Rebuildingsociety will award one free interest free loan to one business. For the selected loan, Rebuildingsociety will pay the interest to the lenders.

Rebuildingsociety will award one free interest free loan to one business. For the selected loan, Rebuildingsociety will pay the interest to the lenders.

Today Zopa announced yet another promotional offer for lenders: Rate Promise. In this limited time offer Zopa promises lenders that ‘… the money you lend within the Offer Period, for up to 5 years, will earn an average return of 5% over the lifetime of those loans.‘ That is after fees. The offer is valid from January 9th till Feb. 3rd. Actually for some lenders this will mean even higher guaranteed returns – see full T&C of the Rate Promise here.

Today Zopa announced yet another promotional offer for lenders: Rate Promise. In this limited time offer Zopa promises lenders that ‘… the money you lend within the Offer Period, for up to 5 years, will earn an average return of 5% over the lifetime of those loans.‘ That is after fees. The offer is valid from January 9th till Feb. 3rd. Actually for some lenders this will mean even higher guaranteed returns – see full T&C of the Rate Promise here.

I think Zopa’s repeated promotional offers (cash backs and now rate promise) are signals that Zopa feels the impact of the p2p lending competition which entice Zopa’s customers with models that seem more appealing (there has been a lot of discussion that with the introduction of Safeguard Zopa became much less transparent) or could yield higher returns. In terms of p2p lending loan volume originated per month the main competitors are certainly gaining ground on Zopa.

While this is a (nearly) no risk offer for those lenders managaing to invest during the promotion duration, users on the Zopa Talk board do wonder what longtime impact this has for Zopa. And rightly so as Zopa will have to cover any shortcomings from its fee margin. Done repeatedly it will effectively result in an unlisted fee decrease.

I am sure it will fulfill the probable short term goal: increase funds on offer and originations in January.

Everybody talks about the win-win situation p2p lending offers for lenders and borrowers. By cutting out the large spread a bank takes when making a loan, the lender can get a higher interest rate, than he might in a savings account and the borrower may get a lower interest rate, than using his credit card. But who does actually decide what the interest rate for a p2p loan will be?

Several market mechanisms have developed. P2P lending services use combinations of these to built their platforms. I’ll describe some of the elements:

Individual Loan Listings vs Markets: With Listings (e.g. Prosper, Lending Club, Auxmoney, Isepankur) lenders can look at individual loan listings and see multiple parameters (e.g. credit grade, income, DTI, occupation, location,…). The lender can select (“filter”) loans based on his strategy. This is not necessarily a manual process as he can opt to use automatic bidding tools that make the selection for him based on criteria he set in advance. Other p2p lending services use Markets (e.g. Zopa, Ratesetter) which combine loans based on broader criteria (e.g. loan term, or credit grade). Here a lender can only decide which market to invest into, but does not pick individual loans.

Close at Funding vs Auctions: Some p2p lending services close loan listings once they are 100% funded. The loan is then originated. Others uses an auction process where the listing is open for bidding for a set time. If the loan amount is 100% funded then the bidding continues for the remaining auction period. New bids at lower interest rates push out old bids at higher interest rates, thereby lowering the final interest rate for the borrower. Some p2p lending services allow loan listings of both types or let the borrower prematurely end an auction (e.g. Rebuildingsociety, Isepankur, Assetz Capital).

Uniform vs Mixed Lender Rates: After an auction the interest rate for the borrower can be set at the rate of the highest successful bid. In this case all lenders on the same loan get the same uniform interest rate (e.g. Isepankur). Another option is to calculate the interest rate as an aggregate of all successful auction bids. In this case each lender gets the rate he did bid – there will be a wide mix of lender interest rates on the same loan (e.g. Rebuildingsociety).

