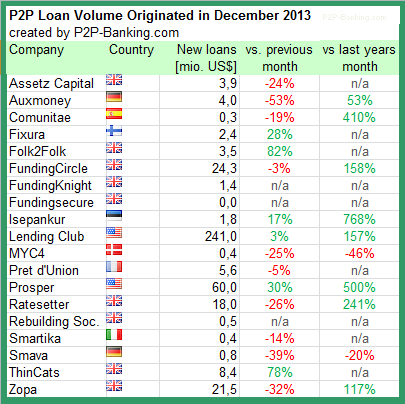

December was a month with mixed developments. While the US services and selected other services continued to grow, other services – especially the UK ones – had a slow month with decreasing volume. Of course this is influenced by the Christmas holidays. I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

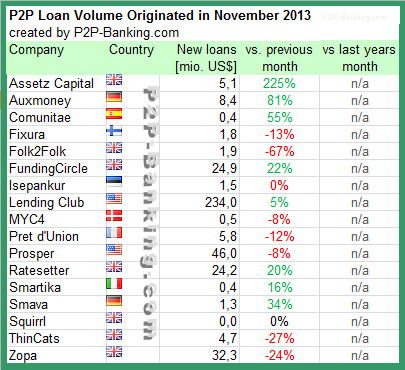

Table: P2P Lending Volumes in December 2013. Source: own research

Note that volumes have been converted from local currency to US$ for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.

This month I added 3 more UK services to the table and removed Squirrl, Continue reading