Zopa has run a member competition, asking members to explain how Zopa works for a borrower or a lender.

I watched several of the created videos. My favourite is the video below by Glenmation.

Zopa has run a member competition, asking members to explain how Zopa works for a borrower or a lender.

I watched several of the created videos. My favourite is the video below by Glenmation.

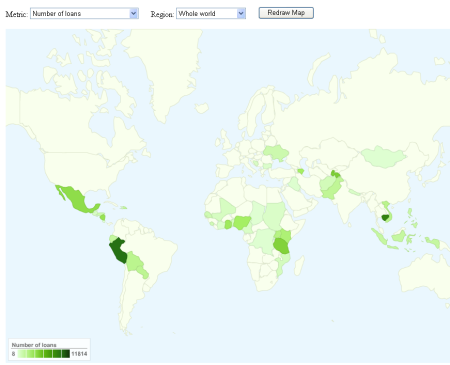

The Kiva API allows anyone to develop applications that use the data from Kiva loans. Below are screenshots from two Kiva loan apps.

Kiva loans by country of borrower – source Kivadata.org Continue reading

I am blogging this live while listening to the Kiva conference call. Kiva plans a loan matching program, where lenders and institutions can opt to automatically match loans made by other lenders.

Some statements/explanations from the conference call:

Kiva says the new feature allows to automate the lending process and hopes that it inspires others to lend more.

The matching program will probably be launched in summer 2009.

On terms of automation there are similarities to the autobid feature MYC4 has.

See the following presentation for more details on the plans.

On other issues, there was the message that chances are good, that the Ebony Foundation (a MFI) repays outstanding loans (approx. 40,000 US$).

Over the last months it became clear that MYC4.com loans default at a much higher percentage then expected. MYC4 management states several growth and quality problems that led to the situation. Better training of the local providers, partner ratings, spot audits and a license system are measures that shall improve the quality in loan selection and management in the future.

Over the last months it became clear that MYC4.com loans default at a much higher percentage then expected. MYC4 management states several growth and quality problems that led to the situation. Better training of the local providers, partner ratings, spot audits and a license system are measures that shall improve the quality in loan selection and management in the future.

Currently one challenge is to deal with the failing loans issued in the past. The earlier problems with Ivory coast loans continue. About half of the issued loans were insured by the organisation MISCOCI against defaults. MISCOCI failed today and is reported to be bankrupt. MYC4 has announced a few minutes ago, that they will publish until March 20th, what this means for the lenders on the defaulted Ivory Coast loans (MISCOCI covered 242 loans with an outstanding balance of 388,644 Euro).

NotreNation, one of the providers in Ivory Coast, yesterday named poor selection of borrowers by inexperienced credit agents and the difficult economic situation in Ivory Coast as reasons for high default rates.

GrowthAfrica, a provider in Kenya with a high portfolio at risk rate (PAR) has announced yesterday that it will buy back 65 very poorly performing loans at 95 percent of the balance from the lenders. This step was taken as GrowthAfrica felt they share responsibility for the poorly performing loan portfolio. GrowthAfrica expects to buy back loans for more then 125,000 Euro in total.

P2P Lending service Pertuity Direct has launched an affiliate program. The new referral marketing campaign of Pertuity Direct pays:

The campaign runs at affiliate network CJ, where Lending Club does administrate it’s affiliate program, too. Lending Club pays 35 US$ commission for each loan application and 60 US$ per lender registration plus performance incentives.

See earlier posts about p2p lending services using affiliate marketing.

Virgin Money announced that it will support the Uncrunch campaign.