P2P microfinance service Milaap.org reports the milestone of 10 million indian rupees (approx 190,000 US$) lent in 18 months with a repayment rate of 100% so far. Good news right in time for Christmas!

India

My First Unitedprosperity Loan Guarantee

I just guaranteed $25 of a loan to Sakho Devi and group, Ritudih, India via Unitedprosperity.org. United Prosperity has launched on May 28th. See my earlier United Prosperity review including an interview with CEO Bhalchander Vishwanath for more information on the concept.

I just guaranteed $25 of a loan to Sakho Devi and group, Ritudih, India via Unitedprosperity.org. United Prosperity has launched on May 28th. See my earlier United Prosperity review including an interview with CEO Bhalchander Vishwanath for more information on the concept.

Signing up and selecting the loan went smoothly. For the requested loan of 1,052 US$ a guarantee of 579 US$ needs to be raised.

Sakho Devi has a grocery shop of her own, with which she earns her living. She has applied for a microloan to expand her small grocery shop, so that she can meet the demand from customers.

The listing also states some data about the partner MFI – Ajiwika Society – it’s interest rate, delinquency rate, default rate and target clients.

Unitedprosperity.org – guarantee a microloan to small entrepreneur in India

Californian non-profit United Prosperity developed a new twist to social lending – it is a peer to peer guarantee website. Instead of lending money directly and thus needing to transfer it internationally the “social guarantor” provides a cash collateral. This enables the small entrepreneur in the developing country to get a loan from a local bank, which he otherwise would be unable to obtain.

Californian non-profit United Prosperity developed a new twist to social lending – it is a peer to peer guarantee website. Instead of lending money directly and thus needing to transfer it internationally the “social guarantor” provides a cash collateral. This enables the small entrepreneur in the developing country to get a loan from a local bank, which he otherwise would be unable to obtain.

Bhalchander Vishwanath, founder and CEO of United Prosperity answered my questions on the new service.

P2P-Banking.com: What makes the guarantee model better then other lending models (e.g. Kiva or MyC4)?

Bhalchander Vishwanath:

- Maximum impact: Due to United Prosperity’s innovative guarantee model which involves risk sharing with the bank, $1 in guarantee by the social guarantor could lead to $2 to $5 in loan to the borrower thus maximizing their dollar’s impact.

- Local linkages: Our guarantee facilitates the creation of local linkages between domestic banks, MFIs and poor entrepreneurs. In the course of repaying the loan, both the entrepreneur and the MFIs develop credit histories that will enable them to access more funds at a later date with a lower guarantee percentage, or even without a guarantee. MFIs also get to form relationships with banks and offer other products like savings, insurance, money transfer etc. through the bank.

- No foreign exchange risk: Since the loans from Bank to MFI and MFI to entrepreneur are in local currency, there is no foreign exchange risk involved. Most of the smaller MFIs do not have forex hedging capability and our model overcomes that.

- Reduced interest: Our guarantee reduces the interest the bank will charge the MFI since the bank’s risk is lower. Some of the interest benefits get passed on to the borrower.

- Scalability: There is enough money available in the developing countries. Our guarantee frees up those funds. It utilizes capital available effectively and in the long term it is a more scalable model.

- Manages risk better: We get the additional benefit of monitoring of the loan by the bank which is not available with other person to person models.

P2P-Banking.com: How does “$1 in guarantee by the social guarantor could lead to $2 to $5 in loans” work? What determines the applicable ratio?

Bhalchander Vishwanath: The ratio is dependent on several factors. These include the MFI’s or borrower’s prior credit history with the bank or other banks, various banks internal guidelines, their focus on lending to Microfinance institutions and so on. For example for a given MFI we have seen two different banks asking for different guarantee percentages.

P2P-Banking.com: Does the Guarantor earn any interest?

Bhalchander Vishwanath: Guarantors do not earn any interest on their guarantees for two reasons:

- It is legally complex.

- We see ourselves as a ‘social business’. Nobel Laureate Mohammad Yunus states that a social business is ‘designed to be both self-sustaining and to maximize social returns’. We have only one objective: to combat global poverty. As a result, we do not provide any financial returns or interest to our social guarantors and hope to attract social guarantors who share our objective.

P2P-Banking.com: Does the Guarantor actually have to pay money into an account, or does this only occur if the borrower fails to pay back the loan?

