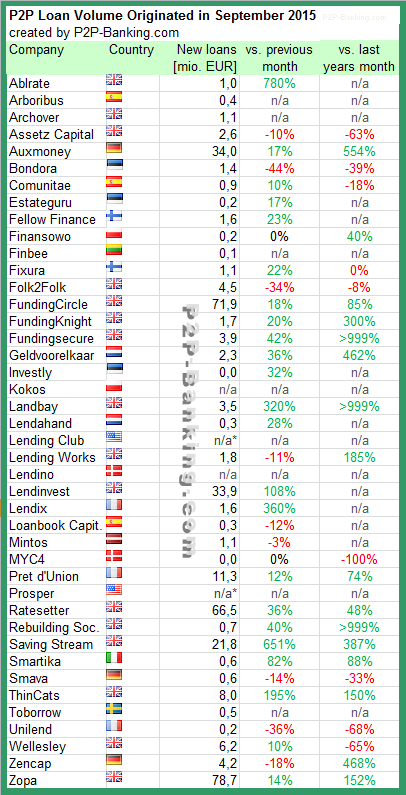

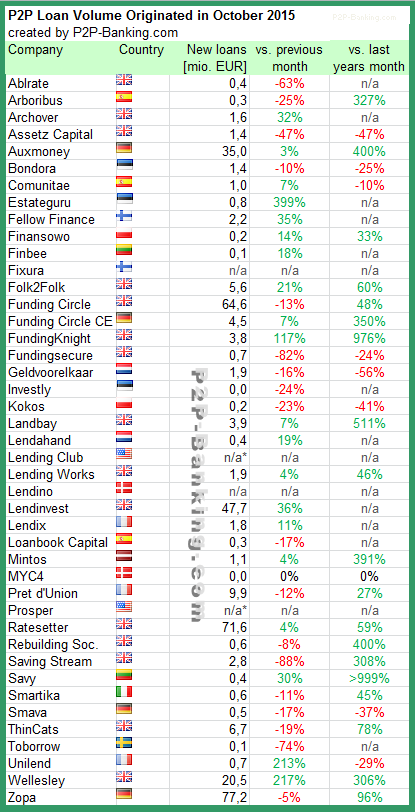

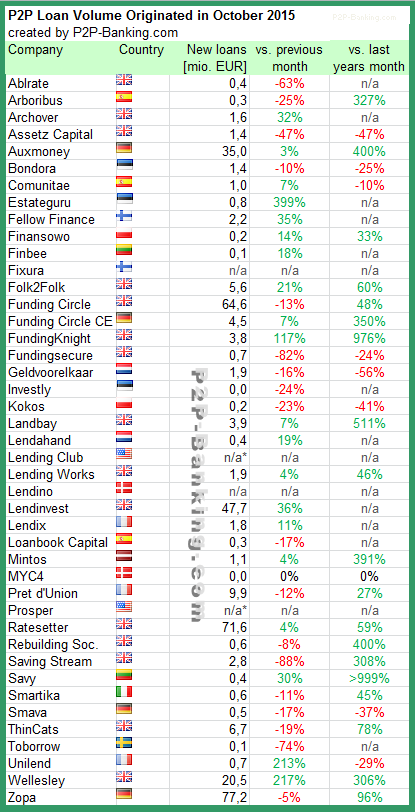

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

The big news at LendIt conference this week in London was that Funding Circle announced the acquisition of German marketplace Zencap. Zencap launched in March 2014 and facilitated SME loans in Germany, the Netherlands and Spain. Working with local teams, the IT infrastructure is run from the headquarter in Berlin.

Samir Desai announcing the acquisition

Zencap has originated more than 35M EUR loans since launch with a monthly volume of 4-5M in the last months. The vast majority of this volume was generated in German loans.

With the acquisition Zencap will become Funding Circle Central Europe and the founders Matthias Knecht and Christian Grobe will head this division. Knecht confirmed that Funding Circle paid in stock through a stock swap. All existing investors stayed onboard. No details on the valuation were publicly available. Knecht said at Lendit that talks between Funding Circle and Zencap started as early as Lendit 2014.

Allegedly Zencap has been trying to raise a new round since May 2015 but struggeled. A source from the VC scene told me that he thinks, that Rocket Internet – the backer of Zencap – might have concluded, that it is more important to prove that Rocket Internet is able to deliver successful exits rather than close another round which might not meet high expectations of onlookers.

What does the deal mean for Funding Circle?

I feel that Funding Circle essentially invests in the future outlook. The current volumes of Zencap are solid but not spectacular. So essentially the deal enables Funding Circle to jump from serving two markets to five markets (even though NL and ES are very small so far) without starting from scratch. They also get local teams that are familiar with the markets and their circumstances.

For Funding Circle Central Europe it means easy access to a large base of institutional investors that are already familiar with the Funding Circle brand and can now diversify into SME loan markets in continental Europe.

When I look at the platforms in continental Europe, Zencap is the obvious choice as acquisition target. It is the only platform with a SME loan model very similar to Funding Circle that already operated in multiple markets.

