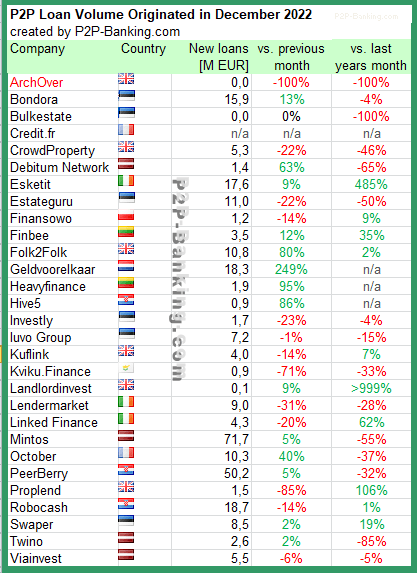

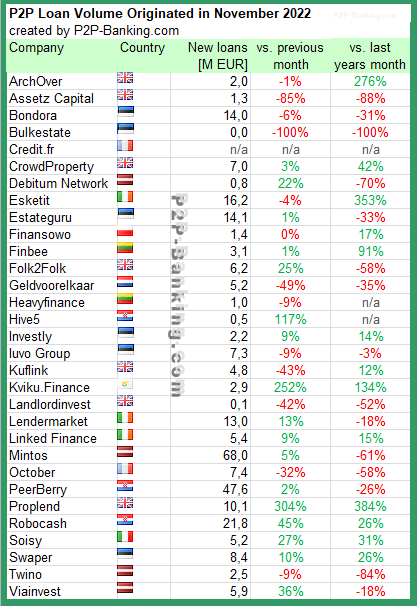

The table lists the loan originations of p2p lending marketplaces for last month. Mintos* leads ahead of Peerberry* and Bondora*. The total volume for the reported companies in the table adds up to 337 million Euro. I track the development of p2p lending volumes for many markets. Since I already have most of the data on file, I can publish statistics on the monthly loan originations for selected p2p lending platforms.

Investors living in national markets with no or limited selection of local p2p lending services can check this list of international investing on p2p lending services. Investors can also explore how to make use of current p2p lending cashback offers available. UK investors can compare IFISA rates.

Table: P2P Lending Volumes in March 2023. Source: own research

Note that volumes have been converted from local currency to Euro for the purpose of comparison. Some figures are estimates/approximations.

Links to the platforms listed in the table: Bondora*, Bulkestate*, Crowdproperty*, Debitum Network*, Esketit*, Estateguru*, Finansowo*, Finbee*, Folk2Folk*, Geldvoorelkaar*, Heavyfinance*, Investly*, Iuvo Group*, Kuflink*, Kviku.Finance*, Landlordinvest*, Lendermarket*, Mintos*, October*, Peerberry*, Proplend*, Robocash*, Swaper*, Twino*, Viainvest*.

Notice to p2p lending services not listed: Continue reading