![]() Prosper raises a 70 million US$ funding round led by Francisco Partners. The additional funding will be used for growth and expansion plans. David Golob from Francisco Partners, global private equity firm which focuses on information technology, will join the Prosper Marketplace Board of Directors. The funding round also includes investments from Institutional Venture Partners (IVP), one of the premier later-stage venture capital and growth equity firms, as well as Phenomen Ventures. Continue reading

Prosper raises a 70 million US$ funding round led by Francisco Partners. The additional funding will be used for growth and expansion plans. David Golob from Francisco Partners, global private equity firm which focuses on information technology, will join the Prosper Marketplace Board of Directors. The funding round also includes investments from Institutional Venture Partners (IVP), one of the premier later-stage venture capital and growth equity firms, as well as Phenomen Ventures. Continue reading

US

International P2P Lending Services – Loan Volumes April 2014

Prosper had a very good April. In UK especially the platforms for property secured lending grew their volume compared to last month. I added two new services to the table. I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

Table: P2P Lending Volumes in April 2014. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.

Lending Club Buys Springstone Financial

![]() Lending Club announced today that it has acquired Springstone Financial for a total consideration of 140 million US$ in cash and stock. Springstone provides financing options for consumers looking to finance private education and elective medical procedures through a network of over 14,000 schools and healthcare providers.

Lending Club announced today that it has acquired Springstone Financial for a total consideration of 140 million US$ in cash and stock. Springstone provides financing options for consumers looking to finance private education and elective medical procedures through a network of over 14,000 schools and healthcare providers.

“The acquisition of Springstone is significantly expanding the services we offer to help consumers achieve their goals,” said Lending Club CEO Renaud Laplanche. “Parents looking to finance their children’s education and patients undergoing elective procedures will now have access to Lending Club loans and benefit from responsible, transparent and affordable financing options.”

Mike Gilroy, CEO of Springstone, said, “Lending Club has established a great reputation as an innovator. We’ve built strong bridges between providers and patients and between educational institutions and parents. We’re excited to become part of the Lending Club platform, which will bring new financing options to our network.”

As part of the financing of this transaction, Lending Club also announced the closing of an equity capital raise. Investors in the $65 million round included funds and accounts managed by T. Rowe Price Associates, Inc., Wellington Management Company, LLP, BlackRock and Sands Capital. According to Peter Renton the valuation of Lending Club at this round is at 3.76 million US$.

“We believe that Lending Club has an opportunity to transform an important part of the banking system into a transparent online marketplace,” said Henry Ellenbogen, Portfolio Manager at T. Rowe Price Associates, Inc. “The Springstone acquisition is another step in that direction, and we are very excited at the prospect of being a long term equity partner of Lending Club.”

Lending Club also raised $50 million in debt financing to fund the acquisition.

(Source: Press release)

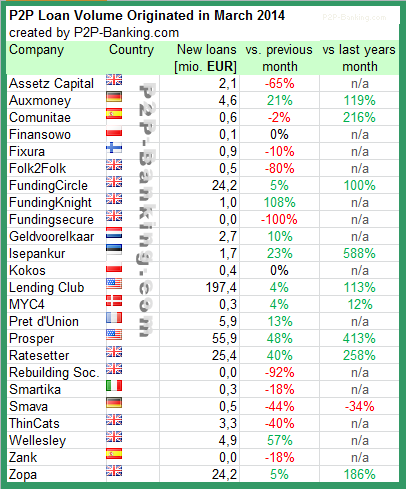

International P2P Lending Services – Loan Volumes March 2014 – Round Figures Crossed

March brought growth for the major p2p lending services. Ratesetter managed to pass Zopa and Funding Circle in newly originated loan volume in the UK. I added one new service to the table. Note that I have switched the reporting currency to Euro as all but two services are located in Europe. Several p2p lending services reached major figures for total loan volume funded since inception:

- Zopa crossed 500 million GBP yesterday

- Funding Circle crossed 250 million GBP in loans

- Ratesetter reached 200 million GBP in loans

- Prosper is approaching 1 billion US$ in loans and will celebrate that with a giveaway

- Lending Club has crossed 4 billion US$ in loans

I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

Table: P2P Lending Volumes in March 2014. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.

Peter Renton Starts Fund

Peter Renton, well known blogger at Lendacademy and founder of the Lendit Conference starts a fund (Lend Academy Investments LLC) that will invest in p2p loans at Prosper, Lending Club and Funding Circle. Co-founders are Jason Jones, a former hedge-fund manager, and Bo Brustkern, a valuation expert. The fund will raise 28 million US$ this year and aims to raise 100 million US$ from investors by the end of 2015.

(Source Bloomberg & other)

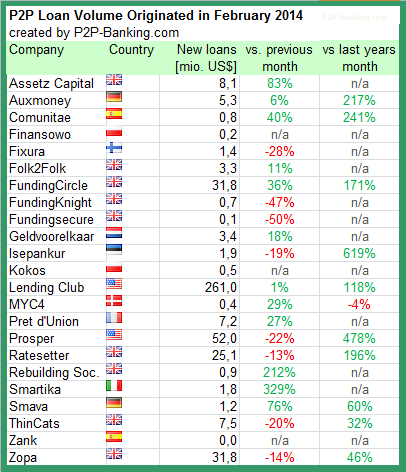

International P2P Lending Services – Loan Volumes February 2014

Even though February was a short month, several p2p lending services topped their January loan volume. Even more impressive is the continued year on year growth. 3 more services were added to the table. I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

Table: P2P Lending Volumes in February 2014. Source: own research

Note that volumes have been converted from local currency to US$ for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.