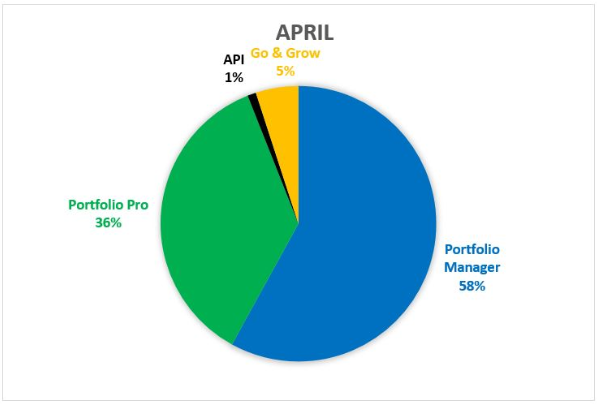

Bondora has been rolling out a new product called Bondora Go & Grow to select users since March. It will be officially launched in June, but existing users can contact support and ask for the product to be made selectable in their accounts.

Go & Grow is designed for the passive investors as hands off p2p lending. One of the main advantages is that Bondora says it is tax optimised.

The Bondora Go & Grow product features a target interest rate of 6.75% which will accrue daily. It runs completly on autoinvest. The investor just needs to join it and pay money into the Go & Grow account (or transfer it from the normal Bondora account). The Go & Grow account promises daily liquidity. There is a 1 EUR withdrawal fee making small withdrawals expensive but for portfolios of 1000 EUR or more and usual investment horizons this fee is negligible.

How does Bondora Go & Grow work?

Simplified it is an autoinvest tool where Bondora invests the deposited money in loans on the Bondora marketplace (the investor does not see the individual loans). The investor automatically sells any claims for repayments and interests from these loans to Bondora which in return agrees to pay the 6.75% interest to the investor. Note that the 6.75% are not guaranteed but Bondora is very confident (based on their over 10 years experience) that they can achieve this yield. So basically Bondora invests the money on the market’s interest rates which are higher than 6.75 and the results influenced by defaults, late payments and cash drag, but Bondora is confident they are higher than 6.75%. Bondora pays the 6.75% to the investor and uses the surplus as reserve, which will be kept separate from Bondora’s funds.

What does tax optimized mean?

Bondora mentions two advantages:

- The product is net of any defaults. This can be advantageous for investors in countries where it is not possible to offset default losses againts interest earned for tax purposes.

- Interest accrues and is only credited at (final) withdrawal. This delays the point in time where interest is taxable according to Bondora.

So is this better than the ‘traditional’ Bondora product?

In my opinion this product is only the better choice, if the investor really does not want to be bothered with making minimal choices the Portfolio Pro requires and some monitoring. As described Bondora invests the money in the very same loans that are available in the traditional product and expects a higher yield than 6.75%.

For that very same reason I would caution investors to carefully consider, if they do want to take up the offered option to sell out their existing ‘traditional’ portfolio when opening/funding a Bondora Go & Grow account. I assume that investors are very likely better off keeping that portfolio than selling it to Bondora at the price Bondora offers. However for an investor that really wants to sell an exitsing portfolio completly this offers a way to cash out (edit: see reader comment below) as the cash is than in the Bondora Go & Grow account and can be withdrawn instantly.

One caveat of course is that according to the T&C the liquidity for Bondora Go & Grow is subject to market conditions and not guaranteed. It reads a bit like the ‘normal market conditions’ wording that Assetz Capital uses for its Quick Access Account.

A lively discussion on the advantages and risks of the new Bondora Go & Grow product is running on the German form with around 100 posts on the subject.

EDIT: An earlier version of the article contained wrong information and has been corrected.

Despite being in prelaunch (select investors only), Bondora Go & Grow already made up 5% of new investments in April (source Bondora blog)