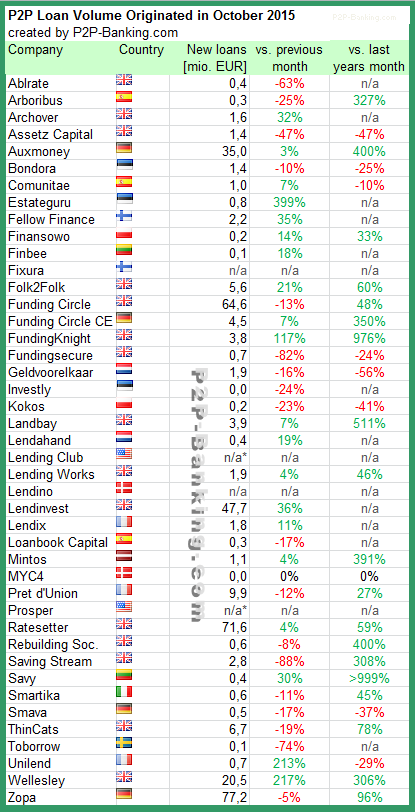

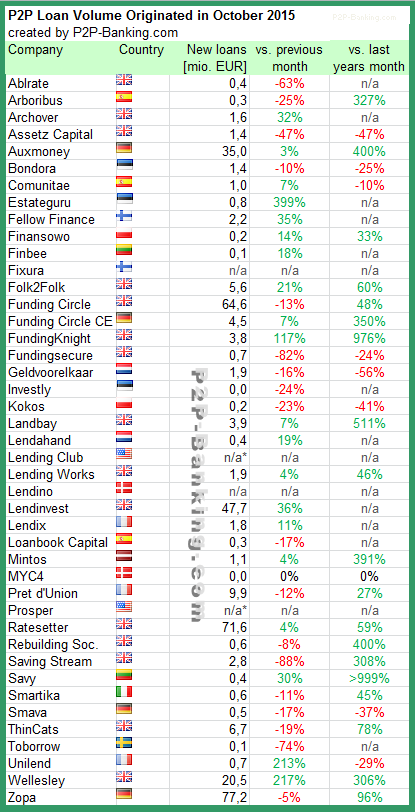

Note that volumes have been converted from local currency to Euro for the sake of comparison. Some figures are estimates/approximations.

*Prosper and Lending Club no longer publish origination data for the most recent month.

The big news at LendIt conference this week in London was that Funding Circle announced the acquisition of German marketplace Zencap. Zencap launched in March 2014 and facilitated SME loans in Germany, the Netherlands and Spain. Working with local teams, the IT infrastructure is run from the headquarter in Berlin.

Samir Desai announcing the acquisition

Zencap has originated more than 35M EUR loans since launch with a monthly volume of 4-5M in the last months. The vast majority of this volume was generated in German loans.

With the acquisition Zencap will become Funding Circle Central Europe and the founders Matthias Knecht and Christian Grobe will head this division. Knecht confirmed that Funding Circle paid in stock through a stock swap. All existing investors stayed onboard. No details on the valuation were publicly available. Knecht said at Lendit that talks between Funding Circle and Zencap started as early as Lendit 2014.

Allegedly Zencap has been trying to raise a new round since May 2015 but struggeled. A source from the VC scene told me that he thinks, that Rocket Internet – the backer of Zencap – might have concluded, that it is more important to prove that Rocket Internet is able to deliver successful exits rather than close another round which might not meet high expectations of onlookers.

What does the deal mean for Funding Circle?

I feel that Funding Circle essentially invests in the future outlook. The current volumes of Zencap are solid but not spectacular. So essentially the deal enables Funding Circle to jump from serving two markets to five markets (even though NL and ES are very small so far) without starting from scratch. They also get local teams that are familiar with the markets and their circumstances.

For Funding Circle Central Europe it means easy access to a large base of institutional investors that are already familiar with the Funding Circle brand and can now diversify into SME loan markets in continental Europe.

When I look at the platforms in continental Europe, Zencap is the obvious choice as acquisition target. It is the only platform with a SME loan model very similar to Funding Circle that already operated in multiple markets.

Knecht said at Lendit that he is looking at Italy and France as markets that look interesting for a further expansion.

What does the deal mean for retail investors?

Unlike on other marketplaces there will be no cross-border lending for retail investors on Funding Circle. Both Samir and Knecht explain that the mid-term outlook for this is that retail investors will be able to invest into loans in multiple geographies via a coming fund.