Bhalchander Vishwanath: The guarantee we offer to banks is a cash secured guarantee. Thus the guarantor has to pay the money upfront. Once the loan is paid back, the money can be withdrawn. Continue reading

RangDe – social lending in India

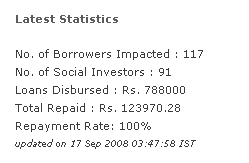

Indian non-profit RangDe.org attempts to bridge the gap between the developed and the developing India. To fight poverty it wants to make microcredit available to everyone at affordable rates. Individual lenders (investors) can lend as little as 1,000 Indian Rupees (approx. 21 US$).

Indian non-profit RangDe.org attempts to bridge the gap between the developed and the developing India. To fight poverty it wants to make microcredit available to everyone at affordable rates. Individual lenders (investors) can lend as little as 1,000 Indian Rupees (approx. 21 US$).

Lenders can select a borrower by browsing profiles. RangDe’s field partners receive and disburse the loan to the borrower, which pays a fixed interest rate of 8.5%, of which the field partner receives 5% and the lender receives 3.5%. Lenders need an Indian bank account to participate.

Lenders can select a borrower by browsing profiles. RangDe’s field partners receive and disburse the loan to the borrower, which pays a fixed interest rate of 8.5%, of which the field partner receives 5% and the lender receives 3.5%. Lenders need an Indian bank account to participate.

According to their blog, RangDe evolved over the past 7 months and launched the current version of the website in August.

RangDe aims to finance itself by generating advertising revenues.

RangDe was financed by a 6,000 US$ investment of the founders along with a 33,000 US$ loan by a group of engineers. Additionally India’s ICICI Group’s Foundation for Inclusive Growth has agreed to pay for RangDe’s operations for a year. (Source: Microcapital.org)

Meanwhile Indian p2p lending startup dhanax, which was covered earlier (see: dhanax brings p2p lending to india). received funding from Morpheus Ventures. (Source: WatBlog)

DhanaX brings p2p lending to India

DhanaX.com introduces p2p lending to India. Lenders can loan to borrowers that a screened by an "agent". The agents typically are small microfinance organisations, rural technology centers or non goverment organizations. One current example is the SOS Family Strength Organisation of Dr. Hermann Gmeiner. Since there is no established credit rating system in India, agents will check the ability of the borrower to repay the loan looking at 40 parameters like borrowers income, stability, occupation.

DhanaX.com introduces p2p lending to India. Lenders can loan to borrowers that a screened by an "agent". The agents typically are small microfinance organisations, rural technology centers or non goverment organizations. One current example is the SOS Family Strength Organisation of Dr. Hermann Gmeiner. Since there is no established credit rating system in India, agents will check the ability of the borrower to repay the loan looking at 40 parameters like borrowers income, stability, occupation.

Some key facts on the dhanaX lending model:

- Lenders can either loan to a single borrower or diversify and fund multiple loans with small amounts

- Minimum investment for lenders is 1,000 Rs (approx 23 US$)

- Maximum investment per lender is 1 million Rs

- Borrower can borrow up to 20,000 Rs (approx. 460 US$)

- Fees: dhanaX charges lenders a 100 Rs sign up fee and 1.5% fee of the monthly repayments. Borrowers are charged 6.5% of the loan amount

- Only Indian nationals can lend, non-resident Indians can lend provided their bank account matches certain specifications

Siva Prasad Cotipalli and Prashant Mishra founded dhanaX using family and friends, prize money from a business plan competition and funds from an angel investor. They talk about the aspects of entrepreneurship in India in a "Making Of" video.

P2P lending Asia

Some news from p2p lending in Asian markets:

Chinese PPdai.com (see earlier coverage) says it has received a first round of funding from Essentia Private equity. The amount was not disclosed.

On February 27th, Zopa's managing director Giles Andrews mentioned in a webchat "I have also been spending time in Asia and hope that we will launch in 2 very significant markets there in 2008, one of which we may even announce shortly….".

In the webchat Giles Andrews also said regarding the US market: "@Tealer We also think that our "competitors" over there are illegal, and I don't want to go to jail!".

Furthermore Zopa said it plans to launch an (optional) capital guarantee product in the UK market.

See earlier coverage of P2P-Banking.com on the p2p lending markets in Corea, China, India or Japan.