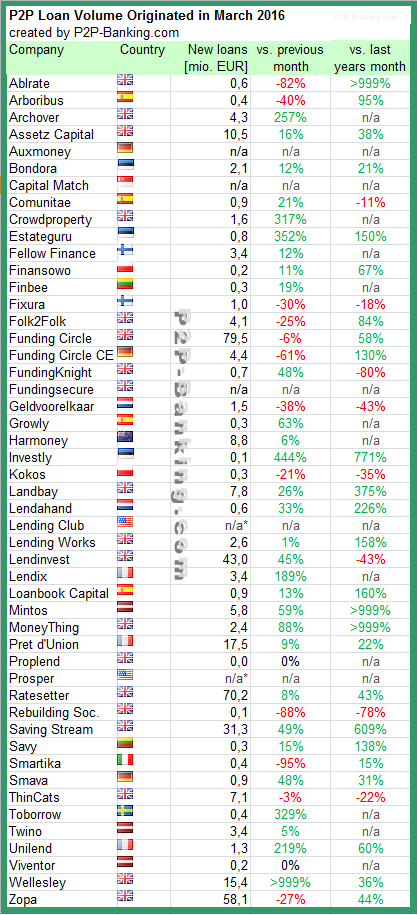

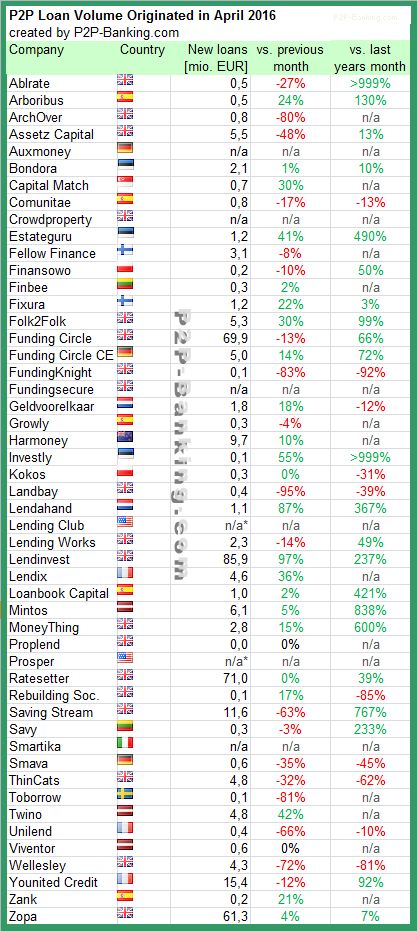

With everybody focussing on the larger p2p lending merketplaces, I think another current development in the space in the UK is happening without much attention. Looking at the numbers each months while the larger players go from strength to strength, some of the smaller marketplaces are in stagnation or even in decline in terms of volume.

Even with numbers fluctating monthly, it can’t be healthly to originate a few 100K each month over years whereas the total sector is doubling each year. Marketplaces have to pay employees, infrastructure and maintain and improve their technology. Add hefty marketing costs on top of that.

The struggeling ones are failing to attract enough new borrowers.

From an investor’s viewpoint there is little incentive to add funds on platforms that are not delivering much dealflow. Selection is superior on other marketplaces and even considering the advantages of diversification across platforms there are now so many choices that investors dedicate their largest amounts on probably not more than 3 to 6 different marketplaces. So every platform needs to compete to at least stay in the top 10 of attractiveness in its sub-category (e.g. consumer, property, SME, …).

So what happens to these platforms? Outright announced closures are rare (remember Squirrl?). With a lot of capital, time and effort spent, the management often hopes for a turn to the better, may it come in form of a new investor, opening up of a new sales channel or an exit/trade sale. Furthermore with an existing loanbook running, there isn’t any easy time to close down operations as the platform will usually have to continue to service the loans for the full remaining loan term. Continue reading

A borrower your software identifies as creditworthy has been previously ruled out by the scoring mechanism of the marketplaces. How would the marketplace deal with this loan when showing a credit grade/score class for this loan to investors? Assign a new class?

A borrower your software identifies as creditworthy has been previously ruled out by the scoring mechanism of the marketplaces. How would the marketplace deal with this loan when showing a credit grade/score class for this loan to investors? Assign a new class?