P2P lending service Lendingclub, which launched last month has passed 100000 US$ in closed loans. The growth rate, compared to other peer to peer startups launched this year in other markets (see previous articles) is very high. More than $210000 in loans will close in the next 12 days. (Source: Techcrunch)

US

Prosper raises $20 million venture capital

Prosper.com has raised another 20 million US$ in funding from DAG Ventures, Meritech Capital Partners. Previous investors also participated in this round. (Source: VentureBeat)

It is speculated that Prosper might use the money to further develop its p2p lending model in order to enhance competitiveness with Zopa and others in the US.

Lendingclub to introduce p2p lending to Facebook members

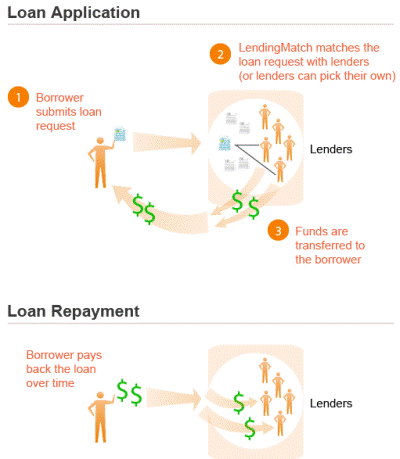

Today, Lendingclub.com launched offering a p2p lending service to Facebook members. Members can request loans between $1000 and $25000. Other facebook members can the lend the money to the borrower. While technically not arranging loans between freinds like CircleLending, Lendingclub makes uses of the social network and the trust that users have into it. Lendingclub combines aspects from other p2p lending sites like Prosper.com and Zopa.com.

Comparing it to Prosper:

- Lendingclub requires higher credit score as threshold for borrowers to apply (640 compared to Prosper’s 520)

- Lendingclub suggests an interest rate based on the borrowers credit grade rather than letting the borrower set an interest rate.

- There are groups like at Prosper

Lendingclub uses what it calls “LendingMatch” to automatically match parties on shared connection it finds. Lenders can additionally manually select and search loans.

The founders of Lendingclub, one of them has a background at Mastercard, raised $2 million in angel funding (source: VentureBeat).

Using an existing social network gives Lendingclub a great marketing advantage over competitor Prosper.com, which had to build its memberbase starting from zero.

Virgin USA acquires CircleLending

Virgin USA has bought CircleLending.com. Unlike Prosper.com CircleLending handels p2p lending between people that knew each other before the transaction, e.g. friends or relatives. Its purpose is to help structuring and managing private loans. Terms of the transaction were not disclosed.

Prosper sees federal license as long term goal

Following up on my previous post there now is a statement by Andrew, an employee of Prosper stating:

Our long-term goal, however, is to get a federal lending license. It will solve a lot of problems for us (state rate caps, primarily), but is simply harder to get. Nonetheless, it is something that we are pursuing aggressively. As with just about everything else we do, unfortunately, I cannot give you a specific date. Please understand that it is a huge priority for our business, and we are ushering the process as quickly as we can (unfortunately, it's more a process of waiting on regulators than us actually doing things proactively).

Prosper riding the state-by-state roller coaster

Most changes and discussion around Prosper.com in May related to the impact of the changes Prosper did to the State Lending Limits on May 1st. While Prosper lending is nearly nationally available (46 of 50 stats) it is regulated based on state laws. Since the launch of Prosper several parameters differ depending on the state the borrower is living in:

- Maximum interest rate: In states without severe restrictions borrowers can offer up to 30 percent interest rate. Other states are capped to much lower rates (e.g. Pennsylvania allows 6% maximum)

- Maximum loan amount. Prosper usually allows borrowing up to $25000. In some states lower amount maximums are imposed (e.g. Vermont – $4000).

- You might not believe it but even the minimum loan amount is regulated in some states. In Georgia loans through Prosper must have amounts of at least $3001. Borrowers can deal with this, by borrowing the minimum and directly repaying the unneeded surplus.

- Further differences existregarding Late Fees and Failed payment fees

While most users were unsatisfied they had over time accustomed themselves fairly to the situation. Main impact was that in states with low rate caps nearly no loans were founded.

This by state table shows the concentration of funded loans on few states like California, Georgia and Texas while other populous states like Pennsylvania, Tennessee, Ohio und Kentucky saw only a handful of successful loans.

But progress was made. Prosper succeeded in gaining licences for states, allowing higher maximum interest rates in these states.

On May 1st Prosper conducted many changes. For the first time maximum interest rates sank in some states, e.g. in Texas from previously 30 percent to 10 percent. In other states loans for personal purposes are no longer available. Changes apply to all new listings.

The rules got more complicated, since for some states:

- different rules for private and business loans were introduced

- maximum loan rates are different depending on loan amount

- APR is used to determine maximum interest rate, while in other states nominal interest rate is used.

Prosper did not disclose the reasons that led to these changes but explained:

All of the changes being made to our rate and loan amount limits are being made by Prosper on our own accord and are not being mandated by any state or federal regulatory authority. Prosper, like any other state-based lender, must make its own legal analysis and determination as to how various state regulations should be (or will be) interpreted, and establish state-by-state rate and loan amount limits accordingly.

Many users found the changes unsatisfactory. Group leaders that concentrated on impacted states complained that prosper made their business impossible. There were discussions how a business loan is defined and how Prosper will validate if the loan is used for business purposes. (Answer: If the borrower has written in his listing that the loan is for business purposes then it is, there is no validation). There was even speculation, if Prosper knowingly violated Texas state law.

A small number of lenders rallies for lobbying to influence state legislation. Others argue Prosper should obtain a  national licence based on federal law.

Zopa has announced it will launch national in the US.

Whether caused by this changes, the high default rates or other reasons: the growth of the count of recentlöy active lenders did slack in the last weeks. While new lenders enter the chart indicates, that numerous lenders stopped reinvesting and are withdrawing.