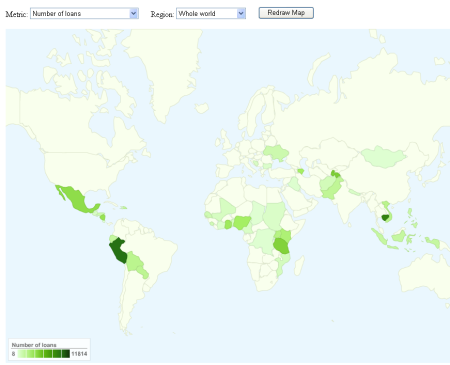

The Kiva API allows anyone to develop applications that use the data from Kiva loans. Below are screenshots from two Kiva loan apps.

Kiva loans by country of borrower – source Kivadata.org Continue reading

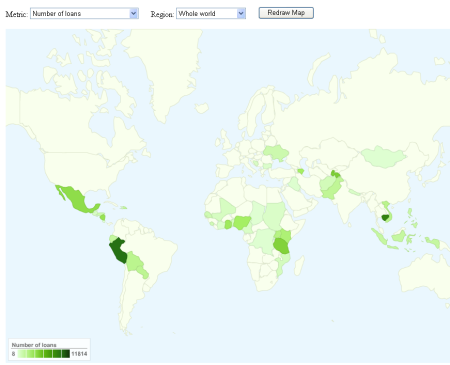

The Kiva API allows anyone to develop applications that use the data from Kiva loans. Below are screenshots from two Kiva loan apps.

Kiva loans by country of borrower – source Kivadata.org Continue reading

I am blogging this live while listening to the Kiva conference call. Kiva plans a loan matching program, where lenders and institutions can opt to automatically match loans made by other lenders.

Some statements/explanations from the conference call:

Kiva says the new feature allows to automate the lending process and hopes that it inspires others to lend more.

The matching program will probably be launched in summer 2009.

On terms of automation there are similarities to the autobid feature MYC4 has.

See the following presentation for more details on the plans.

On other issues, there was the message that chances are good, that the Ebony Foundation (a MFI) repays outstanding loans (approx. 40,000 US$).

P2P Lending service Pertuity Direct has launched an affiliate program. The new referral marketing campaign of Pertuity Direct pays:

The campaign runs at affiliate network CJ, where Lending Club does administrate it’s affiliate program, too. Lending Club pays 35 US$ commission for each loan application and 60 US$ per lender registration plus performance incentives.

See earlier posts about p2p lending services using affiliate marketing.

Virgin Money announced that it will support the Uncrunch campaign.

Kiva has just added the first video to one of the borrower’s profiles. A video conveys much more information about the business of the borrower. And by posting the videos on Youtube, Kiva achives viral marketing effects.

I do wonder why they did post such a short video (5 seconds) as example – bandwidth considerations?

(Source: Kiva announcement)

It has been said before – there might have been no better time to establish p2p lending. With the established system shaken and many consumers not getting loans as easily as before the market environment is good for peer-to-peer lending.

P2P lending gets good media attention. The Uncrunch.org initiative (in which Lending Club takes part) in the Change.org vote for new ideas finished in the Top 15.

On the demand site all p2p lending companies benefit from the crisis. On the supply site, in my opinion the effect is mostly positive too, but some lenders are hesitant to invest their money in a new, innovative model and rather seek a save haven for it.

P2P lending sites that have demonstrated low default rates over a longer time and therefore low risk fared best – especially at Zopa UK supply rose strongly lately.

Bonmot from Spanish Comunitae:

Pues no sabemos si la crisis es buena para Comunitae, pero de lo que no cabe duda es de que Comunitae es buena para la crisis.

Translates to: “Well, we do not know if the crisis is good for Comunitae, but what is certain is that Comunitae is good for the crisis.”