Who does decide what the interest rate will be on a p2p loan

I. Borrower sets interest rate

The borrower decides, what (maximum) interest rate he is willing to pay (e.g. Smava, Auxmoney, Isepankur). The lenders can then decide, if they want to fund this specific loan at that rate or not. If there is an auction and lender demand is strong, then the borrower may get the loan for a lower interest rate then specified. Obviously lenders will fund loans with most attractive rates first and other loans will go unfunded. These borrowers can react by relisting at a higher interest rate. Continue reading

Zidisha has just published the Kindle E-Book ‘Venture: A Collection of True Microfinance Stories‘. Authored by Zidisha staff and volunteers, the book is a rich and readable collection of real-life portraits of Zidisha entrepreneurs worldwide.

Venture is written for Zidisha supporters and anyone else who would like to better understand the realities faced by the poor and the aspiring middle class in the world’s least developed countries, the range of factors that affect their prospects for working their way out of poverty, and how microfinance can impact their lives. There are 34 stories of individual borrowers.

Zidisha founder Julia Kurnia told P2P-Banking.com that all proceeds will go to cover Zidisha’s operating costs.

Note to other p2p lending/p2p microfinance services: Do you have interesting inside stories to tell? Have you considered distributing them in e-book format? The marketing effect could be good compared to other marketing channels. For maximum exposure you might even offer the e-book for download free of charge. If you tried this method, tell us, so we can write about your experiences.

Here is how you can be one of 10 winners of a free copy of the new E-Book

Are you interested in Microfinance? Maybe you have used Zidisha already? Regardless of what triggered your interest in the subject, you have a good chance to win, because the only thing you have to do is: be quick!

The first 10 readers to leave a comment (any comment) under this blog post will win a free copy, courtesy of Zidisha. You need to leave your email address when commenting in the designated field. The email addresses will NOT be publicly visible. The email addresses of the 10 winners will be given to Zidisha. Zidisha will distribute the copies. And after you read it, please do come back and post a comment here how you liked it, so other readers can have some guidance on whether they should go ahead and purchase it. Thank you.

German Smava, launched 2007, yesterday announced that it will offer more products and evolve into a marketplace where borrowers seeking loans get multiple offers. The site logo and layout have been redesigned to reflect this change. Smava said p2p loans will be continued to be on offer and the new products (bank loans) added will give the borrower more choices.

German Smava, launched 2007, yesterday announced that it will offer more products and evolve into a marketplace where borrowers seeking loans get multiple offers. The site logo and layout have been redesigned to reflect this change. Smava said p2p loans will be continued to be on offer and the new products (bank loans) added will give the borrower more choices.

My take on this – what does Smava achieve with this change?

Smava’s new loan volume was static since mid-2010. With the current change Smava:

Why does Smava still keep p2p lending?

The question is not if Smava will continue p2p lending (the announcement said they will), but rather if Smava will continue development on that offer. That is unlikely since little happened in the last years. My assumption is that Smava keeps p2p lending on offer mostly for PR and marketing purposes.It allows Smava to position itself as different to loan brokers and loan comparison sites and keep a little of the image of financial innovation attached to the site. Continue reading

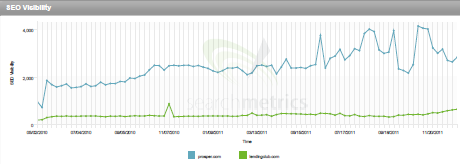

Internet ventures are dependant to a certain degree to new visitors that are referred to them via search engines. A visitor that did a search on a very specific search term, e.g. ‘get a personal loan’ will have a very high chance to sign up if after that search he is introduced to the Prosper or Lendingclub website. There are tools that measure how ‘visible’ a domain is on Google and other search engines providing an index chart, that allows to compare the visibility of several websites.

Prosper’s visibility index (blue line) is much higher than Lendingclub’s. Prosper.com ranks good for more and more important keywords in organic search rankings. Organic search means, that Prosper shows in a the search results at search engines that are not paid ads. But which search terms do the actually rank for? Continue reading