This is an interview with Austrian investor Bernd R. about the experiences he made when he created a company in Estonia to benefit from the advantages that investing as business on Bondora brings. Note that these are his personal experiences and should not be construed to be investment or tax advice. The circumstances for other investors will be different and investors should seek tax advice by qualified and certified tax advisors.

How did you get the idea to setup a company in Estonia for your Bondora investments?

I read a lot about Estonia – its business friendly environment, simple tax system, huge start-up culture and the efforts to make administration processes available online.

Setting up an investment vehicle in Estonia would allow me to combine an uncomplicated taxation system with the advantages of a legal entity and all that at low costs.

What are the main advantages when investing as a company rather than an individual on Bondora?

There are several advantages.

- The corporate tax rate in Estonia is 0%. Only dividends are taxed with 20%. This means that your retained profits will generate additional profit. Double taxation agreements with your home country protect you from being taxed twice and usually limit the total taxation to the tax rate for dividends of your country of residence.

- In Austria interest income of private loans is treated in a different way than regular interest income (e.g. from a bank saving account). Interest income of classic bank saving product are taxed with a 25% flat rate, “private loans†fall under progressive taxation. On-top income of a full-time employee is easily taxed with 43% till 50%. So depending on the individual situation the tax savings can be up to 25%.

- Provisions for bad debts or write-offs reduce the taxation basis.

- Profits and Losses of different activities can be consolidated, e.g. losses generated with stock trading can be consolidated with your Bondora interest earnings and reduce the taxation basis.

How does the tax situation improve in your specific case?

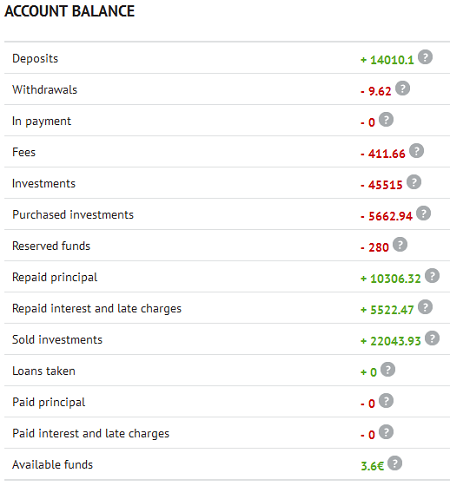

I reduced the tax rate by 25% compared to my individual tax rate.

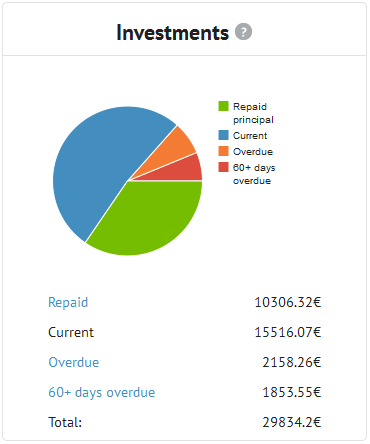

In addition I will generate more profit in absolute numbers due to untaxed retained earnings invested and at the same time reduce the taxation basis with bad debt provisions. The impact of these 2 factors depend on the future default- and interest rate of my Bondora portfolio.

To setup the Estonian OÜ you used a company formation service. Did that require you to travel to Estonia?

No, it was not necessary. A power of attorney does the job. Continue reading

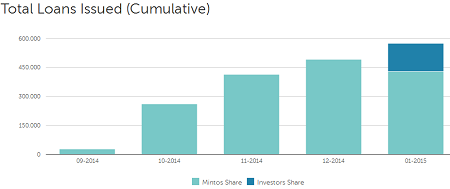

In Latvia p2p lending service

In Latvia p2p lending service

Being a platform that facilitates the exchange between lenders and borrowers, we believe it is our responsibility to bring the best practices, such as credit scoring, to peer lending; thus, making it an effective, efficient and mutually beneficial process for both parties. Eventually, Bondora Ratings will allow credible borrowers get a better rate for a loan, while investors will receive a predictable return level.

Being a platform that facilitates the exchange between lenders and borrowers, we believe it is our responsibility to bring the best practices, such as credit scoring, to peer lending; thus, making it an effective, efficient and mutually beneficial process for both parties. Eventually, Bondora Ratings will allow credible borrowers get a better rate for a loan, while investors will receive a predictable return level.