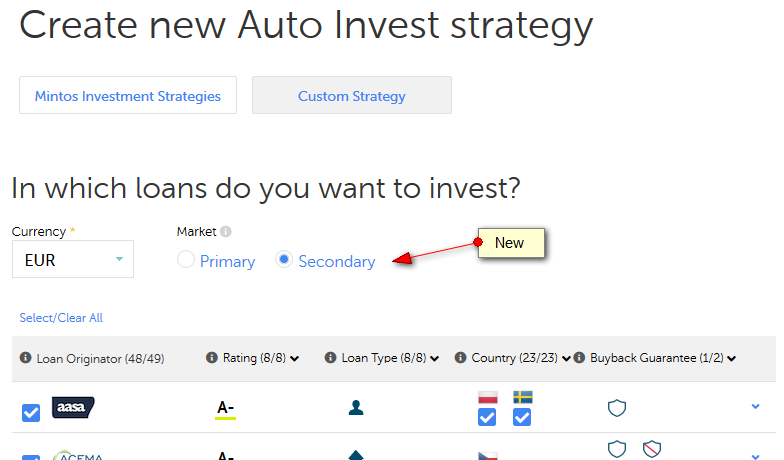

Mintos* has announced a new feature – the autoinvest can now be used to buy loan parts on the secondary market too. I am setting up a new autoinvest to test it and am curious how many loan parts I will be able to acquire with this new feature. Just like on the primary market there are many selections adjustable.

Screenshot Mintos Auto Invest Secondary Market

Mintos will roll out the new feature to all investors on Dec. 3rd. Only selected investors will be unlocked earlier. Mintos* says investors can deposit an additional 5,000 EUR to add to their balance to get early access. Also investorswhich have invested at least 50,000 EUR will have early access.

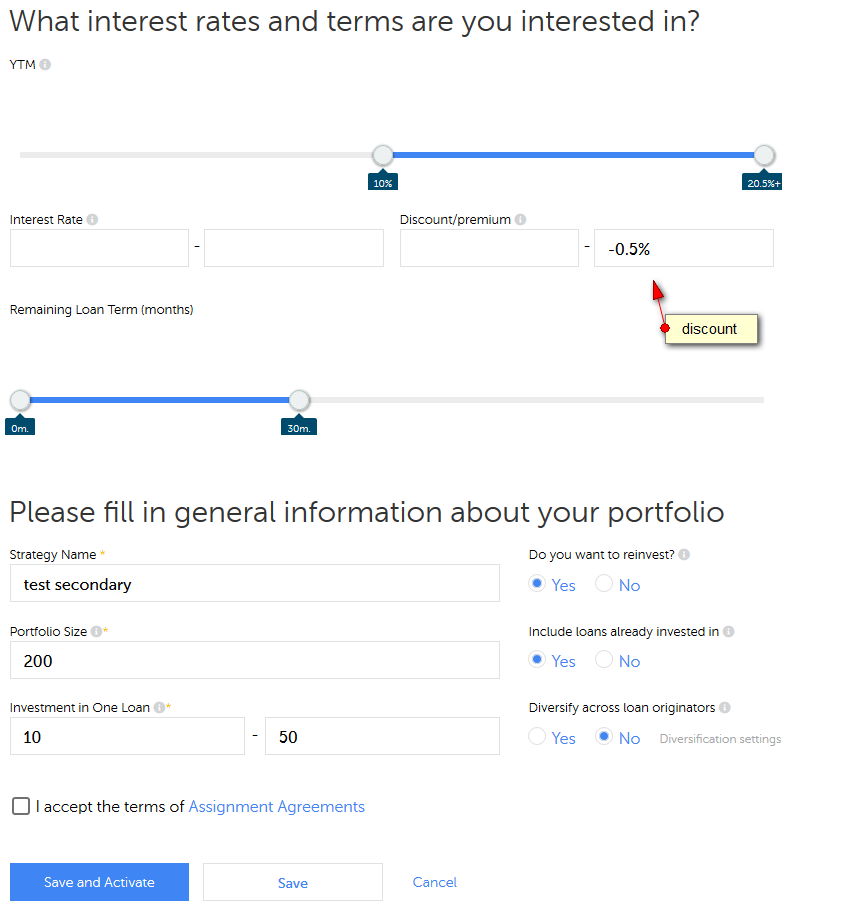

Screenshot: Further details of Mintos Auto Invest Secondary Market

For the further details of the test, I set the secondary market auto invest to buy loans with at least 10% YTM, a maximum loan term of 30 month and at least 0.5% discount. I left the interest rate open, as the restriction is not really necessary for me in this case in conjunction with the YTM and the discount.. For ‘Do you want to reinvest’ and ‘Include loans already invested in’ I choose ‘Yes’. I deselected ‘Diversify across loan originators’ as I want to buy all loans that match these conditions.

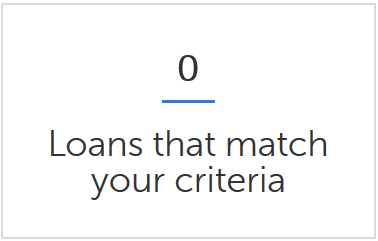

No surprise – no loans match my selection. Loans with these criteria selected by me have been bought up fast in the past, even before the introduction of this new autoinvest. I do wonder, which investor will get priority in case there will be autoinvests of multiple investors matching a new loan up for sale. I expect this new autoinvest will be a popular feature amongst Mintos* investors.

Not many but a few other p2p lending platforms offer autoinvests for their secondary markets too.

Can you select buyback loans?

Yes. Selection criteria are the same as on primary market autoinvest plus YTM, discount and premium settings.

Thanks for the useful article.

I am wondering if there is a possibility to invest in secondary market loans which already has positive payment record.

I have workaround with the filter:

1. Status: current

2. Issue date: 2-3 months back from now

Current status is selected by default, but issue date needs to be selected manually under each loan originator.

I don’t see an automatic way, unless you manually adjust issue date and/or listing date periodically in the secondary market autoinvest.

Why do you think, this will yield better results than just setting it to current? Do you pick non-buyback loans?

Thanks for quick response. Yap, the filter is for non-buyback loans.

Btw, do you have an answer which investor gets priority when multiple investors match a new loan on the sale?