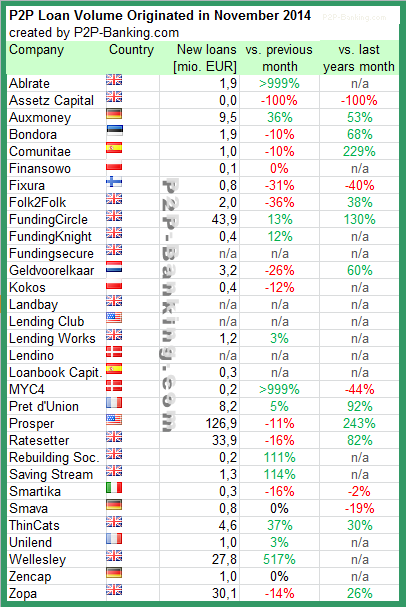

November was a month of mixed results for the listed p2p lending services. Some grew, some had a small decline in newly originated loan volume this month. Ratesetter crossed a total volume of 400 million GBP originated since inception. Ablrate profited from the deal with the first institutional investor, which boosted volume. I added one more service. I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

Table: P2P Lending Volumes in November 2014. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.