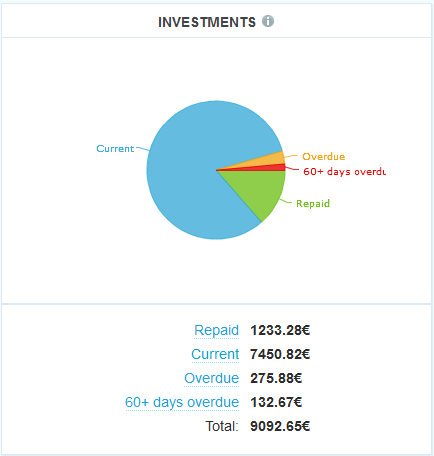

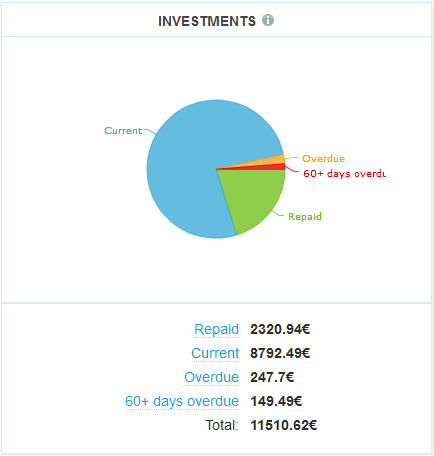

Three months have passed since I last wrote about the status of my p2p lending investment at Isepankur. I have deposited 8,000 Euro (approx. 10,500 US$) since starting in the end of 2012. I hold over 500 loan parts – the diversification achieved is very good. Together the loans add up to 9,190 Euro outstanding principal. Loans in the value of 248 Euro are overdue, meaning they (partly) missed one or two repayments. 149 Euro are in loans that are more than 60 days late. I already received 2,320 Euro in repaid principal back (which I reinvested).

Chart 1: Screenshot of loan status

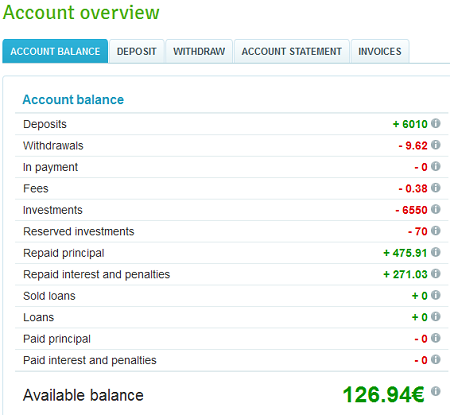

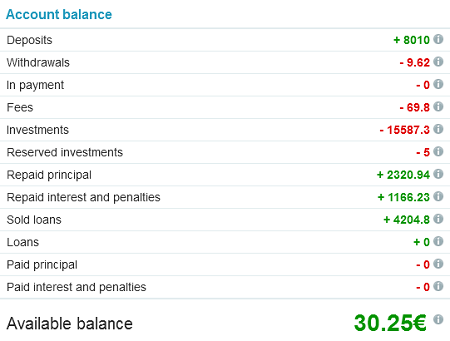

Most of the money in my account is working to earn interest. Only 30 Euro are currently held in cash. 5 Euro are tied in a bid on a current loan listing and will originate in the next few days.

Chart 2: Screenshot of account balance

Return of Invest

Currently Isepankur shows me a 26.7% annual ROI (see chart 3 ). In my own calculations, using XIRR in Excel, I currently get a 23.5% ROI. Continue reading

Estonian p2p lending service

Estonian p2p lending service