US

What changed on Prosper?

Following up on my last post here are the largest operational changes at the new Prosper.com:

Following up on my last post here are the largest operational changes at the new Prosper.com:

- Minimum credit score requirement is now 640 (up from 520)

- Prosper calculates expected defaults (‘loss rate’) now by using the two factors: the credit score obtained by an external agency and the internal Prosper score (in the past the fore-casted value was based only on external data and way to low)

- There is a hard bid floor (a minimum interest rate set by Prosper) on each loan listing

‘The bid floor is the minimum yield a lender can bid on a listing. It’s not possible to bid any lower. This also affects the minimum rate a borrower can possibly receive.The bid floor for each listing is calculated by adding the national average 3yr CD rate to the minimum estimated loss rate assigned to each Prosper Rating. For example, a B-rated listing with a minimum estimated loss rate of 4.0% is added to a national average CD rate of 2.27%*, resulting in a bid floor of 6.27%.‘ - Minimum bid amount is now 25 US$, instead of 50 US$

- There are several legal changes affecting lenders (e.g. ‘In the unlikely event that we receive payments on the corresponding borrower loans relating to your Notes after the final maturity date, you will not receive payments on your Notes after maturity.‘ – this seems to mean that, if a late borrower who paid more than a year after the date the loan was supposed to be paid back in full, the lender is not credited that amount – but check yourself I might be misinterpreting the meaning)

New Lenders should read the SEC prospectus. Some disclosures might make them wary. Quotes:

- You assume the risk that information provided by borrowers may be intentionally false.

- Status information given on loans between inception and March 31, 2009 shows 31.3% of loans had been at least 15 days late at least once, and 20.1% had defaulted.

- The fact that Prosper will have the exclusive right and ability to investigate claims of identity theft in the origination of loans creates a significant conflict of interest between Prosper and the lender members

That might we necessary legal disclaimers – but if Prosper performs in future like in the past, the risk for lenders will be high and by the prospectus Prosper will exclude liability for all risks spelled out.

I read that Prosper makes all lenders re-sign 6 new legal agreements.

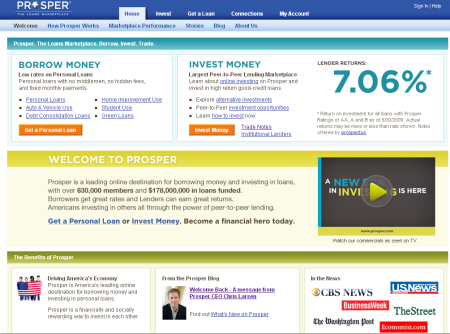

Prosper Reopens with SEC Approval – Starts Secondary Market

Prosper.com has reopened – now with the long sought approval of the SEC which was granted last Friday. In his blog statement “We mean it this time!” CEO Chris Larsen sheds light on what was delaying SEC approval. It was auction bidding on loan requests:

Prosper.com has reopened – now with the long sought approval of the SEC which was granted last Friday. In his blog statement “We mean it this time!” CEO Chris Larsen sheds light on what was delaying SEC approval. It was auction bidding on loan requests:

… the first Internet auction-based P2P loans marketplace and trading platform to have its SEC registration declared effective, which means the SEC is permitting Prosper to facilitate auctions in a way that has never been done before.

Selling securities by auction is not new and critical to greater efficiency in fair price discovery for both sides of the transaction. However, the SEC has never permitted Wall Street investment banks or any other institution to run a true auction where investors could make an irrevocable bid that committed funds prior to the establishment of a final rate….

Prosper introduces a secondary market. The internet auction priced trading platform for Prosper Notes is operated by FolioFN (like Lending Club’s Note Trading platform). Only loans (‘notes’) issued after July 13th can be traded.

At the moment lenders from California, Colorado, Delaware, Georgia, Illinois, Minnesota, Montana, Nevada, New York, South Carolina, South Dakota, Utah, Wisconsin and Wyoming can use Prosper, if they fulfill state set financial suitability requirements. Prosper is open to borrowers from almost all states.

With the PR Prosper will likely build up a large selection of loan listings again fast (as of now there are 10). The interesting question will be if Prosper lenders will continue to have faith investing via Prosper after extremely high default rates and low collection results in the past. Furthermore disappointed (former) long term lenders are critisizing risks for lenders embedded in the latest SEC filing.

With the likely press coverage of the relaunch all p2p lending companies in the US can expect to see a rise in traffic.

P2P Lending Service People Capital Gets More Funding

People Capital, a p2p lending service for college students to obtain student loans via an online lending exchange, announced that it has closed a 500,000 US$ round of Series B funding. The Serious Change fund, helmed by investor Josh Mailman, led the round of financing. People Capital will use the funding to accelerate technological development of its peer-to-peer lending platform which will offer a unique solution for students to finance their college educations. This platform is poised to provide funding for students in the fall 2009-10 academic year. “We are delighted to welcome Serious Change as our new financial partner,†said Tom Shelton, CEO of People Capital. “With this financial commitment, we will continue to develop our proprietary lending technology which, when launched, will help students receive more favorable private student loans for high education needs.†“Although peer-to-peer lending technology is not new, we had been looking for a company that could bring the technology to the next level, one that offers a responsible alternative to students wishing to take out loans for college,†said Josh Mailman, head of Serious Change. “After extensive research, seeing the technology in action, and meeting company executives in person, we became convinced that People Capital presents by far the most exciting opportunity of companies in the peer-to-peer lending space.

(Source: press release)

Peer to Peer Lending Jobs

Today I have added the new ‘Peer to Peer Lending Jobs‘ section and started it with listing the current 4 positions startup Loanio wants to fill in Nanuet, NY.

As P2P Lending is a very new and emerging field there are very few experts who have gathered previous practical experience in this field and these are highly sought after. One example is Arkadiusz Hajduk, who founded Fairrates in Denmark, then worked for IOU Central in Canada and now works at Smava.pl in Poland. Continue reading

Kiva Enacts Currency Risk Changes

Kiva has now enacted changes in how currency risks are accounted for. The model was first proposed in March.

Kiva has now enacted changes in how currency risks are accounted for. The model was first proposed in March.

Now MFIs can choose “currency risk protection” for their new loans. If this option is selected lenders will have to cover any losses that arise from a devaluation of the local currency exceeding 20% (for the part that is over the 20%).

On listed loans at Kiva there will be a new information status on the “about the Loan” Section under “Currency Exchange Loss”. The status will either be:

- “Covered”: Meaning the MFI covers any losses (like it has been in the past)

- “Possible”: The MFI has opted for the new rule – the lender covers currency losses above 20%

I browsed some new loan listings today – most are still offered under the “covered” rule, one example of a loan under the new “possible” rule is this Tajikistan loan. Continue reading