As the end of 2008 approaches here is a look back on the highlights of peer to peer lending news in 2008:

- February: Gartner predicts that by 2010 social lending captures 10% market share; p2p lending in Poland takes off; IOUcentral launches in Canada – only to be suspended by regulator a week later

- April: Lendingclub enters quiet period for SEC registration; Cashare launches p2p lending service in Switzerland; Prosper goes national with 36 percent max. interest rate – partnering with WebBank; Zopa UK reshapes markets – concentrates on 36 and 60 months loan terms

- May: MyC4 has new interface and shifts currency risks to lenders

- August: Zopa UK launches young market; Maneo launches p2p lending services in Japan

- September: Kiva repayments are now immediately available for reinvestment; Zopa grows in Italy – has secondary market

- October: Loanio launches in the US; Friendsclear launches in France; Smava raises more venture capital; Zopa US closes; Veecus launces p2p microfinance; Lending club comes out of quiet period and introduces secondary market note trading platform; Prosper enters quiet period for SEC registration; Kiva wins grant; more than 685M US$ p2p lending volume; two funds will invest more than 2M Euro in Africa through MyC4

- November: 50 million US$ Kiva loans reached; Comunitae gets funding; SEC orders Prosper to cease and desist; Loanio suspends operations

- December: Class action lawsuit and other legal troubles challenge Prosper

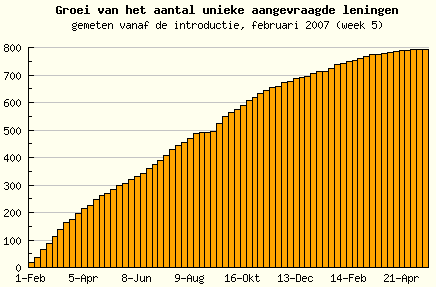

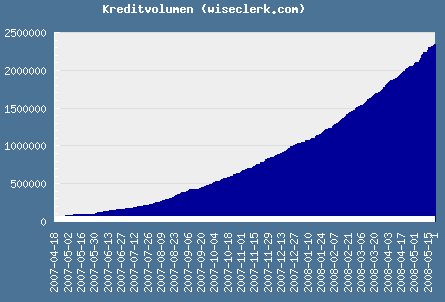

Smava.de

Smava.de