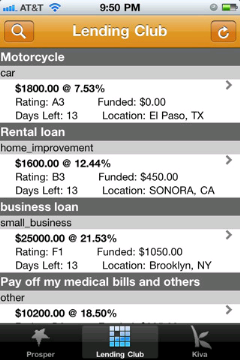

I just saw the first iPhone App that is to support lenders in using p2p lending services. It aims to help them keeping up to date with the latest listings at Prosper, Lending Club and Kiva.

I just saw the first iPhone App that is to support lenders in using p2p lending services. It aims to help them keeping up to date with the latest listings at Prosper, Lending Club and Kiva.

The features of this app are rather basic, but with the number of people lending at p2p services there could be a market for a sophisticated app that really helps lenders select loans while on the move.

Update: There are in fact two other free apps to browse Kiva loan listings.

P2P Lending site

P2P Lending site