Estonian p2p lending service isePankur successfully improved the loan quality in 2010. The company added several validation steps for loan applications. On top of the existing credit bureau checks and it’s own scoring model isePankur introduced several manual checks on the borrowers in May and July. Since September borrowers need to submit bank statements which isePankur uses to verify information presented in the loan application. The measures implemented are listed in detail here.

Estonian p2p lending service isePankur successfully improved the loan quality in 2010. The company added several validation steps for loan applications. On top of the existing credit bureau checks and it’s own scoring model isePankur introduced several manual checks on the borrowers in May and July. Since September borrowers need to submit bank statements which isePankur uses to verify information presented in the loan application. The measures implemented are listed in detail here.

CEO Pärtel Tomberg told P2P-Banking.com: “… these [new] loans will … be the most profitable social banking loans for investors across the globe”.

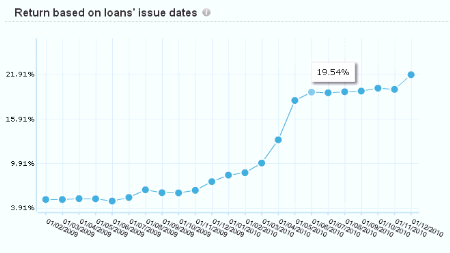

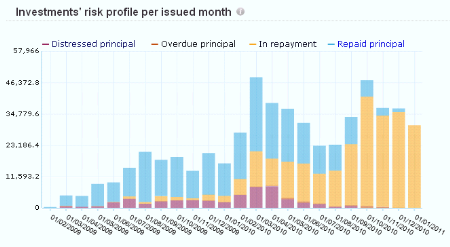

To prove this claim Isepankur is publishing real time performance data on its marketplace.

(See Isepankur site for larger size interactive charts)

‘Unlike other companies you can see the quality of loans per month so the growth rate of the portfolio will not hide the actual returns from loans issued previously.‘ says Pärtel Tomberg.

The charts reflect the drastic reduction of bad debt from loans issued after May 2010 and the very positive impact on lender returns. Continue reading

A few days ago Finnish p2p lending site

A few days ago Finnish p2p lending site