Rob Garcia, Director Web Production of Lendingclub, told P2P-Banking.com that Lendingclub will offer data export soon. The data on loans will be supplied in XML or Excel format and allow anybody to do their own statistical analysis. Lendingclub will announce the availability of the data export in it's blog.

US

Quarrel over the content of the Wikipedia article on Prosper

The Wikipedia article on Prosper was for months subject to heated editing and deleting. Not much diplomacy. Some edits wanted to get as much criticism in as possible while others removed as much negative tone as possible to get it more neutral. Currently the article is locked.

See the discussion on what should be stated in the article in the future when it will be unlocked again.

Prosper starts blog

With several posts by CEO Chris Larsen Prosper.com starts blogging.

Welcome to the new Prosper Blog.

We’ll be using this blog to create a place to find up-to-the-minute news on the latest Prosper enhancements, enlightening and thoughtful Personal Finance opinions, touching Prosper Member Stories, and more. Your contributions are welcome. Please feel free to submit comments to any of the blog posts or send new articles and ideas to us at blog @ prosper.com (please remove spaces before using this email address) or submit a guest post.

We’ll be adding in posts regularly, so please stop back in again soon.

Warmly,

Prosper

The blog has been in preparation for some time. I believe we can look forward to some interesting articles by Prosper staff, borrowers, lenders and other guest writers.

First impressions of the Zopa US site

I explored the new Zopa US site today. While the layout resembles the UK site the process is totally different.

Borrower's view

Use as a borrower is pretty straightforward. First sign up and then request an online quote.

After several seconds waiting the borrower is presented with the interest rate for his loan request.

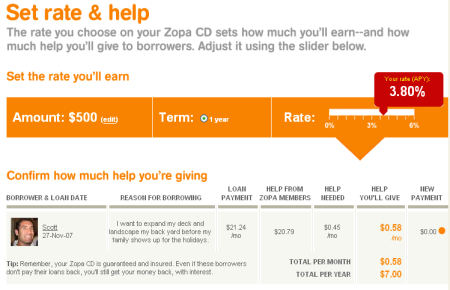

Lender's view

For a lender things are a little more complicated. After deciding how much is to be invested, the lender must choose at least one borrower.

Using a sliding marker the lender then can select his desired interest rate (max. 5.1%). The lower the interest rate the more "help" the borrower gets on his loan.

Today already more then 310 users signed up at Zopa. When logged in, it is possible to browse other member's profiles. A profile can contain photos, long descriptions and integrate an (external) blog. An interesting example is Scott's profile, containing some informations on the history of Zopa US.

Over at thebankwatch Colin is wondering if the US model of Zopa will provoke interest.

What do you think of Zopa US? Post your impressions and experiences and discuss them with other users.

Lending experiences at Lending Club

In a post at PersonalLoanPortfolio the first experiences of a lender at Lendingclub.com are given. The author says the Lendingclub website was easy to use and understand, but states that the list of loans to fund is too small, resulting in him investing only $400 instead of the planned $500.

If you are a lender at Lendingclub please share your experiences.

Zopa US launch next week

According to the Wall Street Journal p2p lending service Zopa will launch in the US next week. Zopa has been established in the UK since 2005. The long announced US start had been postponed several times due to regulation issues.

In the US Zopa will partner with six credit unions. Lenders will benefit since they can be sure to get their principal back – deposits are insured up to $100,000 per member. This is new for p2p lending, where lenders usually carry the default risk (only Dutch p2p lending service Boober.nl guarantees for certain credit grades the bulk of the pricipal via insurance against default.

According to the WSJ article neither lenders nor borrowers will have to pay fees to use Zopa but have to sign up with one of the six participating credit unions.

An article on Netbanker.com already spoke of congestion, since Globefunder and Loanio will launch at a later stage and Prosper, Lending Club and Virgin Money are active in the market.

What's your opinion on this? Post your thoughts in the wiseclerk forum!