The University of Cambridge, Monash Business School and Tsinghua University launch the 2016-2017 Asia Pacific Alternative Finance Industry Survey with the support of major industry associations across the region.

The University of Cambridge, Monash Business School and Tsinghua University launch the 2016-2017 Asia Pacific Alternative Finance Industry Survey with the support of major industry associations across the region.

The Cambridge Centre for Alternative Finance at University of Cambridge Judge Business School, Australian Centre for Financial Studies at Monash University and Tsinghua University Graduate School at Shenzhen are teaming up to launch the 2016-2017 Asia-Pacific Region Alternative Finance Industry Survey with the support of more than 20 major industry organisations across the region. This is the largest regional study to date focused on crowdfunding, peer-to-peer lending & other forms of alternative finance.

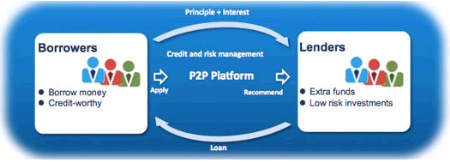

From equity-based crowdfunding to peer-to-peer consumer and business lending, invoice trading to reward-based crowdfunding, these alternative financing activities are supplying credit to SMEs, providing venture capital to start-ups, offering more diverse and transparent ways for consumers to invest or borrow money, nurturing creativity, fostering innovation, generating jobs & funding worthwhile social causes across the Asia Pacific region.

Opening on February 15th 2017, this benchmarking survey aims to capture the key trends, developments, size, transaction volume and growth as well as the impact of changing regulations on the alternative finance markets across Asia in 2016 – building on last year’s inaugural study.

Last year’s inaugural report – Harnessing Potential – gathered survey data from 503 leading alternative finance platforms operating in 17 Asia-Pacific countries and regions. The study was cited by over 100 mainstream media organisations and has informed policymakers and regulators of industry developments in Asia Pacific countries including Malaysia, Singapore, India, Australia, Hong Kong and Indonesia for example. The report estimated the total Asia-Pacific online alternative finance market to have grown 323% year-on-year to reach 102.81 billion USD in 2015. China is the world’s largest market by transaction volume, registering 101.7 billion in 2015. Outside mainland China, the rest of the APAC region accrued 1.12 billion USD in 2015 with a 313% year-on-year growth rate from the 271.94 million raised in 2014. The authors hope this year’s study will dive even deeper into the growth and dynamics of the APAC alternative finance market. Continue reading

…

…

The Chinese p2p lending service

The Chinese p2p lending service