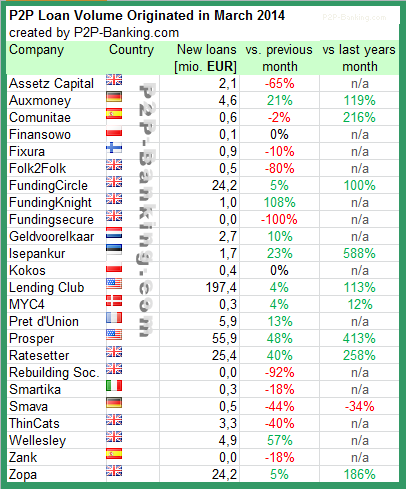

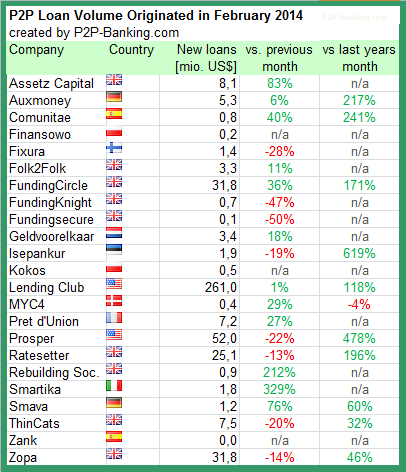

Prosper had a very good April. In UK especially the platforms for property secured lending grew their volume compared to last month. I added two new services to the table. I do monitor development of p2p lending figures for many markets. Since I already have most of the data on file I can publish statistics on the monthly loan originations for selected p2p lending services.

Table: P2P Lending Volumes in April 2014. Source: own research

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

Notice to p2p lending services not listed:

If you want to be included in this chart in future, please email the following figures on the first working day of a month: total loan volume originated since inception, loan volume originated in previous month, number of loans originated in previous month, average nominal interest rate of loans originated in previous month.