Today Zopa announced yet another promotional offer for lenders: Rate Promise. In this limited time offer Zopa promises lenders that ‘… the money you lend within the Offer Period, for up to 5 years, will earn an average return of 5% over the lifetime of those loans.‘ That is after fees. The offer is valid from January 9th till Feb. 3rd. Actually for some lenders this will mean even higher guaranteed returns – see full T&C of the Rate Promise here.

Today Zopa announced yet another promotional offer for lenders: Rate Promise. In this limited time offer Zopa promises lenders that ‘… the money you lend within the Offer Period, for up to 5 years, will earn an average return of 5% over the lifetime of those loans.‘ That is after fees. The offer is valid from January 9th till Feb. 3rd. Actually for some lenders this will mean even higher guaranteed returns – see full T&C of the Rate Promise here.

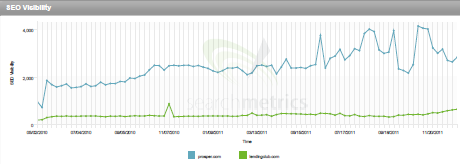

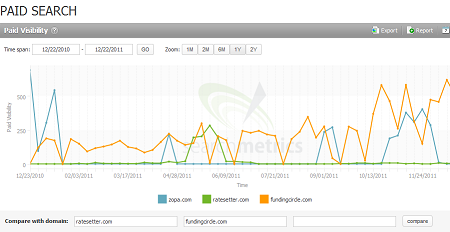

I think Zopa’s repeated promotional offers (cash backs and now rate promise) are signals that Zopa feels the impact of the p2p lending competition which entice Zopa’s customers with models that seem more appealing (there has been a lot of discussion that with the introduction of Safeguard Zopa became much less transparent) or could yield higher returns. In terms of p2p lending loan volume originated per month the main competitors are certainly gaining ground on Zopa.

While this is a (nearly) no risk offer for those lenders managaing to invest during the promotion duration, users on the Zopa Talk board do wonder what longtime impact this has for Zopa. And rightly so as Zopa will have to cover any shortcomings from its fee margin. Done repeatedly it will effectively result in an unlisted fee decrease.

I am sure it will fulfill the probable short term goal: increase funds on offer and originations in January.

German

German