This is a guest post by Kevin Allen, Head of Insight at RateSetter.

Credit management and consumer trust: the words are inexplicably linked for the majority of financial services providers, particularly those dealing with personal finance. In fact the approximate to translation of the Latin “Creditum†meaning a loan is to the French “crédit†meaning trust. There is little doubt that consumers are increasingly alive to the mechanics of how institutions are looking after their hard-earned money – something that has stemmed from the global financial crisis when banks were guilty of lending household savings to all sorts of risky endeavours, with well documented results.

There is no clearer example of the importance of credit management than within the peer-to-peer lending industry. In the absence of the Financial Services Compensation Scheme, the biggest single risk to lenders is that borrower defaults reach a level so severe that it absorbs not only the interest they might earn but their capital as well. RateSetter were the first peer-to-peer company globally to introduce the concept of a provision fund that provides lenders with an added level of control against loss of even the expected interest amount.

The provision fund has proved very successful, not only in providing lender confidence, but also in terms of its track record. We also aim to gain depth and breadth to our lending portfolio through an evolution of our offering. This will always include our core consumer lending offering for customers to buy cars, make home improvements and consolidate expensive credit card debt, but will include property development and commercial business lending to support the UKs SMEs.

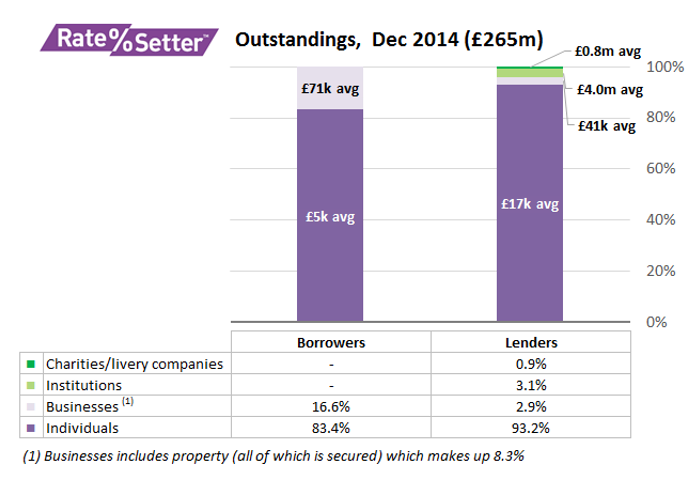

RateSetter aims to continue this growth to provide more confidence to prospective and existing lenders and to ensure we can maintain our “every lender, every penny†through all economic cycles. Although as we always say, we cannot guarantee anything. And our lenders will also be diversified to include individuals, charities, institutions and businesses. The breakdown currently shows us as potentially the only P2P lender in the UK whose recent lending is dominated by individuals;

So, although a peer-to-peer lender can rely on us to manage the Provision Fund, this leads us to the natural questions: who exactly am I lending my money to? And, how much are they contributing to the fund? So everything we say and do is built around careful and cautious credit assessment and any potential impact on the provision fund. But, equally important to the mechanics, is the transparency for our users. While banks and building societies still, even today, maintain an impenetrable barrier for users trying to understand what is happening to their money, we have gone to the opposite end of the spectrum, making openness part of our DNA. Continue reading

For peer to peer lenders we welcome the benign attitude of the larger banks as it is the type of attitude that drives investors and borrowers towards this market. Australia is marketplace where the internet is a well-accepted forum for doing business and the financial services industry is already using it to develop their own businesses. This type of lending is a graduation of the electronic age of the financial services industry in Australia and here to stay.

For peer to peer lenders we welcome the benign attitude of the larger banks as it is the type of attitude that drives investors and borrowers towards this market. Australia is marketplace where the internet is a well-accepted forum for doing business and the financial services industry is already using it to develop their own businesses. This type of lending is a graduation of the electronic age of the financial services industry in Australia and here to stay.