When was the last time you stood in a long line outside your bank branch, patiently waiting to deposit money into your savings account? Imagining a scene like that seems ridiculous at a time with near-zero interest rates in an increasingly large number of developed countries.

But there where you would least expect it, in the Fintech world of fast-moving bits, some startups actually are imposing measures to throttle influx of investor money in order to balance it with borrower demand. Welcome to p2p lending (short for peer-to-peer lending). The sector is experiencing tremendous growth rates. With attractive yields for investors some platforms struggle to acquire new borrowers fast enough for loan demand to match the ever-rising available investor demand.

One challenging factor is deeply ingrained in the business model of p2p lending marketplaces: once a new investor is onboarded and found the product satisfactory, he is most likely to stay a customer for years to come and reinvest repayments received and maybe the interest also. On the other hand the majority of borrowers are one-time customers. They take out a loan typically just once. While it may take years for the borrower to repay that loan, in most instances there is no repeat business for the marketplaces. So the marketplaces have to constantly fire on all marketing cylinders to win new borrowers in order to keep up and grow loan origination volume.

This has sparked some outside of the box thinking, e.g. the partnership of Ratesetter with CommuterClub to win their loan volume, which is in fact mostly repeat business.

Winning investors has been relatively easy for many of the p2p lending services in the recent past. Investors are attracted typically through press articles or word of mouth. One UK CEO told me he never spent a marketing penny ever to acquire investors.

But what happens on the marketplace, when there are so many investors waiting to invest their money in loans, but loans are in short supply?

- If the marketplace does nothing or little to steer it, then those investors that react the fastest, when new loans are available, will be able to bid and invest their money. This is the situation e.g. on Prosper, Lending Club and Saving Stream.

- The marketplace has some kind of queuing mechanism. This is typically coupled with an auto-bid functionality. Examples of this are Zopa, Ratesetter and Bondora.

- The investors are competing during an auction period by underbidding each other through lower interest rates. Examples of p2p lending services with this model are Funding Circle, Rebuilding Society and Investly.

- The marketplace can lower overall interest rates to attract more borrowers while the resulting lower yields slow investor money influx.

The UK p2p lending sector is eagerly awaiting the sector to become eligible for the new ISA wrapper. Inclusion into the popular tax-efficient wrapper will attract an avalanche of new investor money to the platforms.

“That’s going to be a challenge for the industry,†said Giles Andrews, CEO of Zopa. “Once the dates are worked out, the industry will need to plan for that together, and we may have to do something we have never done before, which is to limit the supply of money. It’s not good to have people’s money lying around [awaiting new borrowers] or to lower standards of borrowers.â€[1]

So there is some speculation that UK p2p lending services could impose temporary limits on new investments.

The investor viewpoint

The aim of the investor is to lend the deposited money easy and speedy into those loans that match his selected criteria/risk appetite. Idle cash earns no interest and will impact yields achieved (aka cash drag).

For the retail investor none of the above mentioned mechanisms are ideal. The “fastest bidder wins†scenario means he would either have to sit in front of the computer most of the time or be lucky to be logged in just as new loans arrive. The queuing mechanisms are disliked as they can prove to be very slow in lending out the funds and can be perceived as nontransparent (see the lengthy and numerous forum discussions on the Zopa queuing mechanism). Underbidding in auctions does provide the chance to lend fast, but at the risk of setting the interest rate too low and this requires a strategy and can also be time consuming. Continue reading

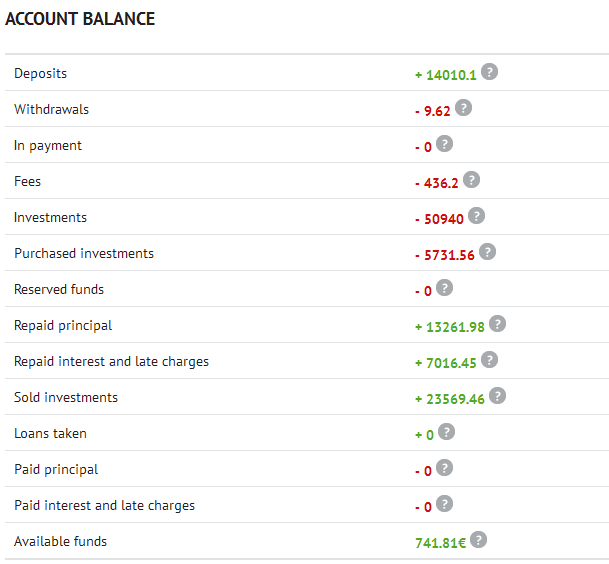

Latvian p2p lending marketplace

Latvian p2p lending marketplace