The German platform receives some critic from retail investors, which complain that it is less than perfect and reporting and processes need to improve. This got me wondering for a short while whether the British platform would be used to replace the IT for the continental European markets too. However when I asked Knecht at the conference, he said that there are no plans for that, and that Funding Circle would continue to run seperate IT platforms. Continue reading

There is an article in a German startup news magazine speculating that Funding Circle might have bought German p2p lending marketplace for SME loans Zencap from Rocket Internet or is in the process of doing so. The article does not provide any evidence but cites unnamed entrepreneural sources.

I reached out to both Funding Circle and Zencap for comment today but have not heard back yet. EDIT: I received a reply from Zencap that they do not comment on rumours/speculations.

I also checked the filing history of the commercial register and there have been no telltale filings on the Zencap file in the past months, therefore I doubt a sale has been completed. But it still is a possibility because it likely would take some time for the filing to appear.

While I don’t have any hard facts either, I think the scenario has some plausibility. In emails I exchanged with a Zencap founder in the past months, there have been hints about upcoming major developments (without any specifics) at Zencap. Also it would match the intentions of Funding Circle to move into continental Europe. Continue reading

![]() German marketplace Zencap says the ‘Retail Investor Protection Act (Kleinanlegerschutzgesetz)’, passed into law in July 2015, is the main cause for a shortage of new loans on offer to retail investors on the platform. While Zencap welcomes regulatory guidelines, the company thinks that this law was not thoroughly thought out. Zencap stated: ‘For investors it is confusing that an investment into loans to companies for an amount of more than 100,000 Euro should be subject to different regulatory conditions than loans below that amount.’ (own translation from German original source).

German marketplace Zencap says the ‘Retail Investor Protection Act (Kleinanlegerschutzgesetz)’, passed into law in July 2015, is the main cause for a shortage of new loans on offer to retail investors on the platform. While Zencap welcomes regulatory guidelines, the company thinks that this law was not thoroughly thought out. Zencap stated: ‘For investors it is confusing that an investment into loans to companies for an amount of more than 100,000 Euro should be subject to different regulatory conditions than loans below that amount.’ (own translation from German original source).

While Zencap could offer loans regardless of size to retail investors in the past, it is has now restricted its offer to retails investors in Germany to loans up to 100,000 Euro as it would be forced to serve a prospectus (‘Vermögensinformationsblatt’) for which the borrowing company would be liable. Continue reading

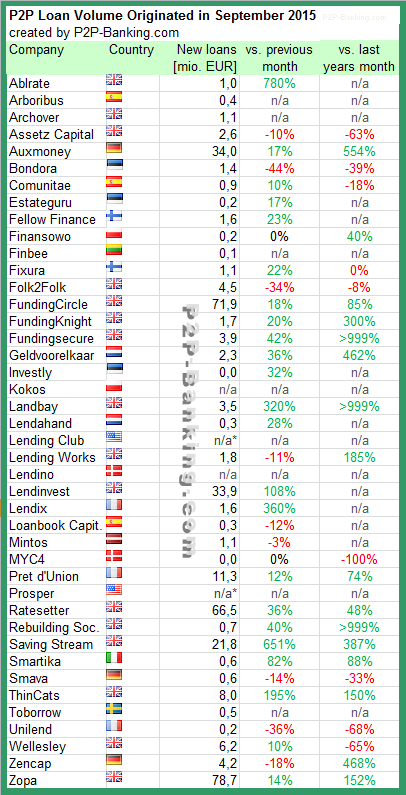

As reported earlier today, new p2p marketplace Crosslend (Spanish site) (German site) offers unsecured p2p loans to consumers. There was a soft launch phase last week, which enabled me to register early and gain first insights into the marketplace interface. After registration I awaited verification of the newly opened lender account at biw Bank and then deposited money there (if you are outside the Eurozone, you may consider using Transferwise or Currencyfair instead of doing a direct transfer).

In the dashboard I selected ‘Browse Notes‘ which led me to an overview of all available note. Since my test was conducted during soft launch, there was only one available not.

Screenshot Browse Notes (click for larger view): at the bottom there is the listed loan (risk grade B) for 6,000 EUR vehicle financing at 8.59% interest

Crosslend Filters

Initially only the general filters (loan term, risk classes) for selecting loans are displayed. By clicking on ‘show all filters’ I expanded further loan selection filters: Borrower filters are DTI, monthly net income, home owner, country and supporting documents (proof of income, proof of residence and utility/phone bills). Loan filters include loan amount, funding percentage and loan purpose. It is possible to save filters to reapply them again in future. Continue reading