Knecht said at Lendit that he is looking at Italy and France as markets that look interesting for a further expansion.

What does the deal mean for retail investors?

Unlike on other marketplaces there will be no cross-border lending for retail investors on Funding Circle. Both Samir and Knecht explain that the mid-term outlook for this is that retail investors will be able to invest into loans in multiple geographies via a coming fund.

The German platform receives some critic from retail investors, which complain that it is less than perfect and reporting and processes need to improve. This got me wondering for a short while whether the British platform would be used to replace the IT for the continental European markets too. However when I asked Knecht at the conference, he said that there are no plans for that, and that Funding Circle would continue to run seperate IT platforms. Continue reading

LendIt Europe conference in London, where I have been the last three days, was a special highlight for me. The expertise and knowledge level of the attendees as well as the quality of the presentations is outstanding. The number of attendees jumped from from about 450 last year to more than 750 this year. And it was a chance for me to chat with representatives of many European p2p lending marketplaces.

Biggest news

Peter Renton opening Lendit Europe conference (Source: Lendit Europe; photo used with permission)

Major trends

There are so many things evolving and it is sometimes hard to see which are the most relevant ones. And it certainly is a question of perspective. But from my view the three biggest developments are

1. Institutional investors will increasingly dominate the investor side

There is quite a consensus among most of the p2p lending marketplaces that institutional capital is very important for growing and scaling the marketplaces. While marketplaces value a mix of capital sources and many of them feel an obligation to retail lenders, which allowed the industry to create itself, the volume will be increasingly dominated by institutional investors. One way some platform see as a route to cater for a broader base of retail investors is to create funds that allow retail investor to buy into this asset class through traditional distribution channels. Still those platforms that are open to both kinds of investors pledge to guarantee equal access and not allow institutional lenders preferential access.

The ‘Up and coming European platforms’ panel I moderated with panelists from Investly, Lendix, Mintos, Zencap and Fellow Finance (Source: Lendit Europe; photo used with permission)

2. Continued expansion in additional geographies

The headline news with the merger of Funding Circle and Zencap fits into the bigger picture as many platforms are moving beyond there national market. Examples include:

On the other hand Aaron Vermut, CEO of Prosper, said at the dinner event ‘Global trends in consumer lending’ (thanks again for the invitation to that -it was very interesting) that Prosper has no plans to expand into other geographies, as that would distract Prosper too much and all activities are focused on the US market which offers a huge potential for further enormous growth.

3. The UK market offers a perfect environment for p2p lending companies

The UK market is a market were all puzzle pieces are falling into place and offer p2p lending marketplaces (and other alternative finance companies) an environment that has no parallels in any other country

Given these preconditions analyst Cormac Leech is predicting that alternative finance companies might take away as much as 20-30% of bank’s consumer lending activity and more than 40% of banks SME lending activity over the next 10 years. Banks are still looking to find out what an appropriate startegy is to respond to that, and according to Matt Hammerstein of Barclay they’ll need to execute the strategy fast, once they defined it.

The debate on how this asset class will fare in the next recession is still ongoing. Continue reading

There is an article in a German startup news magazine speculating that Funding Circle might have bought German p2p lending marketplace for SME loans Zencap from Rocket Internet or is in the process of doing so. The article does not provide any evidence but cites unnamed entrepreneural sources.

I reached out to both Funding Circle and Zencap for comment today but have not heard back yet. EDIT: I received a reply from Zencap that they do not comment on rumours/speculations.

I also checked the filing history of the commercial register and there have been no telltale filings on the Zencap file in the past months, therefore I doubt a sale has been completed. But it still is a possibility because it likely would take some time for the filing to appear.

While I don’t have any hard facts either, I think the scenario has some plausibility. In emails I exchanged with a Zencap founder in the past months, there have been hints about upcoming major developments (without any specifics) at Zencap. Also it would match the intentions of Funding Circle to move into continental Europe. Continue reading

![]() This week UK p2p lending marketplace Ratesetter celebrates its 5th anniversary. When Ratesetter launched in 2010 it introduced the concept of a Provision Fund to p2p lending – an idea that has been adopted by several UK marketplaces since. The Provision Fund now stands at over £16m, the largest in the industry, and has ensured that so far no individual investor has ever lost a penny.

This week UK p2p lending marketplace Ratesetter celebrates its 5th anniversary. When Ratesetter launched in 2010 it introduced the concept of a Provision Fund to p2p lending – an idea that has been adopted by several UK marketplaces since. The Provision Fund now stands at over £16m, the largest in the industry, and has ensured that so far no individual investor has ever lost a penny.

Since 2010, the fast-growing platform has delivered 815M GBP in loans to individuals, businesses and sole traders and expects to lend 500M GBP this year. While most loans are used to buy a car (28%), to pay off more expensive credit card balances (18%) and for home improvements (17%), RateSetter’s 160,000 loans have funded things as diverse as a mobile pizza kitchen that operates from the back of a Land Rover, a didgeridoo and a wind turbine.

Over 26,000 people currently invest with RateSetter, a number that is growing. In total, investors have earned 25M GBP in interest by using the platform. Continue reading