As the end of 2009 approaches here is a selection of main news and developments covered by P2P-Banking.com:

- January: Smava expands into Poland (interview); Pertuity Direct launched; German Smava raises fees; total global p2p lending loan volume is about 740 million US$

- February: Sobralaen launches in Estonia (later renamed Isepankur)

- March: Lending Club receives 12M US$ in VC funding and introduces self-directed IRA; Dutch p2p lending service Boober fails

- April: Aqush launches friends and family loans in Japan; Prosper very briefly reopens

- May: Vittana launch; IOU Central files SEC registration to open in the US; United Prosperity launches with a loan guarantee microfinance model

- June: Spanish bank Caja Navarra experiments with own p2p lending platform; my article ‘For Debate: A Flaw in Current P2P Lending Models?‘ gets quite some email feedback; Kiva launches with loans to US businesses; Loanio SEC filing; Zopa prospers in the UK; P2P Lending Services in Germany get a boost by media coverage; Kiva enacts currency risk coverage changes

- July: Prosper reopens with SEC approval and starts secondary market

- August: Blogs discus whether p2p lending is or will become disruptive; Pertuity Direct closes after only 7 month of operations

- September: Smava Poland interview; the article ‘P2P Lending Technology – Make or Buy‘ is one of the most-read and the most commented article in 2009

- October: Moneyauction booms in Korea

- November: Kiva surpasses 100 million US$ in loans; Prosper and MYC4 have problems with non-payments/defaults; Virgin Money exits US p2p lending market

- MYC4 reduces staff

Off to new shores (Photo credit: Nattu)

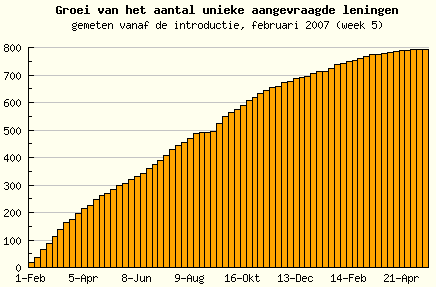

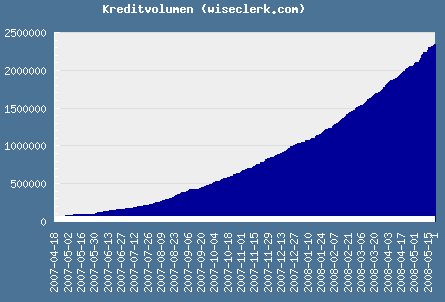

In the Netherlands p2p lending service

In the Netherlands p2p lending service  Tools for

Tools for