lendingclub

Lending Club Fourth Quarter Results

![]() Lending Club just announced the 4th quarter numbers in the investor conference call.

Lending Club just announced the 4th quarter numbers in the investor conference call.

CEO Renauld Laplance stated: “We have continued to expand our reach through 2014 by doubling the size of the business again, while continuing to invest heavily in future growth and risk management. Our IPO in December was an important milestone in the life of the company, and everyone at Lending Club is excited about the next 5 to 10 years and committed to delivering more value and a great experience to our customers. 2015 is going to be another investment year, and we intend to continue growing originations and revenue at a fast, yet deliberate pace.”

Fourth Quarter 2014 Financial Highlights

Originations – Loan originations in the fourth quarter of 2014 were $1,415 million, compared to $698 million in the same period last year, an increase of 103% year-over-year. The Lending Club platform has facilitated loans totaling over $7.6 billion since inception.

Operating Revenue – Operating revenue in the fourth quarter of 2014 was $69.6 million, compared to $33.5 million in the same period last year, an increase of 108% year-over-year. Operating revenue as a percent of originations, known as our “revenue yield”, in the fourth quarter was 4.92%, up from 4.79% in the prior year.

Adjusted EBITDA(3)  – Adjusted EBITDA was $7.9 million in the fourth quarter of 2014, compared to $6.5 million in the same period last year.

Net Income/Loss– GAAP net loss was ($9.0) million for the fourth quarter of 2014, compared to a net income of $2.9 million in the same period last year. Lending Club’s GAAP net loss included $11.3 million of stock-based compensation expense during the fourth quarter of 2014.

Earnings (Loss) Per Share (EPS) Â – Basic and diluted loss per share was ($0.07) for the fourth quarter of 2014 compared to EPS of $0.00 in the same period last year.

Adjusted EPS(3)– Adjusted EPS was $0.01 for the fourth quarter of 2014 compared to $0.02 in the same period last year.

Cash and Cash Equivalents – As of December 31, 2014, cash and cash equivalents totaled $870 million, with no outstanding debt.

“We are entering 2015 with strong momentum on many fronts, and we intend to continue to execute on our strategy of fast yet disciplined growth,” said Carrie Dolan, CFO of Lending Club. “We will also continue to aggressively invest in product development, engineering, process automation, and the buildup of support and risk management functions to pave the way for our long term growth opportunity.”

Outlook

Based on the information available as of February 24, 2015, Lending Club provides the following outlook:

First Quarter 2015

Operating Revenues in the range of $74 million to $76 million.

Adjusted EBITDA(3) in the range of $6 million to $9 million.

Fiscal Year 2015

Total Revenues in the range of $370 million to $380 million.

Adjusted EBITDA(3) in the range of $33 million to $42 million

(3) Adjusted EBITDA and Adjusted EPS are non-GAAP financial measures

Strategy is to focus on the US market in the near future. There is no urgency to expand into international markets. There is not a lot of clarity which of the different models in particular geographies might prevail in customer adoption and get blessed by regulator.

Google and Lending Club Pilot Offering Loans to Businesses

![]() Today p2p lending marketplace Lending Club and Google launch a new pilot program in partnership to facilitate low-interest financing to eligible Google partners. The program leverages Lending Club’s ability to provide access to credit in a highly automated, cost-efficient manner, and allows Google to purchase the loans, thus investing its own capital in its partner network to drive business growth. Lending Club will service the loans.

Today p2p lending marketplace Lending Club and Google launch a new pilot program in partnership to facilitate low-interest financing to eligible Google partners. The program leverages Lending Club’s ability to provide access to credit in a highly automated, cost-efficient manner, and allows Google to purchase the loans, thus investing its own capital in its partner network to drive business growth. Lending Club will service the loans.

Eligible Google partners will have access to financing with low interest and no fees, enabling them to invest in business development and other growth opportunities, hire additional staff and plan for future expansion.

“This first of its kind program enables Google to invest its own capital in the growth of its partners,” said Renaud Laplanche, founder and CEO of Lending Club. “This is a new delivery model for financial services; this program opens up many possibilities for Lending Club partners to enable credit for consumers and business owners.”

