Fellow Finance is a p2p lending marketplace in Finland. It started 2013 with loans to Finnish consumers, and later added Polish consumer loans and loans to Finnish SME’s. Since launch more than 100 million EUR in loans were funded. See earlier blog coverage on Fellow Finance by P2P-Banking.com.

The basics are:

- minimum bid is 25 EUR

- no investor fees (except for 1% fee for selling on secondary market)

- loans rated from 1 star to 5 stars, interest rates depend largely on this rating, terms up to 7 years

- underbidding auctions, but in practise most bidding is done by allocator (autoinvest) at a ‘market rate’

I started a small test investment early in 2016, but really started building my portfolio from autumn 2016. Since then I have deposited 4,000 Euro. I currently invest only in Finnish consumer loans and concentrate on 3 and 4 star loans for which the market rates are currently 13% and 15%. The Finnish consumer loans are covered by a buyback guarantee of 70%, meaning in case they are 90 days overdue, they will be sold for 70% of outstanding principal to a collection agency.

My investment on Fellow Finance is conducted solely through the allocator (the autoinvest) function.

My current Fellow Finance allocator settings – click to enlarge

Basically for me Fellow Finance is a mostly hands-off investment running on autopilot. I do log in at least bi-weekly to check if the market rates have changed. The market rates do fluctate sometimes at +/- 1%, and I felt it necessary to tweak the rate of my allocator then to keep it bidding (at the best possible rate). Fellow Finance is one of the very few platforms, where investors can configure the autoinvest to buy on the secondary market, but I have not used that. Also so far I feel no need to use the secondary market for selling. While several of my loans have gone late, they all catched up and none have defaulted. But my portfolio is still very young so it is bound to happen sometime in the future. The Fellow Finance statistics page gives figures for past loss rates by credit grades. It also shows that interest rate levels have sunk sharply in the end of 2015, beginning of 2016 – I guess I should have started to use this marketplace earlier.

Getting money deployed can take a while, as a lot of the bids (loan reservations) are cancelled. I started with 25 EUR bids by the allocator but to speed deployment up, I increased my maximum bid size to 60 Euro.

Overall the website – which is available in english language – is good, only sometimes a tad slow to respond. A mobile is needed to receive SMS codes to confirm some actions.

My plan it to increase my portfolio by another 1,000 Euro, bringing it to 5,000 and then to reinvest proceeds and see how it develops over time.

What are your Fellow Finance experiences? There are over 150 posts on the German investor’s Fellow Finance forum thread. Reviews there are mostly positive in tone.

My Fellow Finance portfolio dashboard

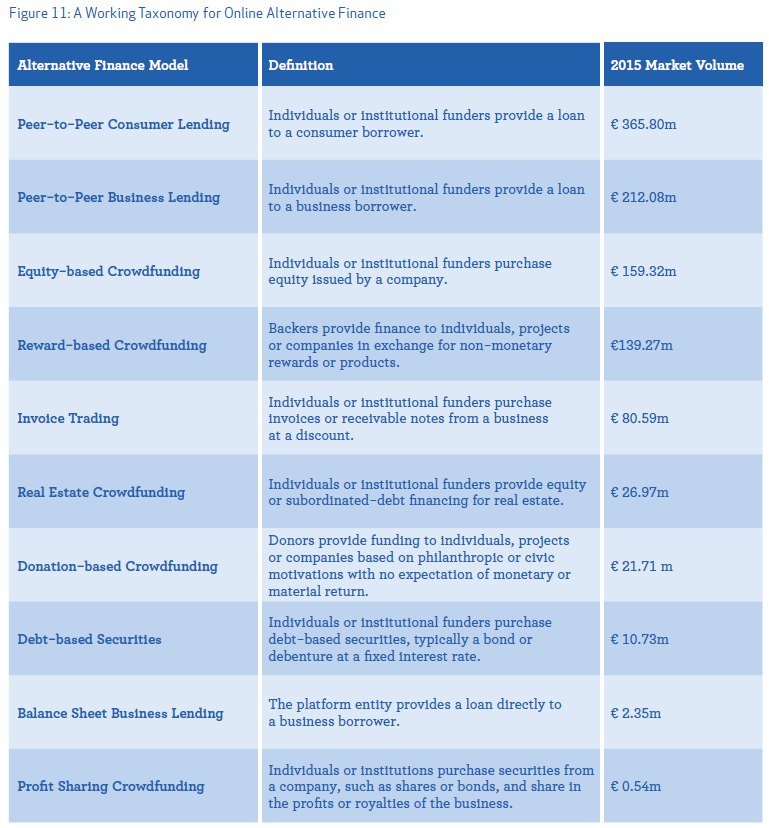

The European online alternative finance market, including crowdfunding and peer-to-peer lending, grew by 92 per cent in 2015 to €5.431 billion, according to the results of the 2nd Annual European Alternative Finance Industry Survey conducted by the Cambridge Centre for Alternative Finance at University of Cambridge Judge Business School, in partnership with KPMG and supported by CME Group Foundation.

The European online alternative finance market, including crowdfunding and peer-to-peer lending, grew by 92 per cent in 2015 to €5.431 billion, according to the results of the 2nd Annual European Alternative Finance Industry Survey conducted by the Cambridge Centre for Alternative Finance at University of Cambridge Judge Business School, in partnership with KPMG and supported by CME Group Foundation.