Today Ablrate announced it will voluntary wind down operations. Existing loans will continue to be served, but no new loans will be funded. Ablrate, which launched in 2014, had funded 68 million GBP in business loans over the course of the 8 years. Reasons for the decision given by Ablrate are ‘The decision has not been taken lightly so I would like to explain why we are now on this path as it is a combination of the economic outlook, some of the challenges on our loan book, and regulatory trajectory. It is a challenging environment for small businesses. Interest rates are likely to rise putting pressure on incomes and already retail sales are being hit putting pressure on the wider economic outlook. Strikes and resultant potential wage hikes may fuel inflation in the short term and add to the volatility of the economy adding additional risk to lenders and our business.’

Ablrate also states that increasing regulation and restrictions were challenging for the future outlook of business. ‘If the proposed ruling of banning incentives to invest comes to pass, our opinion is that it is likely that Instant Returns would be banned, of which borrowers have paid over £200,000 since it was implemented.‘

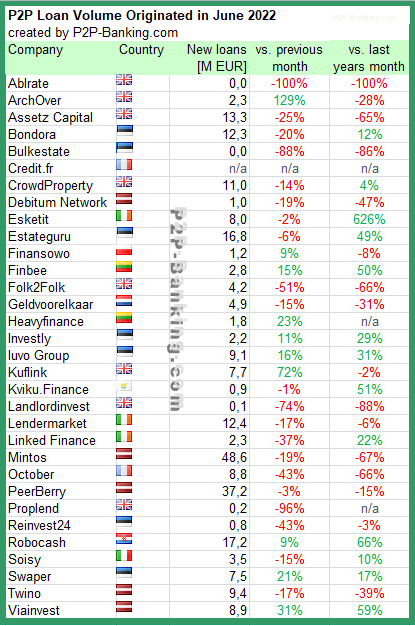

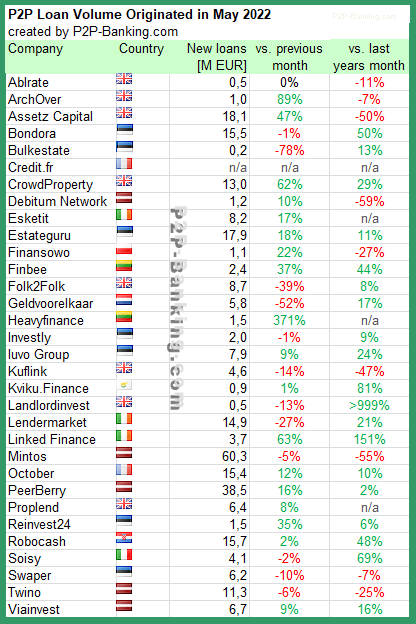

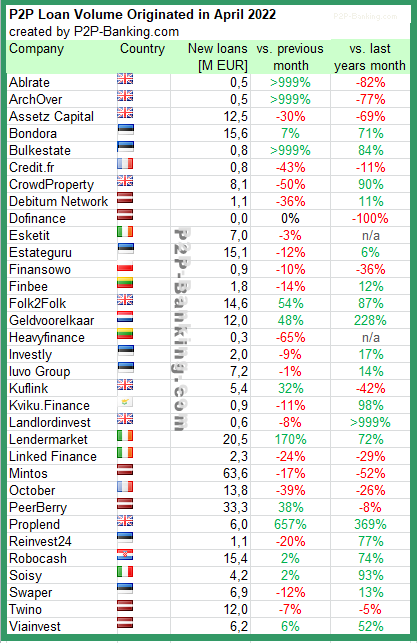

A significant number of the loans is outside the planned payment schedule, that is either delayed, restructered or in collections. Loan originations have been slow lately, with only 13M GBP funded in the past two years.