Google for Work has built a network of more than 10,000 partners in recent years, including resellers, consultants, and system integrators, which help Google distribute its applications and services. The company recently launched a new incentive program for partners, boosting the rewards for top performers. The partnership with Lending Club is part of this expanded incentive program.

Currently, the pilot program is available to Google reseller partners in the U.S. who meet certain eligibility criteria. Eligible partners can obtain two-year loans of up to $600,000 to invest in growth initiatives. With an interest-only structure in the first year and a fully amortizing second year, the loan payback schedule is designed to match the cash-flow profile of growth investments.

News Coverage of the Lending Club IPO

![]() Yesterday was a very exciting day for Lending Club and p2p lending as a whole. I must say I was awed when I saw the opening price of around 25 US$ as that put the company valuation around 9 billion US$. Looking through the coverage the excitement is certainly shared:

Yesterday was a very exciting day for Lending Club and p2p lending as a whole. I must say I was awed when I saw the opening price of around 25 US$ as that put the company valuation around 9 billion US$. Looking through the coverage the excitement is certainly shared:

- The Lending Club IPO: A First Hand Account at the NYSE, by Peter Renton of Lendacademy

- IPO: The Day the Nation Met Lending Club (with video), by Simon Cunningham of Lendingmemo

- Lending Club nabs $9 billion valuation in IPO, challenges big banks, San Jose Mercury News

- The Biggest U.S. Tech IPO Of The Year Went Nuts Today, Business Insider UK

- What Does Lending Club’s IPO Mean for the Future of Alternative Lending? American Banker

- One small step for P2P, one giant leap for Lending Club, Zopa Blog

- In French: Succès pour Lending Club : la finance à l’ère Google, Le Monde

- In German: Lending Club glänzt beim Börsendebüt, Wall Street Journal

- In Dutch: Stralend beursdebuut voor kredietsite Lending Club, De Telegraaf

The venture capital companies that backed Lending Club will be excited too (see graphic).

The Position of Lending Club at IPO

The long announced IPO of marketplace lender Lending Club is imminent now, with the first day of trading expected to be around Dec. 10th.

The long announced IPO of marketplace lender Lending Club is imminent now, with the first day of trading expected to be around Dec. 10th.

Lending Club will issue 57.7 million new shares priced in the range of 10 to 12 US$. On the upper end this means the company will have a valuation of around 4.4 billion US$. At the same time existing shareholders will offer 7.7 million new share for sale.

Lending Club did not forget it roots. At the begin of the astonishing growth curve it were the small retail investors that funded all the Lending Club loans. So now Lending Club has reserved 10% of the new shares and offered them to these retail investors through a ‘Directed Share Programs’ via Fidelity Investments. For each investor a certain amount of shares (mostly 350) was reserved and offered.

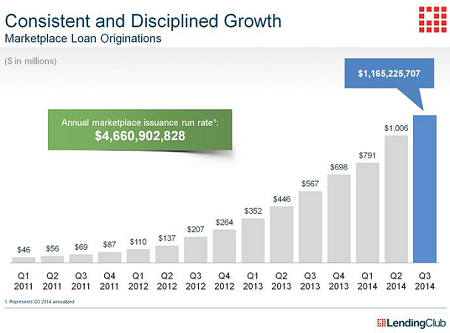

Aside from the IPO financials the big news is the strong position Lending Club has built in the p2p lending market:

Source of all images: Lending Club

Lending Club showed strong growth every quarter.

Lending Club Valuation at IPO 4.33B Max.

![]() For the coming Lending Club IPO a recent SEC filing reveals details on the valuation of the company.

For the coming Lending Club IPO a recent SEC filing reveals details on the valuation of the company.

LendingClub Corporation is offering 50,000,000 shares of its common stock and the selling stockholders are offering 7,700,000 shares of common stock. We will not receive any proceeds from the sale of shares by the selling stockholders. This is our initial public offering and no public market currently exists for our shares of common stock. We anticipate that the initial public offering price will be between $10.00 and $12.00 per share.

After the IPO there will be 361,111,491 shares of common stock outstanding at Lending Club so at 12 US$ per share this will result in a 4.33 US$ billion valuation. Read more details on Lend Academy.